-

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

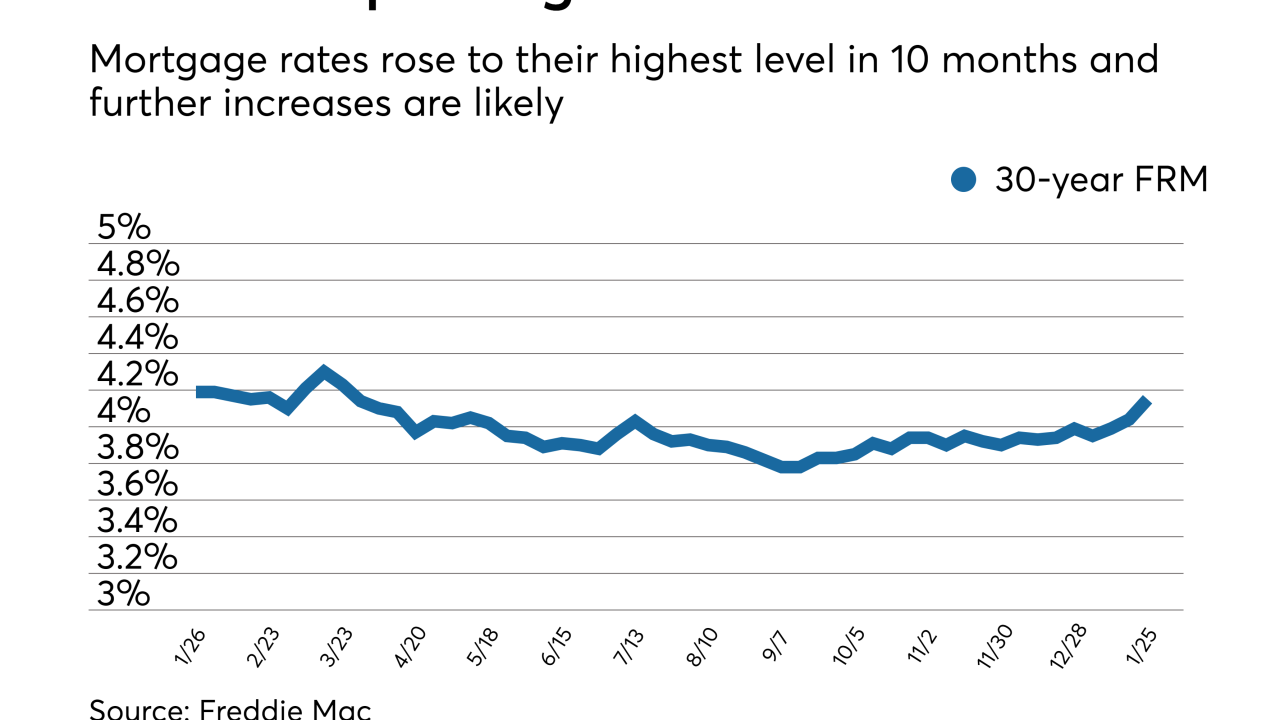

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25 -

Supporters of an unreleased bill to revamp the housing finance system say the plan strikes a middle ground that can gain support from both sides of the aisle.

January 24 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, said his department "broadly" agrees with the FHFA plan, which would return Fannie Mae and Freddie Mac to the private market and provide them an explicit government guarantee.

January 18 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac should be reincorporated as private entities and the government must provide an explicit guarantee for catastrophic losses in the secondary mortgage market.

January 17 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

Laurie Maggiano, the Consumer Financial Protection Bureau's program manager for servicing and secondary markets, died on Sunday.

January 8 -

The Senate Banking Committee is expected soon to release a bipartisan bill that would significantly reshape the housing finance market, but key issues remain unresolved.

January 8 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

A group of reinsurers has committed to provide up to $650 million of coverage for credit risk on some $21 billion of 30-year, fixed-rate loans that the government-sponsored agency will acquire over the next two years.

January 4 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

The GSEs are on their way to paying back the money they owed the government under the original bailout deal made at the height of the financial crisis, making 2018 an opportune time for an overhaul of the housing finance market.

December 29

-

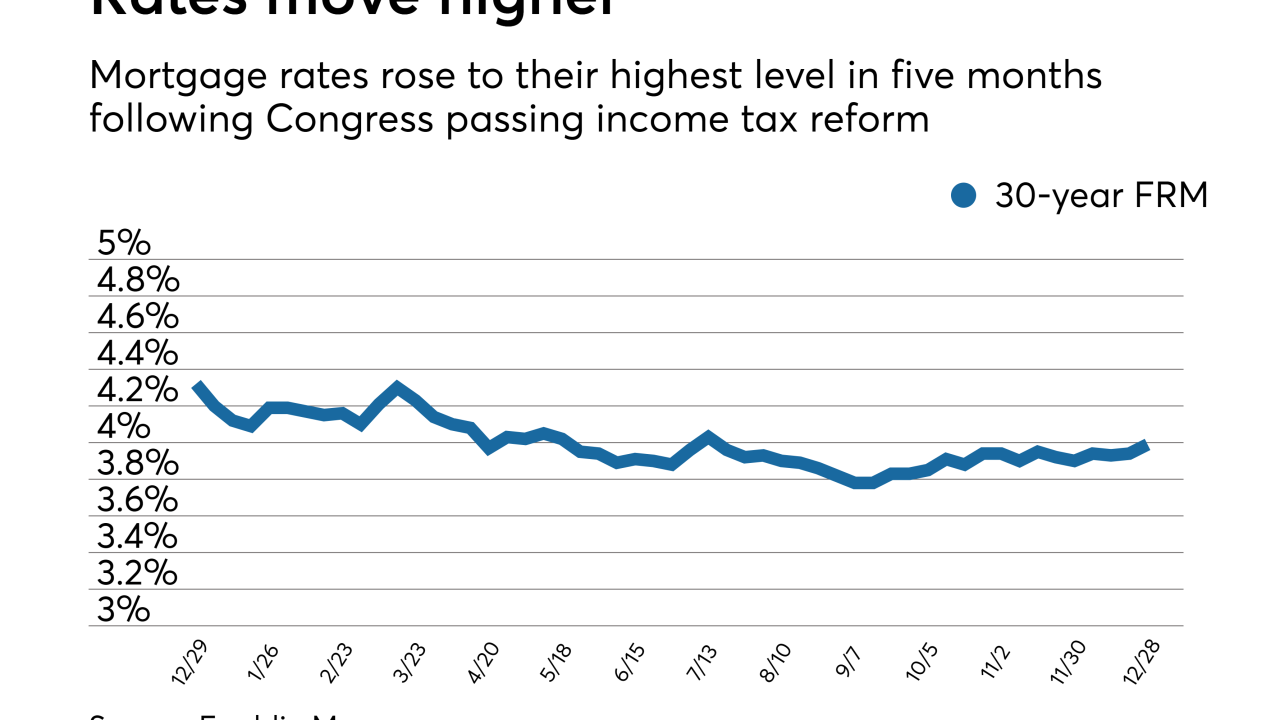

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Shifting policy stances and a renewed focus on housing finance reform from the White House could make 2018 a breakout year for Congress to finally resolve the conservatorship of Fannie Mae and Freddie Mac.

December 26