-

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

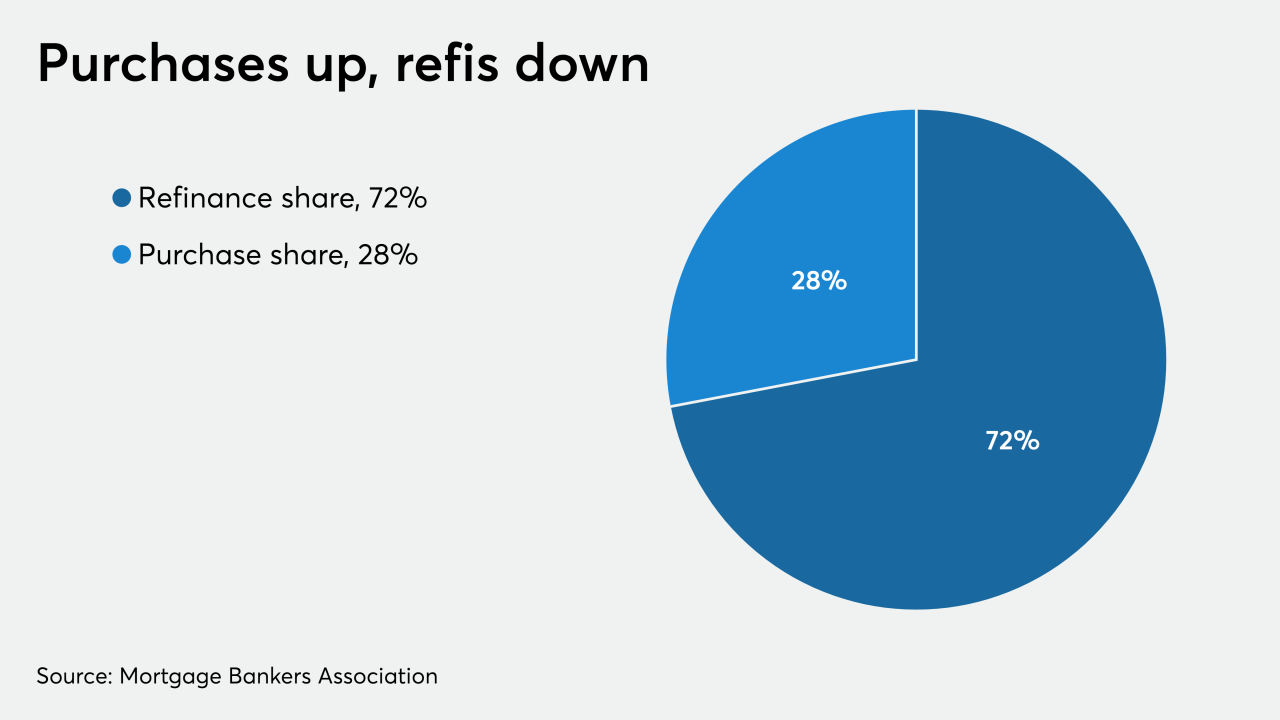

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

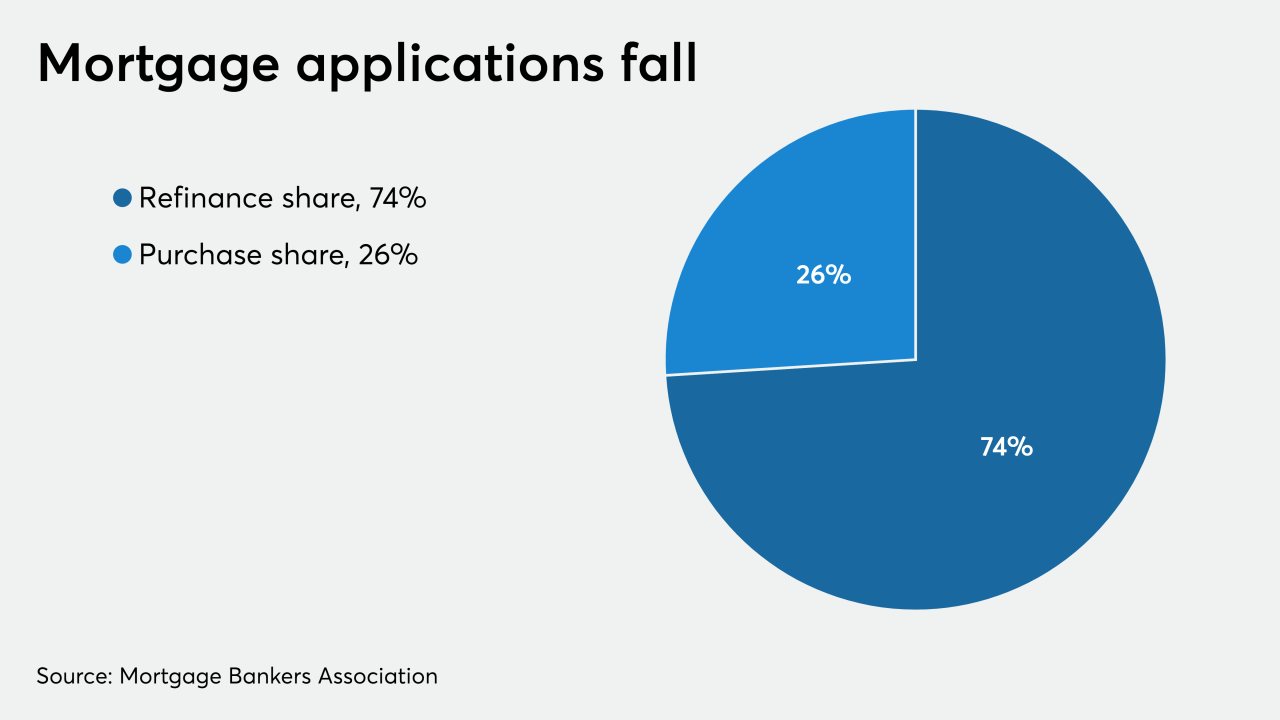

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

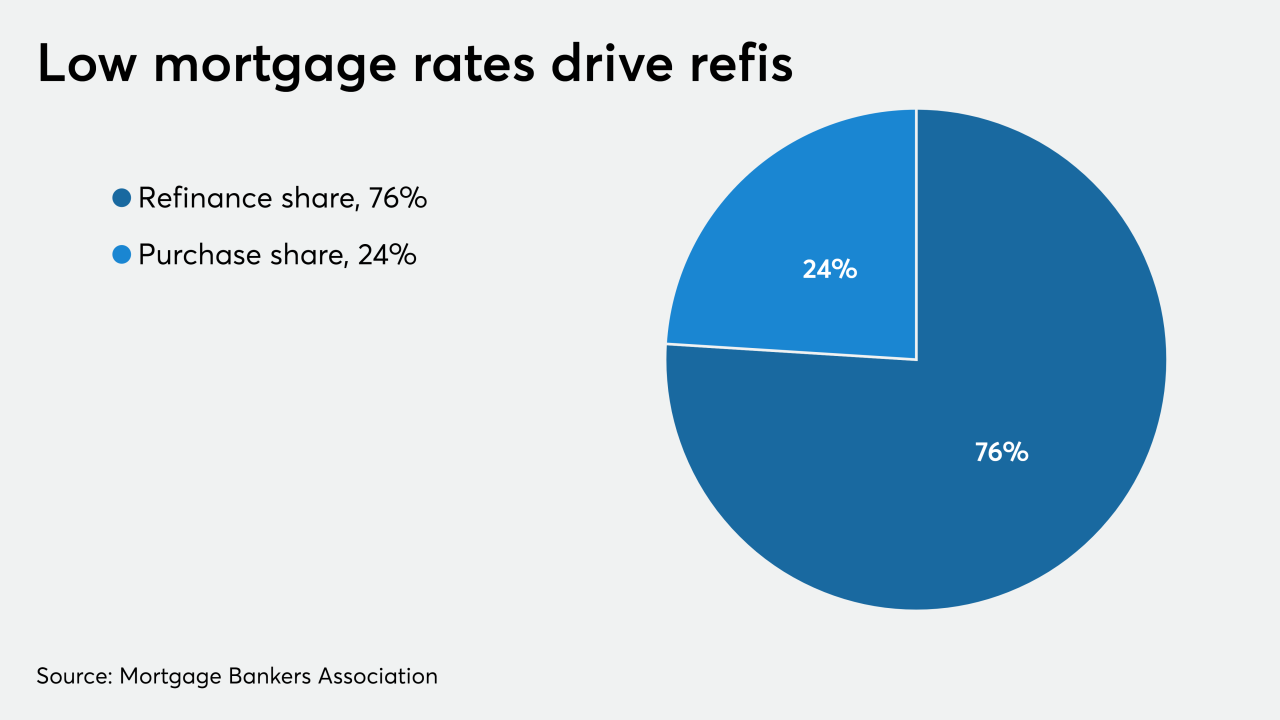

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

A top U.S. regulator is exploring whether to throw a lifeline to mortgage servicers stressed by the coronavirus pandemic by tapping a program meant to address natural disasters.

March 27 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Mortgage application volume decreased 8.4% compared with one week earlier as lenders managed activity by raising rates even as 10-year Treasury yields fell below 1%, according to the Mortgage Bankers Association.

March 18 -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

February 26 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12