-

The Federal Housing Finance Agency was supposed to finalize its original proposal this month, but will redraft it because it was drawn up before the coronavirus emerged as a concern.

June 15 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

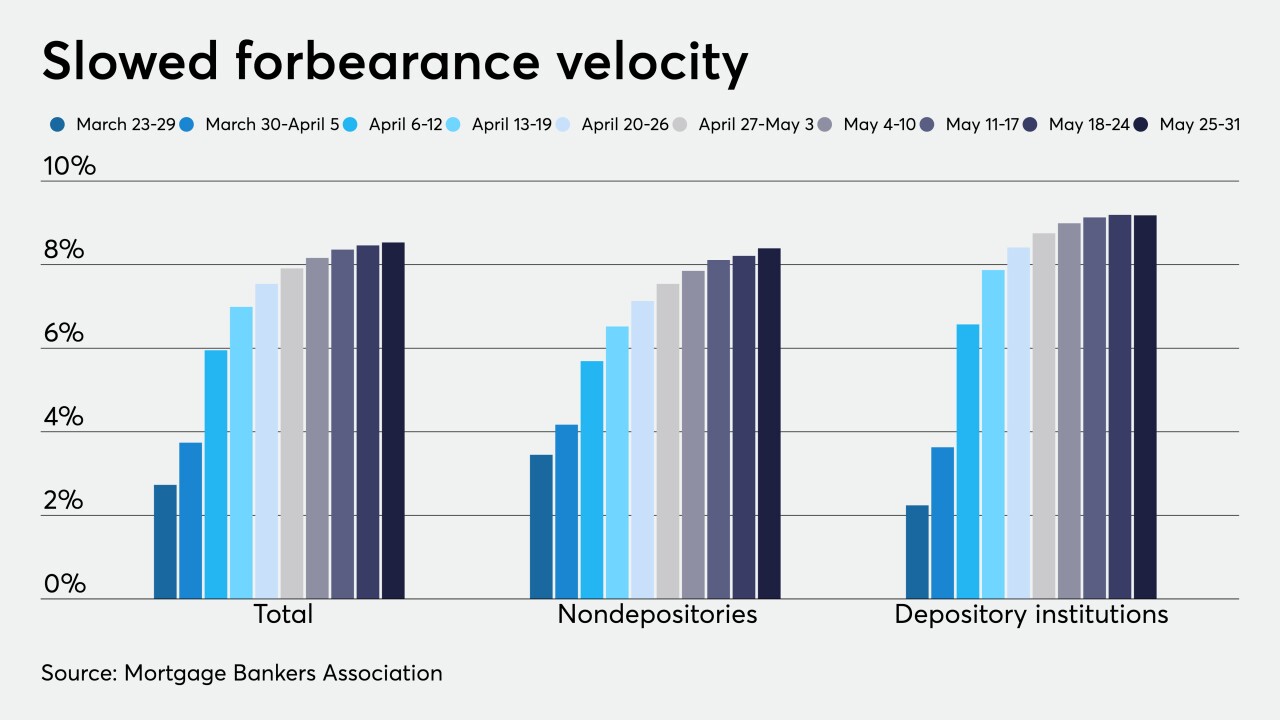

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

Self-service portals fielded at least half of coronavirus-related forbearance-plan requests and made it possible to handle an influx at a challenging time, but the GSEs recommend circling back to borrowers.

June 3 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

Steps have been taken to manage coronavirus-related liquidity risks to the housing finance system, but some remain, according to Mortgage Bankers Association President and CEO Robert Broeksmit.

June 1 -

Aggregate numbers for coronavirus-related payment suspensions are showing more consistency as organizations clarify how they handle them, and some consumers' incentives to use them may be declining.

May 29 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

Ginnie Mae is offering temporary relief related to its acceptable delinquency-rate threshold in response to issuers' need to fulfill the forbearance requirements in the coronavirus rescue package.

May 18 -

The number of mortgages in coronavirus-related forbearance rose by 37 basis points as the unemployment rate soared, according to the Mortgage Bankers Association.

May 11 -

The total coronavirus-related mortgages in forbearance grew by 55 basis points, in lockstep with rising unemployment claims, according to the Mortgage Bankers Association.

May 4 -

The number of loans in forbearance increased by a full percentage point over the past week, according to the Mortgage Bankers Association.

April 27 -

The Federal Housing Administration has provided struggling homeowners with payment flexibility and explored other measures. At the same time, the agency is mindful of protecting itself against downside risks.

April 23 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

Federal backing for firms facing a deluge of missed mortgage payments is still on the table despite recent comments by an official who questioned the need to help the industry.

April 20 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

At issue is whether the U.S. should step in now to save nonbank mortgage servicers to head off damage to the housing market.

April 13 -

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC

![“We want to make sure that our cash [inflows] exceed our cash outflows, so again, we’re looking at a lot of different things, and premiums being one of them, but there are other things that we’re considering as well," FHA Commissioner Brian Montgomery said.](https://arizent.brightspotcdn.com/dims4/default/15b0d4f/2147483647/strip/true/crop/1260x709+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fc0%2Fd2%2F5bd96a5a4a9eb632ac3bfd4b8da9%2Fmontgomery-brian-fha.png)