-

Refinance mortgage volume hit a 10-year low during the first quarter, while a tepid market for purchase lending put total origination activity at its lowest level since 2014.

May 25 -

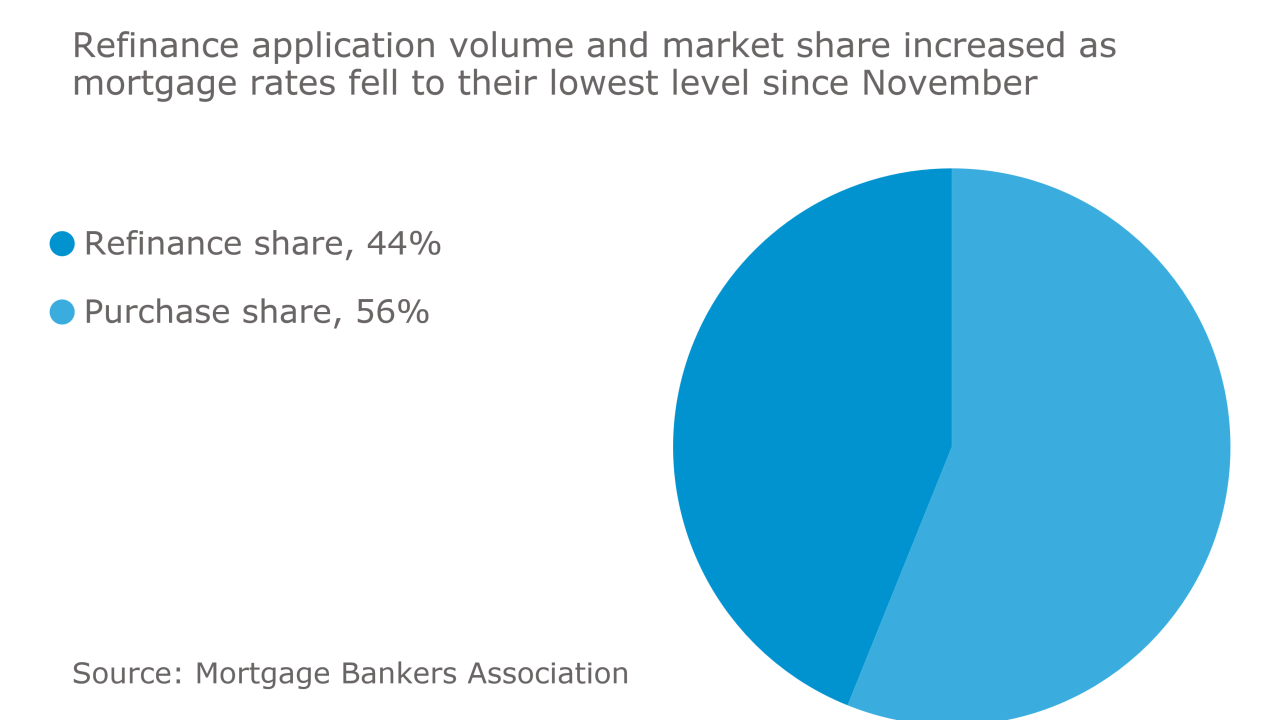

Application volume increased 4.4% from one week earlier as rates hit their lowest level in seven months, according to the Mortgage Bankers Association.

May 24 -

Maine's residential mortgage lending industry bears little resemblance to its prerecession version as changing conditions have shuffled the deck of top lenders and created new choices for borrowers.

