-

The Trump administration’s 2019 budget highlights the administration’s goal of reining in the post-crisis regulatory apparatus, with proposed cuts for several agencies including the Consumer Financial Protection Bureau.

February 12 -

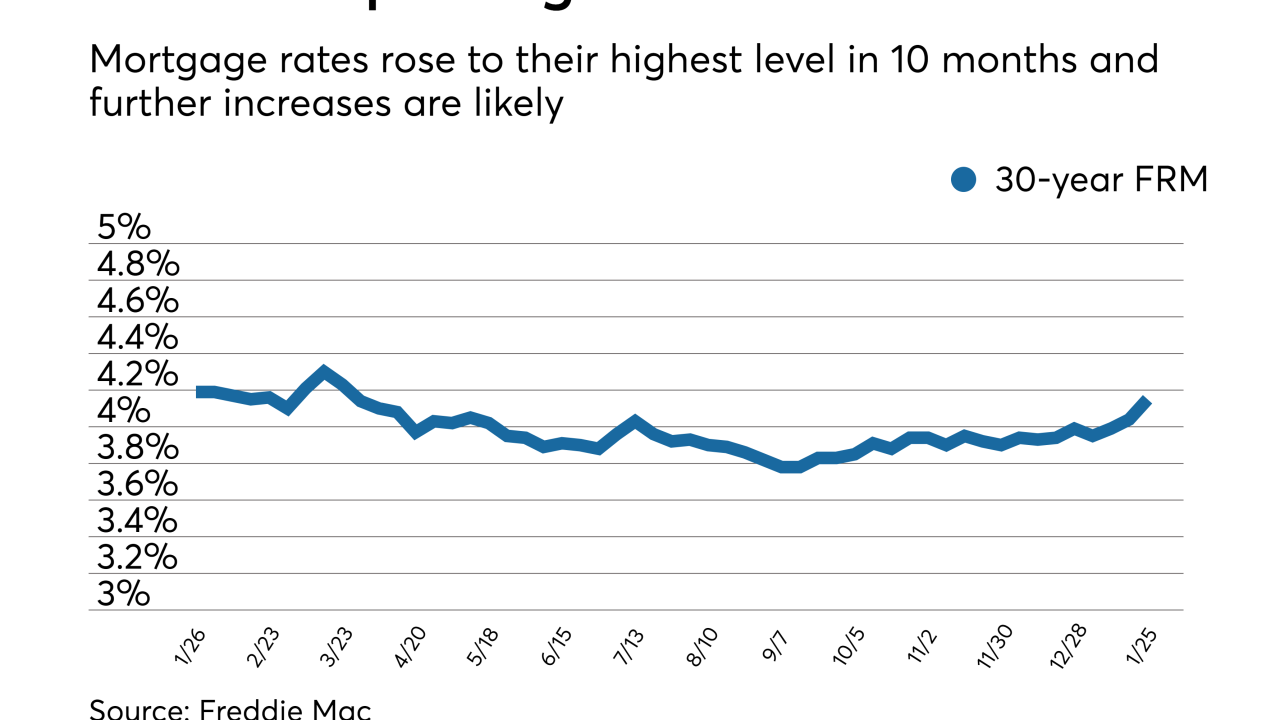

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

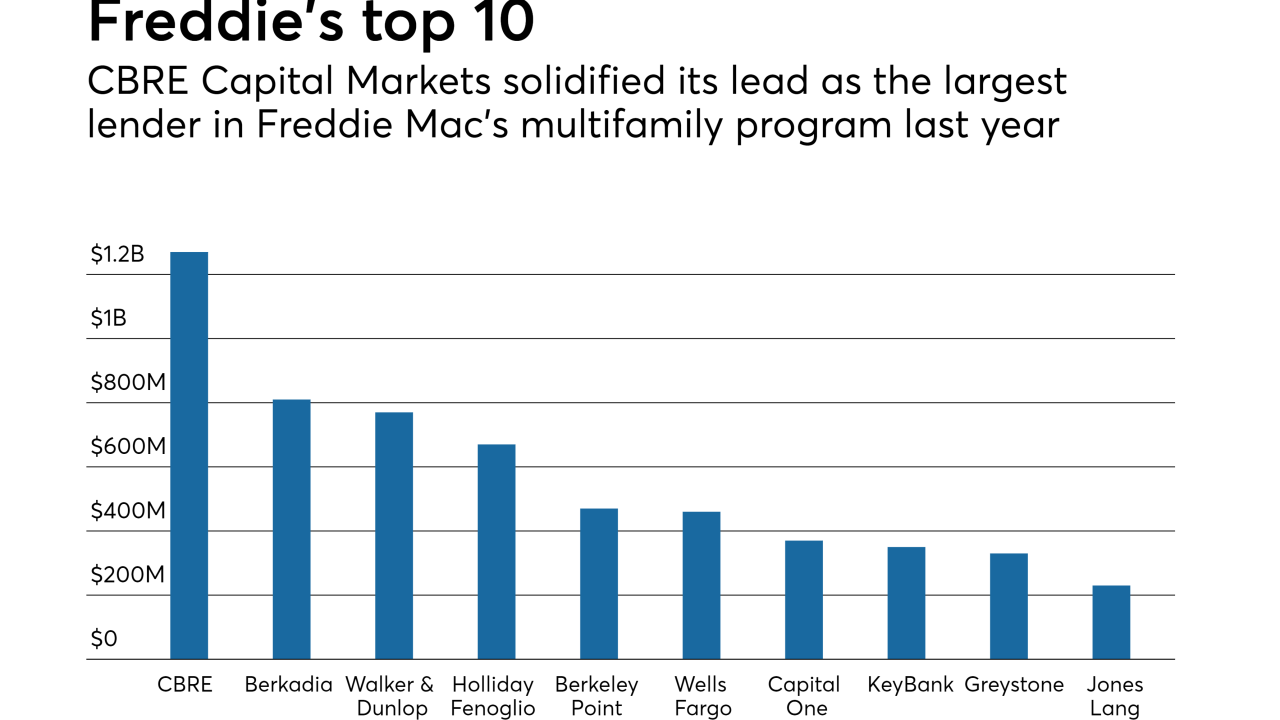

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

Housing finance reformers are pushing full steam ahead to get a bill introduced before the political calendar makes passage nearly impossible.

February 2 -

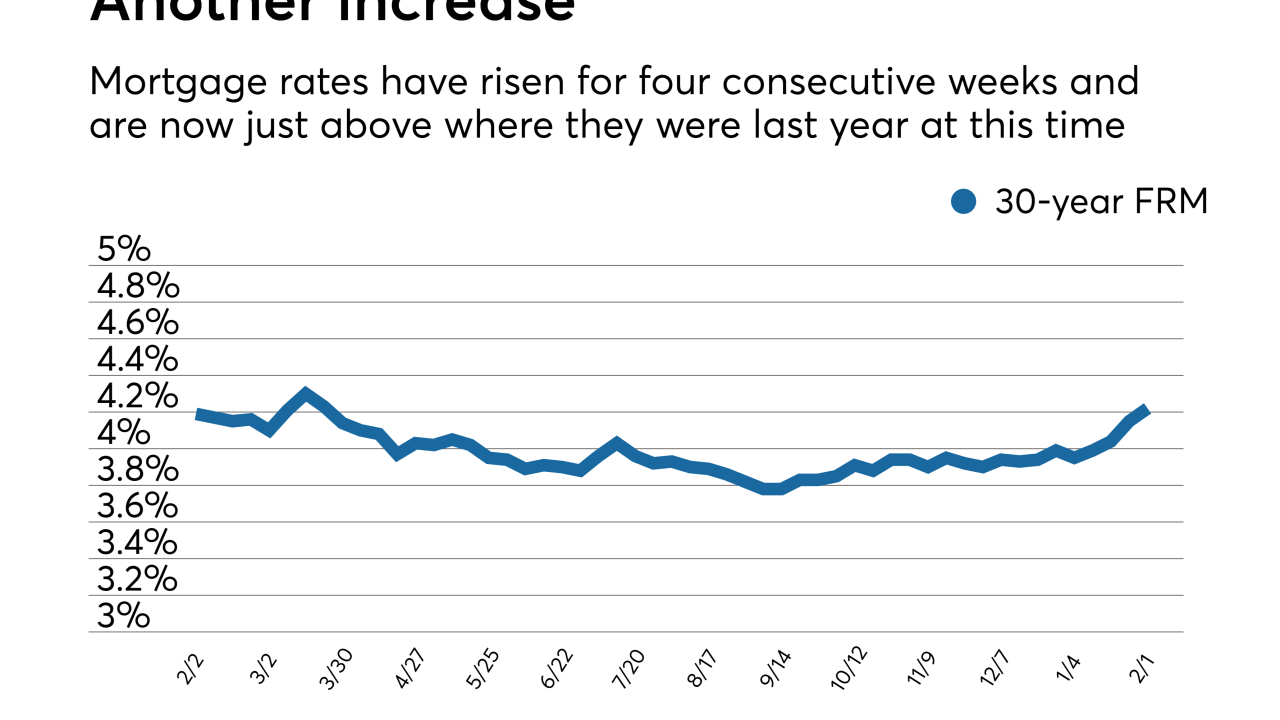

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

With compensation accounting for 80% of the cost to originate a mortgage, lenders are developing new strategies to attract and retain top talent, while keeping wage expenses in check.

January 29 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25 -

Supporters of an unreleased bill to revamp the housing finance system say the plan strikes a middle ground that can gain support from both sides of the aisle.

January 24 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, said his department "broadly" agrees with the FHFA plan, which would return Fannie Mae and Freddie Mac to the private market and provide them an explicit government guarantee.

January 18 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac should be reincorporated as private entities and the government must provide an explicit guarantee for catastrophic losses in the secondary mortgage market.

January 17 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11