Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Wells Fargo must pay $97 million to home mortgage consultants and private mortgage bankers in California who didn't get the breaks they were entitled to under the state's stringent labor laws.

May 9 -

A Texas lawyer pleaded guilty to his role in an elaborate $5 million mortgage fraud scheme involving pricey beach homes, according to the U.S. Attorney's Office in Houston.

May 1 -

CEO Tim Sloan and board chair Elizabeth Duke fielded tough questions Tuesday on everything from the embattled bank’s culture to its ties to the private prison industry.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 -

Months after President Trump vowed that Wells Fargo would pay a severe penalty, the CFPB and OCC hit the bank with a $1 billion fine to settle claims it overcharged customers for auto insurance and home loans.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase were weaker than Keefe, Bruyette & Woods forecast due to lower-than-expected gain-on-sale margins.

April 13 -

The firm warned Friday that it may take a charge of as much as $1 billion to settle a U.S. probe of its consumer business.

April 13 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

A pair of the nation's largest banks, Citigroup and Wells Fargo, made changes to their mortgage banking executive teams.

April 2 -

Democrats used a hearing with Fed Chair Jerome Powell to lay the groundwork for an intraparty debate over the merits of the Senate’s regulatory relief bill.

March 1 -

Some Wells Fargo customers on social media Thursday afternoon expressed frustration with not being able to log in to accounts digitally. The San Francisco bank responded in a tweet acknowledging the problem.

February 22 -

Jeffrey Taylor, a former Wells Fargo reverse mortgage executive and founder of Wendover Funding, has died following a battle with cancer.

February 14 -

Powell, a former investment banker who has served as a Fed governor, was confirmed by the Senate last month to a four-year term as chair of the central bank.

February 5 -

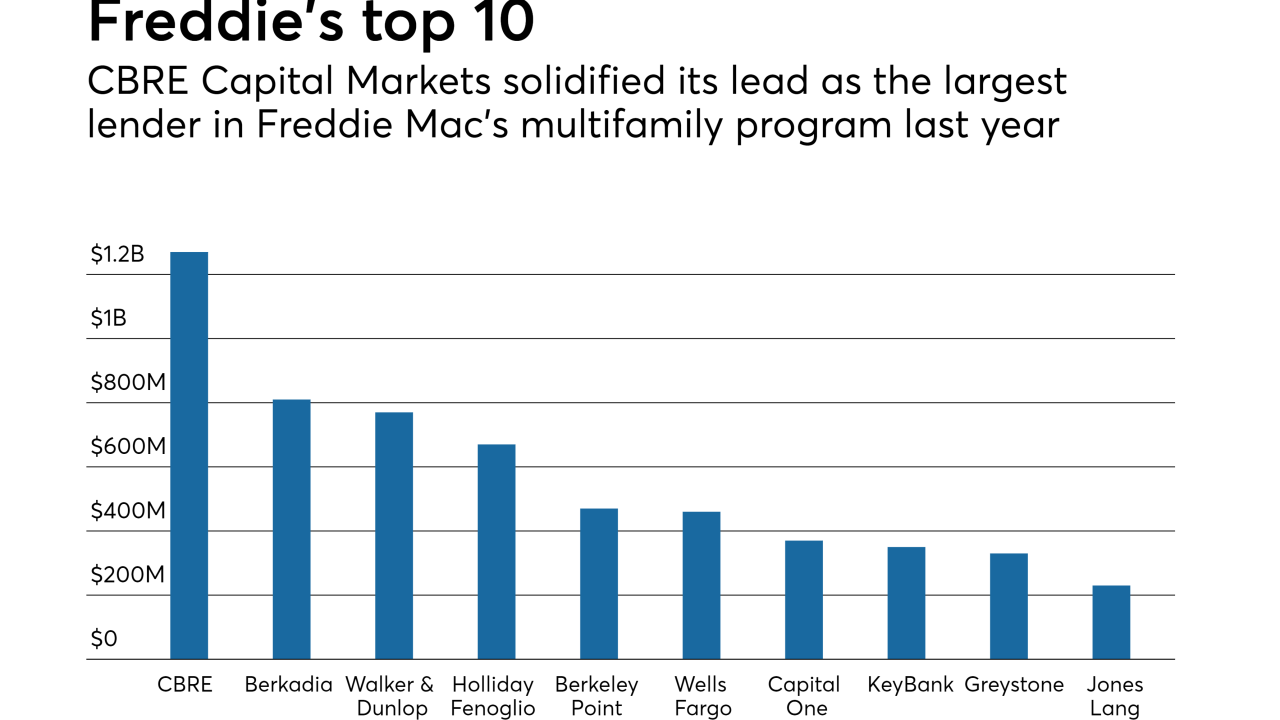

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

Servicers that handle loans in the government's Making Home Affordable program could face more enforcement at the urging of the Special Investigator General for the Troubled Asset Relief Program.

February 1 -

Michael DeVito, who was named Wells Fargo's interim head of home lending after the bank fired consumer lending head Franklin Codel, is now officially leading the residential mortgage unit.

January 30 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

A group of big financial institutions wants to use the blockchain to make it easier and less costly to track home mortgages packaged into securities.

January 18 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12