May 23 -

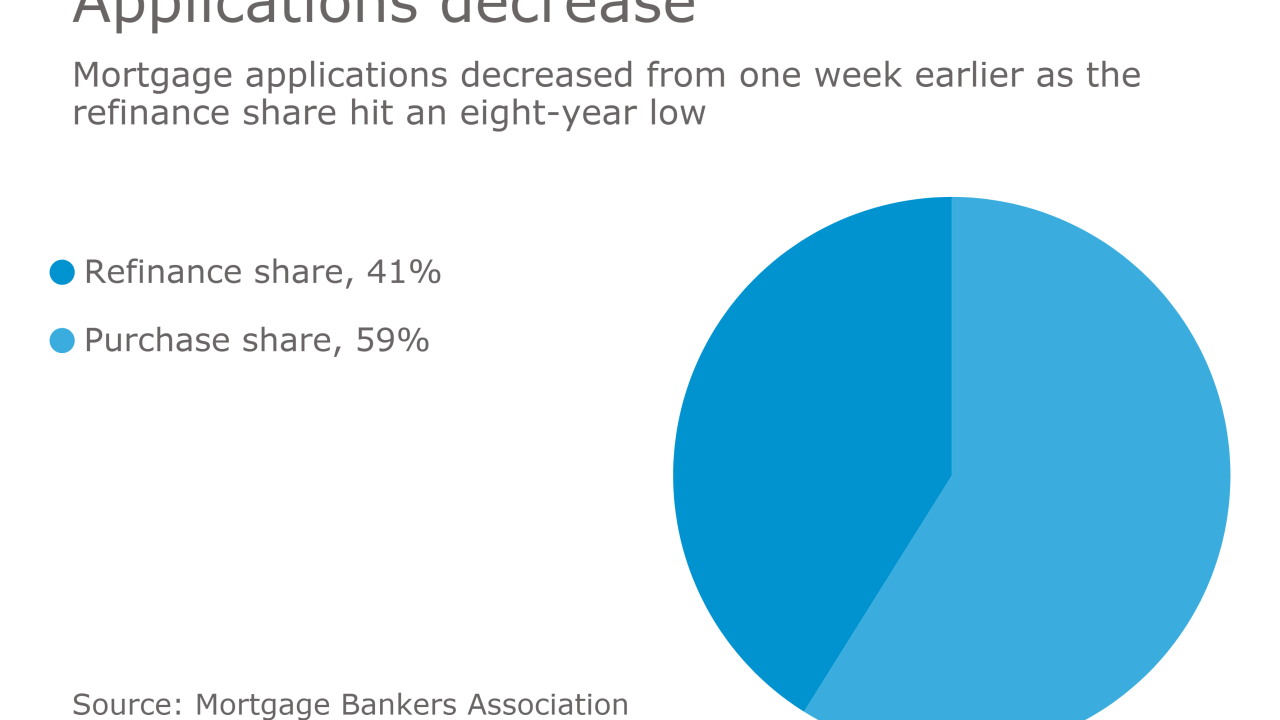

Mortgage applications decreased 4.1% from one week earlier as the refinance share hit an eight-plus-year low, according to the Mortgage Bankers Association.

May 17 -

The six private mortgage insurers are jockeying to differentiate themselves with value-add services that complement their core product.

