JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

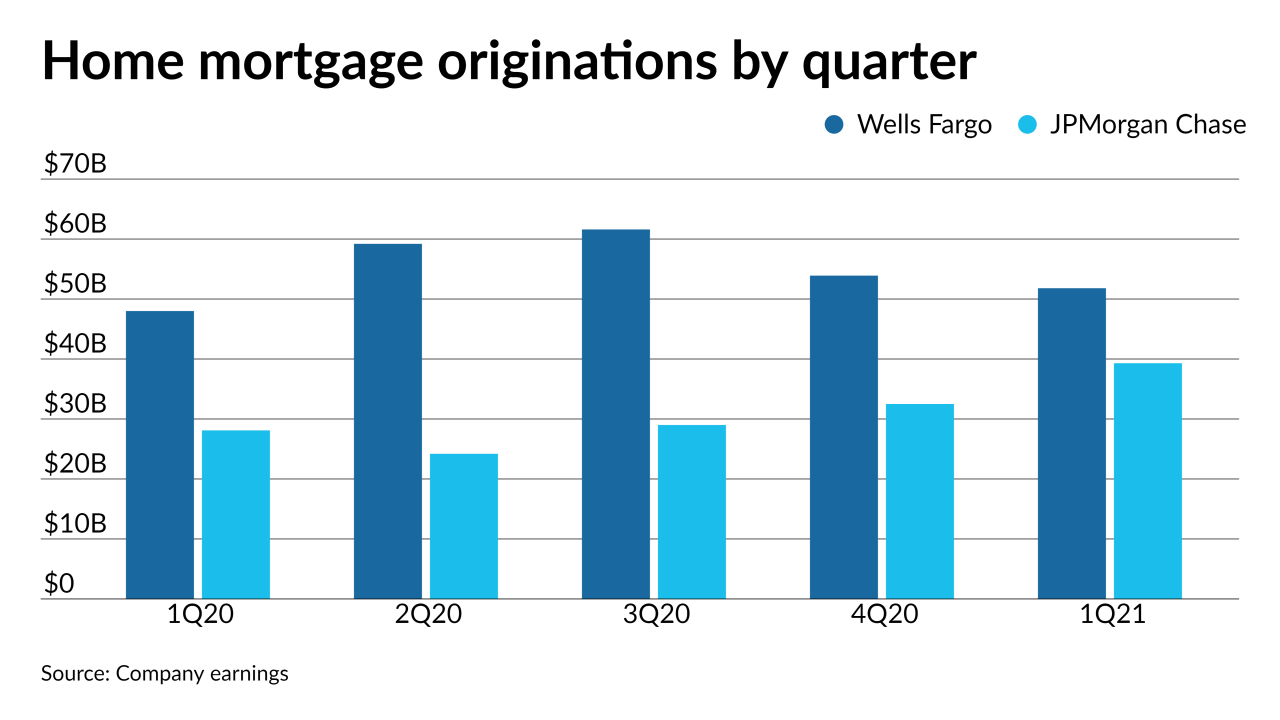

JPMorgan Chase now tops Wells Fargo in third-party servicing, origination volume and on-balance-sheet home loans, according to company filings.

October 13 -

The Federal Reserve's rate hikes so far are just "catching up," the JPMorgan chairman and CEO says. Dimon predicts inflation will be at 4% early next year and "won't be coming down for a whole bunch of reasons."

September 21 -

The construction manager for the beleaguered New Jersey mall is suing JPMorgan Chase & Co. to recover more than $30 million of unpaid work and accrued interest.

June 20 -

The locations being shuttered are spread across eight states, according to a spokesperson. JPMorgan took over 84 First Republic branches when it bought the failed San Francisco bank a month ago.

June 1 -

The San Francisco-based bank — which regulators seized and sold to JPMorgan Chase early this month — was paying dozens of employees more than $10 million apiece annually in the heyday before its collapse.

May 25 -

JPMorgan bought First Republic Bank earlier this month after it became the second-largest bank failure in U.S. history and the fourth regional-bank collapse this year.

May 22 -

"I think it's going to get worse for banks — more regulations, more rules and more requirements,'' JPMorgan Chase CEO Jamie Dimon said in a Bloomberg Television interview from Paris on Thursday.

May 11 -

Overall, depository share has shrunk, but the major player, which had reduced its involvement, has been increasing it and recently shared some thoughts with a HUD official.

February 27 -

JPMorgan Chase's asset-management arm entered into a deal to acquire more than $1 billion of single-family rentals, a sign that choppy markets haven't scared investors away from suburban housing.

November 15 -

The Fed's tests have become a menacing countercyclical force that could further drive down liquidity in the mortgage market over the next year, the chairman of Whalen Global Advisors writes.

July 19 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14 -

JPMorgan Chase is going on the “offensive” in mortgages as home prices rise across the country, said Marianne Lake, the bank’s chief executive for consumer lending.

November 9 -

The company says it plans to originate 40,000 mortgages for Black and Hispanic households and finance 100,000 affordable rental units over five years.

October 8 -

The Mortgage Industry Standards Maintenance Organization drew up the recommended wording in consultation with a group of lenders and investors after the passage of the Taxpayers First Act last year.

September 30 -

Wall Street won big buying up homes during the foreclosure crisis and renting them out. Now, it's headed back to the suburbs in hopes of scoring again.

September 25 -

Perry Hilzendeger’s new role as president of mortgage servicing for Home Point Financial is in line with a previous role he had, and follows broader executive changes at Wells.

August 14 -

Deferrals on residential mortgages and home-equity loans have been a common theme at JPMorgan Chase, Bank of America, Wells Fargo and Citigroup since the start of the coronavirus pandemic.

August 5 -

JPMorgan Chase Asset and Wealth Management Private Bank is pooling over 400 seasoned mortgage loans from its high-net worth clients. The loans are considered low-risk, but were not tested against CFPB qualified-mortgage standards.

July 23 -

The national conversation around systemic racism has compelled large banks to withdraw support from the “disparate impact” proposal. But community banks maintain that the proposed reforms would reduce frivolous claims.

July 20