-

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Instead of shrinking the GSEs, the housing regulator is letting them expand into a host of new products and programs.

June 28 American Enterprise Institute

American Enterprise Institute -

The Trump administration's plan to end the conservatorship of Fannie Mae and Freddie Mac marked its first effort to solve a problem left over from the financial crisis, but ultimately raised more questions than it answered.

June 27 -

Meet the new housing finance reform plan, same as the old ones. While that gives it legs, it also presents big challenges.

June 25IntraFi Network -

The plan would end the GSE conservatorships and create an explicit federal guarantee, but it's unclear if even other parts of the Trump administration support it.

June 21 -

Incenter Mortgage Advisors is facilitating the sale of more than $10 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans originated by mortgage brokers.

June 21 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

Walker & Dunlop has been approved as a seller and servicer under Freddie Mac's Affordable Single-Family Rental pilot program, allowing the company to focus on middle markets.

June 20 -

Risk management and technology systems at the Federal Housing Administration lag decades behind Fannie Mae and Freddie Mac and desperately need to be revamped, according to a top official at HUD.

June 18 -

The bill aimed at helping struggling homeowners also requires documentation of servicer behavior and FHFA evaluation of the services provided to borrowers.

June 18 -

No plan will be implemented as long as Fannie Mae and Freddie Mac remain in conservatorship, but a capital framework for the companies could still have a substantive impact.

June 15 -

Sales of nonperforming loans by Fannie Mae and Freddie Mac slowed during the past year as the number of delinquent loans on their books continued to drop.

June 14 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

The agency proposed new minimum capital requirements for Fannie Mae and Freddie Mac that would only go into effect if the government ends its conservatorships.

June 12 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

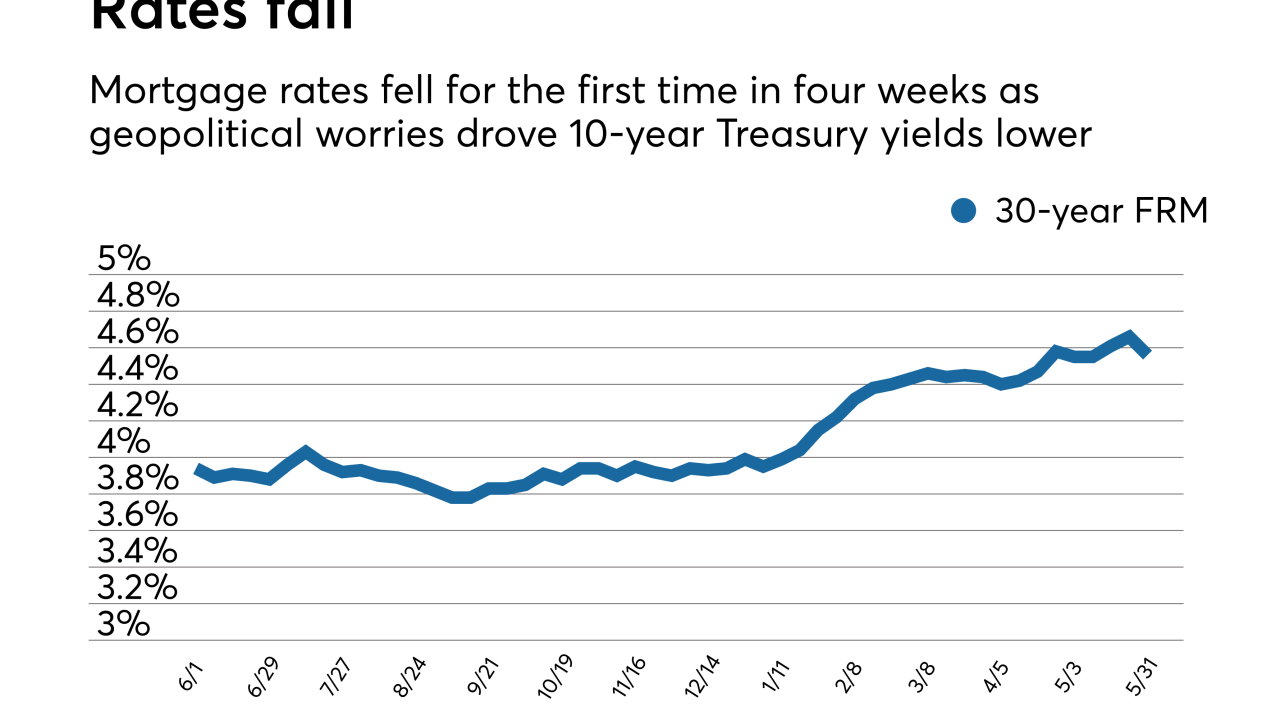

Mortgage rates fell for the first time in four weeks, dropping 10 basis points as investors' concerns over a government crisis in Italy drove bond yields lower.

May 31 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

Mortgage rates continued their climb this week, jumping 5 basis points to their highest level since May 2011, according to Freddie Mac.

May 24