-

One night in January, volunteers across the country counted 40,056 veterans living on the streets or in transitional housing and shelters — 585 more than in 2016 and the first increase of homeless veterans since 2010.

December 8 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Mortgage application volume increased from one week earlier, driven by a boost in refinance activity, according to the Mortgage Bankers Association.

December 6 -

Mortgage application volume decreased 3.1% from one week earlier as the start of the holiday shopping season likely slowed activity, according to the Mortgage Bankers Association.

November 29 -

Mortgage applications rose slightly this week, increasing 0.1% from a week earlier, according to the Mortgage Bankers Association.

November 22 -

The three major hurricanes that caused so much devastation during August and September was largely responsible for the third-quarter increase in mortgage delinquencies.

November 17 -

Mortgage application activity rose 3.1% from one week earlier as refinance demand increased, according to the Mortgage Bankers Association.

November 15 -

The U.S. Justice Department has sued the largest foreclosure trustee in the Pacific Northwest, claiming it illegally foreclosed on at least 28 military members or veterans in the past six years.

November 10 -

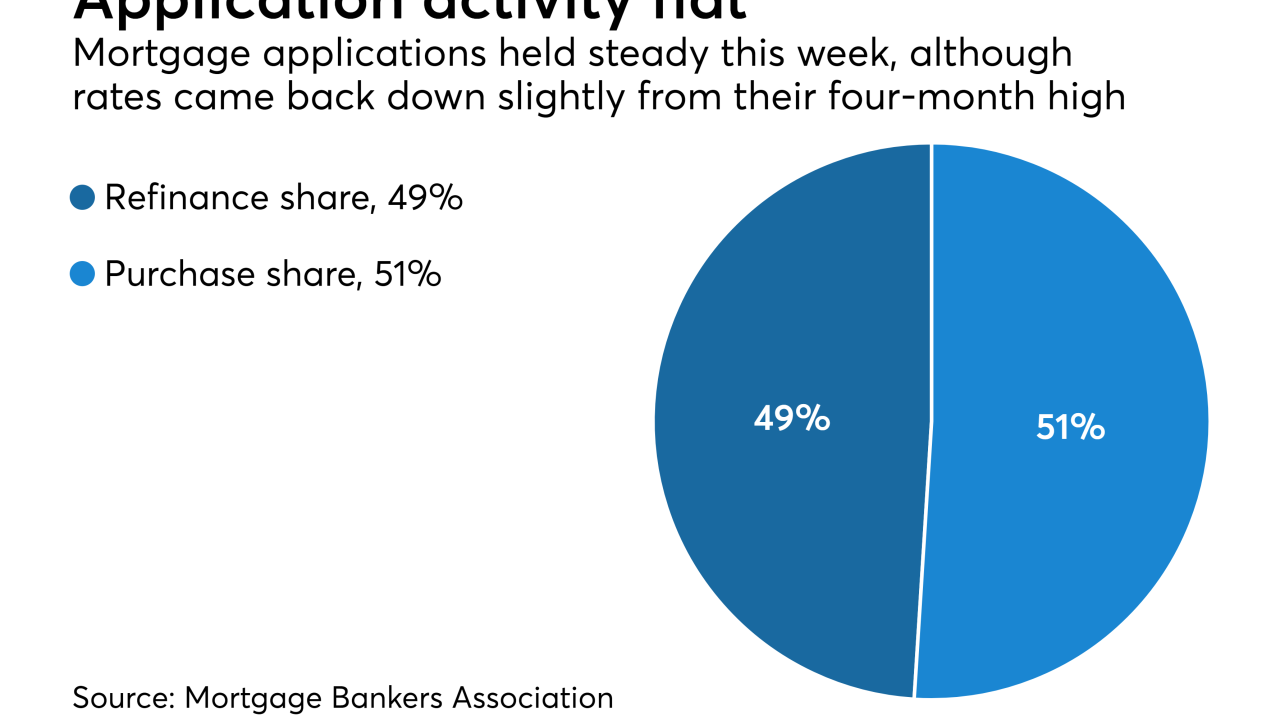

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8 -

Serious delinquencies on Federal Housing Administration loans popular among first-time home buyers with affordability constraints have improved this year, but may be reaching a plateau.

November 6 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

The Canyon 2 wildfire has been contained for more than a week, but aftereffects from the 9,200-acre conflagration still are rippling throughout Orange County, Calif.

October 27 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

To protect veterans from predatory lending practices, Ginnie Mae and the Department of Veterans Affairs should remove lenders' financial incentive for originating Interest Rate Reduction Refinance Loans.

October 20 Chrysalis Holdings

Chrysalis Holdings -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

Ginnie Mae and the Department of Veterans Affairs have described in more detail the VA loan refinancing practices they will crack down on to eliminate a long-running churning concern.

October 16 -

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10 -

Building off the success of policy changes in 2016, there are now even more ways for mortgage lenders to help student loan borrowers become homeowners.

October 4 Bilt Rewards

Bilt Rewards