May 11 -

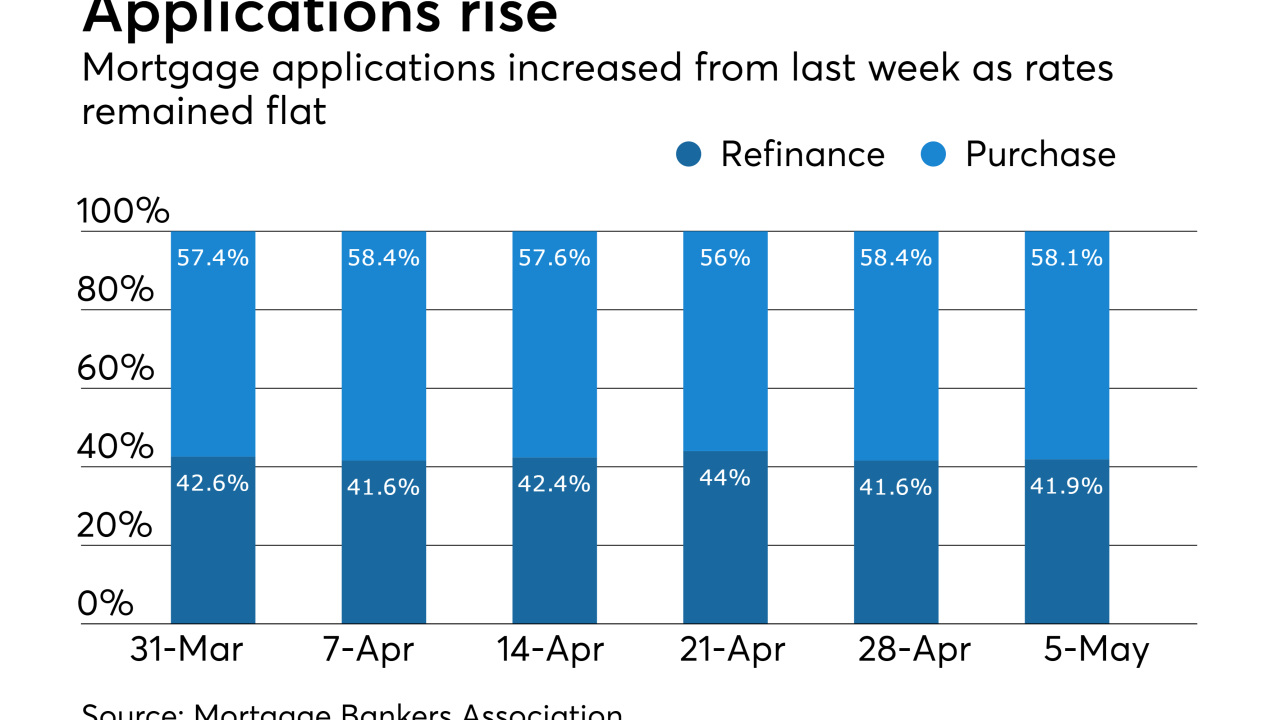

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

Seasonal factors contributed to an 89,000-unit increase in the number of seriously delinquent properties in the first quarter from the fourth quarter of 2016.

May 4 -

From housing finance reform to the latest economic projections, here's a look at the biggest stories and best insights from this week's Mortgage Bankers Association National Secondary Market Conference in New York.

