-

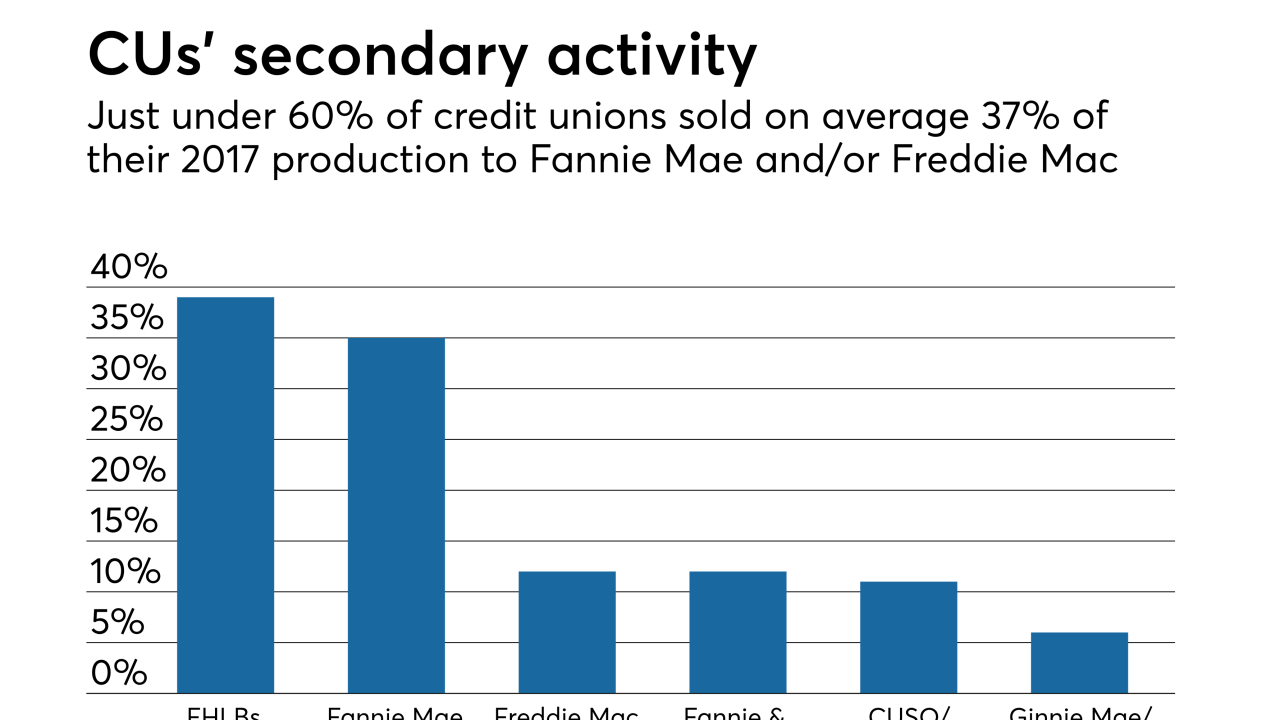

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

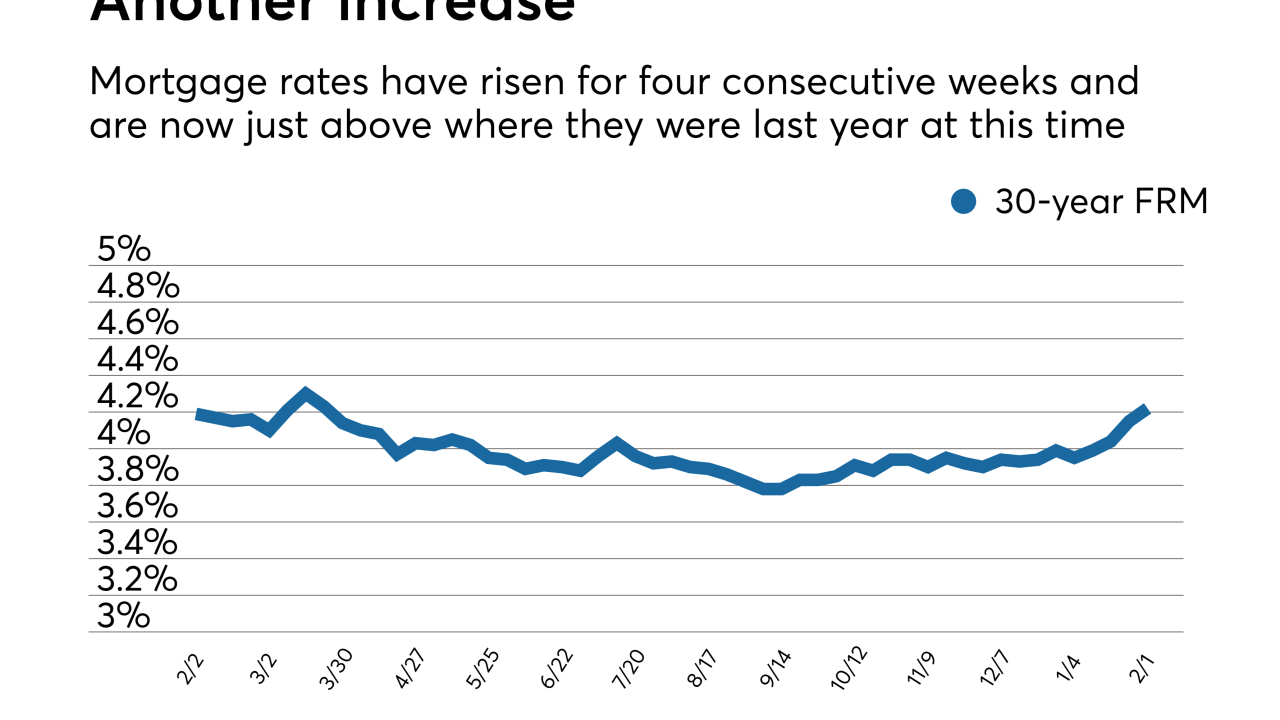

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

As the debate over housing reform heats up, policymakers should give careful consideration to a plan that recapitalizes the government-sponsored enterprises.

