-

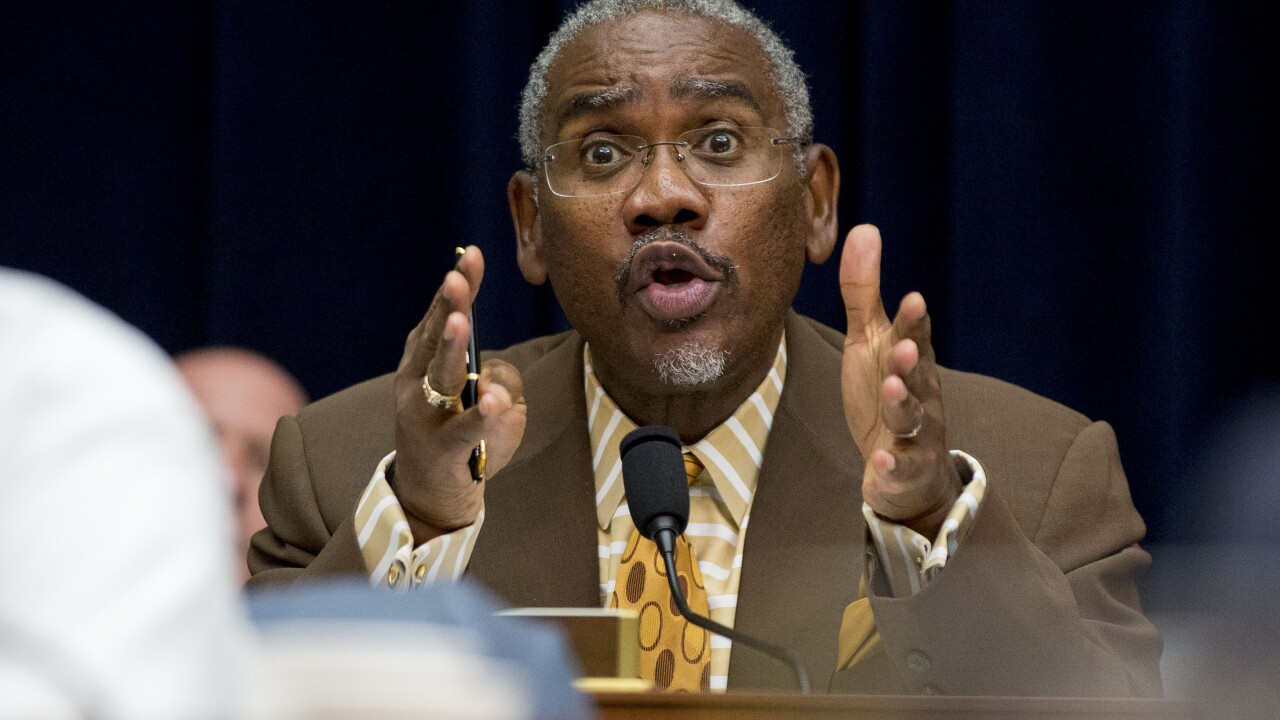

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

While regulatory relief legislation would raise the asset threshold for “systemically important” banks, Federal Reserve Chairman Jerome Powell said the central bank could still apply prudential scrutiny to banks below that new cutoff.

March 21 -

Sen. Elizabeth Warren, D-Mass., introduced a bill to create a permanent law enforcement unit to investigate criminal activity at large banks, just as the Senate was close to passing a regulatory relief package.

March 14 -

The Senate legislation could be crucial for three moderate Democrats backing the bill who are up for re-election this fall, although the package has divided the party more broadly.

March 8 -

More than 50 amendments had been filed by Wednesday afternoon to be considered as part of a Senate regulatory relief bill, but it was unclear which proposed changes if any have the approval of the legislation's key sponsors.

March 7 -

On the eve of a crucial Senate vote to roll back parts of the Dodd-Frank Act, the divide between progressive and moderate Democrats on regulatory relief has never been starker.

March 6 -

Democrats used a hearing with Fed Chair Jerome Powell to lay the groundwork for an intraparty debate over the merits of the Senate’s regulatory relief bill.

March 1 -

The interim head of the Consumer Financial Protection Bureau said the agency may allow prudential regulators to take the lead on more supervisory matters to cut down on duplication.

March 1 -

Acting CFPB Director Mick Mulvaney dismissed concerns by Sen. Elizabeth Warren, D-Mass., about his leadership of the consumer agency while supporting a lighter regulatory touch for credit unions.

February 27 -

The war of words between acting Consumer Financial Protection Bureau Director Mick Mulvaney and Sen. Elizabeth Warren, D-Mass., the agency's architect, is escalating.

February 23 -

Democratic lawmakers are objecting to acting CFPB Director Mick Mulvaney's decision to strip the fair-lending office of enforcement powers.

February 16 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5 -

Housing finance reformers are pushing full steam ahead to get a bill introduced before the political calendar makes passage nearly impossible.

February 2 -

Mick Mulvaney’s unapologetic memo to staff about the Consumer Financial Protection Bureau’s mission headlined a spate of developments this past week as he continues to transform the agency. Here are the key developments.

January 29 -

The candidates being discussed lately to run the agency bring experience on consumer protection issues, and potential bipartisan appeal.

January 26 -

Many in the industry applauded the Consumer Financial Protection Bureau's new mission statement shifting the agency's focus away from using enforcement actions as a substitute for rules of the road.

January 24