May 3 -

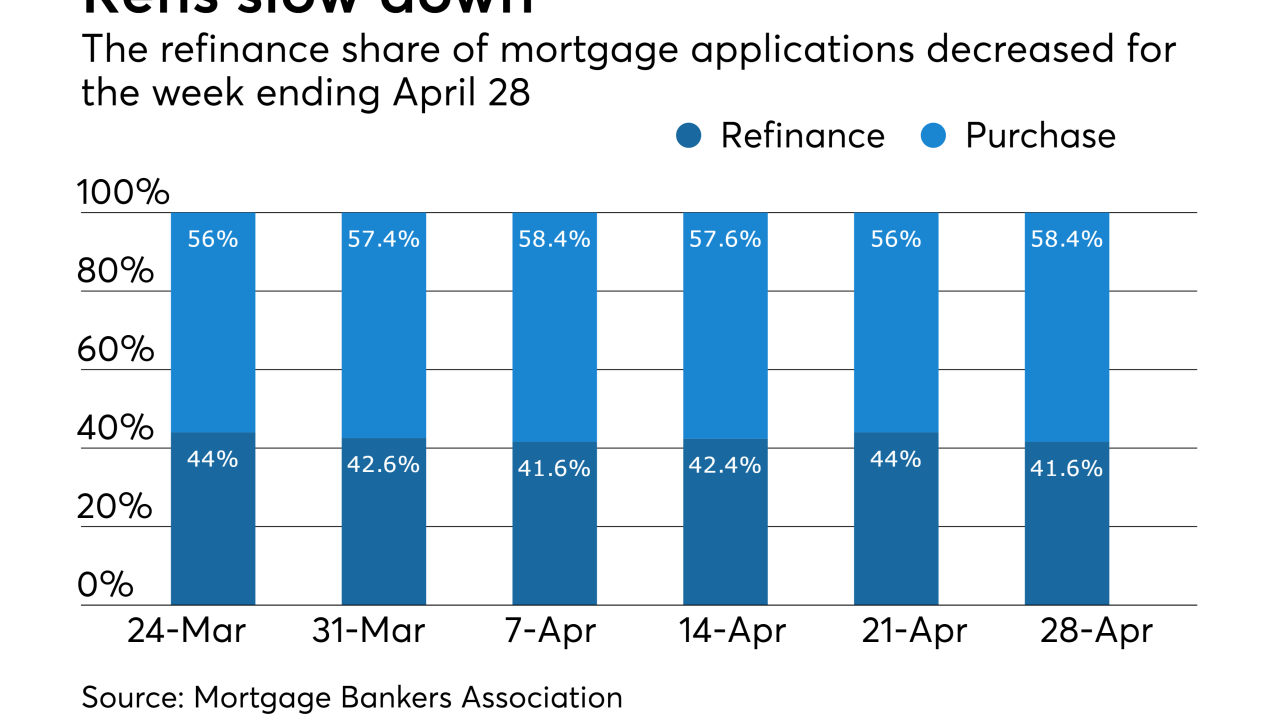

Mortgage application volume decreased 0.1% from one week earlier as refinance activity resumed its decline, according to the Mortgage Bankers Association.

May 3 -

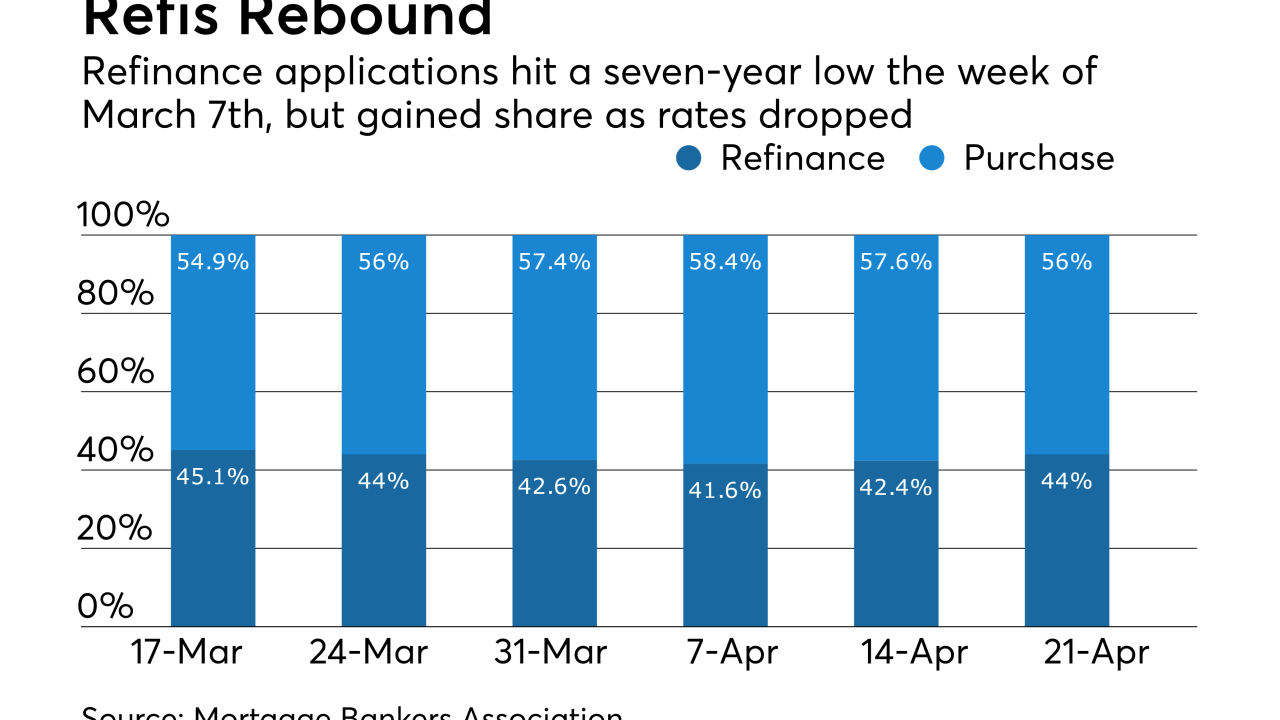

Mortgage application volume increased 2.7% for the week of April 21 as more consumers applied for refinance loans.

April 26