February 16 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

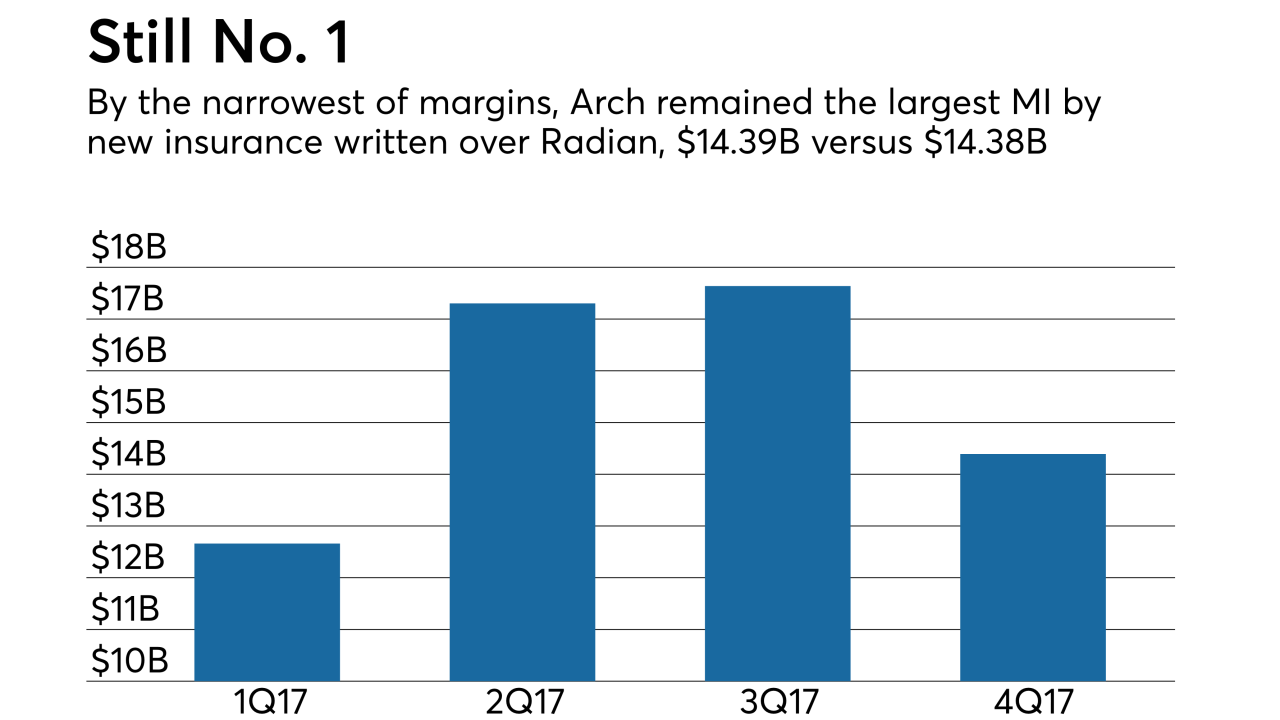

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13 -

The Trump administration’s 2019 budget highlights the administration’s goal of reining in the post-crisis regulatory apparatus, with proposed cuts for several agencies including the Consumer Financial Protection Bureau.

February 12 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

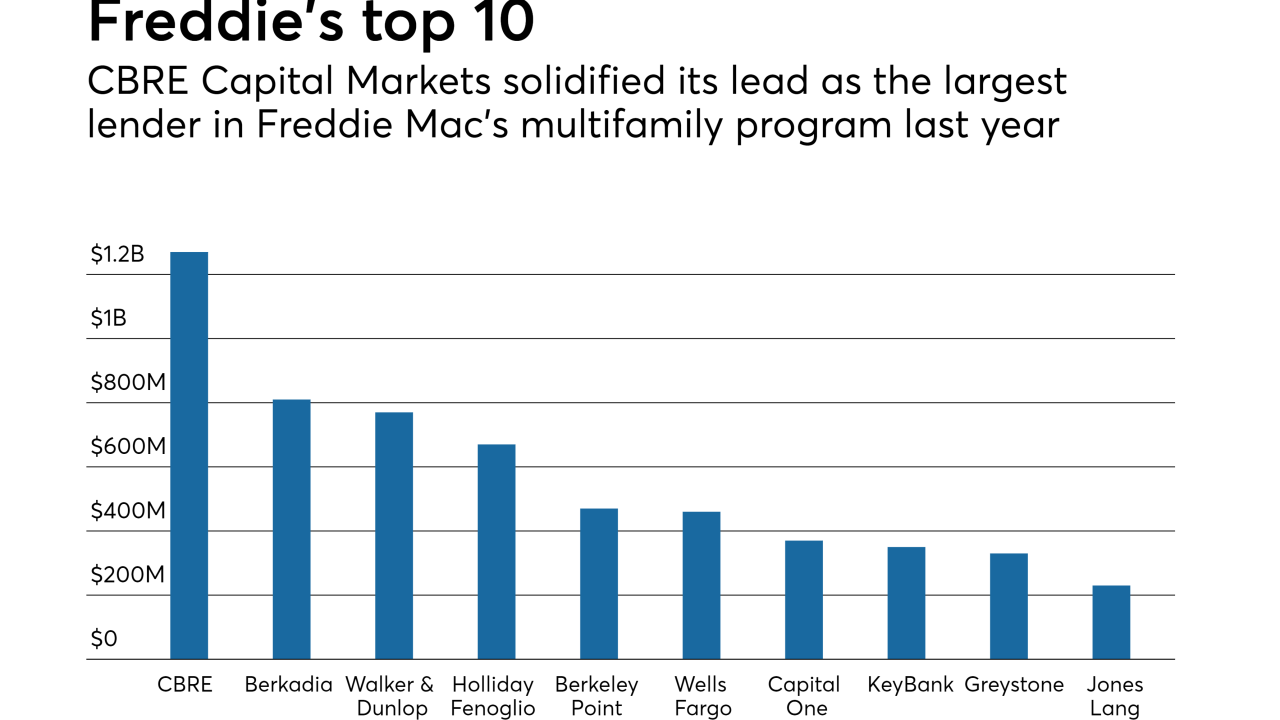

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

Housing finance reformers are pushing full steam ahead to get a bill introduced before the political calendar makes passage nearly impossible.

February 2 -

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

With compensation accounting for 80% of the cost to originate a mortgage, lenders are developing new strategies to attract and retain top talent, while keeping wage expenses in check.

January 29