-

Mortgage applications decreased 5.8% from one week earlier, although rates fell during the period to their lowest point in three months, according to the Mortgage Bankers Association.

December 19 -

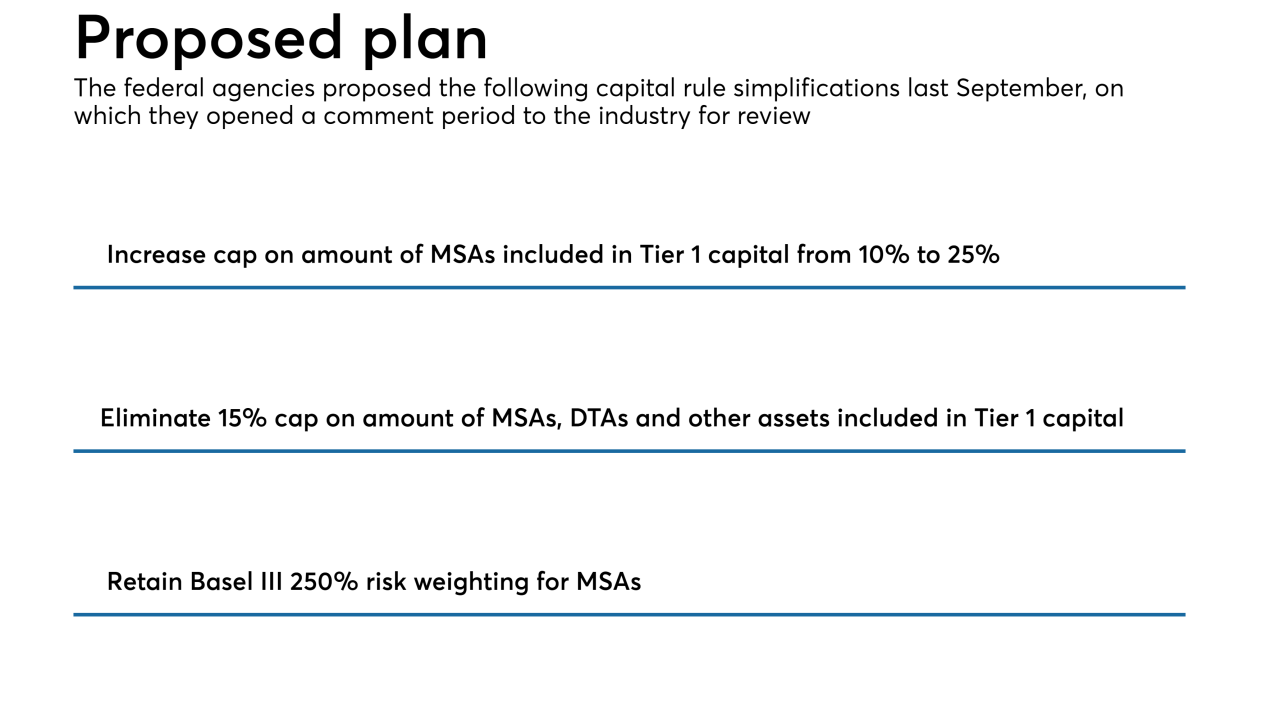

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

Mortgage applications to purchase newly constructed homes continues to decline, driven by affordability concerns among potential buyers, the Mortgage Bankers Association said.

December 13 -

Mortgage applications rose 1.6% from one week earlier as falling interest rates contributed to a boost in refinance activity, according to the Mortgage Bankers Association.

December 12 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

The number of workers employed by non-depository mortgage companies experienced a typical seasonal drop month-to-month, but employment remained higher than a year ago due to the persistence of competitive hiring practices.

December 7 -

Mortgage credit available to consumers increased in November by 1.1% from the previous month as lenders offered more conventional products with expanded underwriting criteria, the Mortgage Bankers Association said.

December 6 -

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

Third-quarter profitability fell to 2008 levels in the Mortgage Bankers Association's latest report, suggesting the seasonally slower fourth quarter could be particularly challenging this year.

November 29 -

The rush in holiday shopping also boosted the housing market as mortgage applications increased 5.5% from one week earlier, according to the Mortgage Bankers Association.

November 28 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

Mortgage application activity decreased 0.1% from one week earlier as refinance volume tanked, although interest rates fell, according to the Mortgage Bankers Association.

November 21 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6