-

Angel Oak Companies' affiliates increased their production of loans made outside the boundaries of the Qualified Mortgage definition by 90% year-over-year during the second quarter, when most lenders' volume fell.

July 23 -

Oaktown Re II is National Mortgage Insurance's first rated transaction, according to Morningstar; it reinsures $5.47 billion of policies on mortgages with a total balance of $30.12 billion.

July 18 -

As property values continue appreciating, Caliber Home Loans added a jumbo loan product to its portfolio lending suite to support borrower needs in a climate of higher home prices.

July 17 -

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

The Royal Bank of Scotland is paying $20 million to settle an investigation by the Illinois attorney general related to the bank's marketing and sale of residential mortgage-backed securities.

July 5 -

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise credit risk transfer deals.

July 3 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

Impac Mortgage Holdings will sell up to $600 million of non-qualified mortgage loans to Starwood Property Trust over the next 12 months that will be securitized.

June 27 -

CoreVest American Finance’s next offering of rental bonds is backed by homes that are older and smaller than any of its previous transactions, according to Kroll Bond Rating Agency.

June 25 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

Bank of America Corp.'s Merrill Lynch unit will pay $15.7 million to settle a U.S. regulator's allegations that it failed to properly supervise traders who persuaded clients to overpay for mortgage bonds by misleading them about how much the firm paid for the securities.

June 12 -

IH 2018-SFR1 refinances three earlier transactions (one each from 2013, 2014 and 2015) and is initially sized at $1.1 billion; it may be upsized to $1.3 billion, depending on investor demand.

June 11 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

Freedom Mortgage is being punished by a government-owned mortgage guarantor amid concerns that the Mount Laurel, N.J.-based company is helping to enable unnecessary refinances of veterans' loans.

June 4 -

There are almost 7 million coastal homes facing more than $1.6 trillion in potential storm-surge reconstruction expenses this year, representing a 6.6% cost increase from last year's hurricane season.

May 31 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

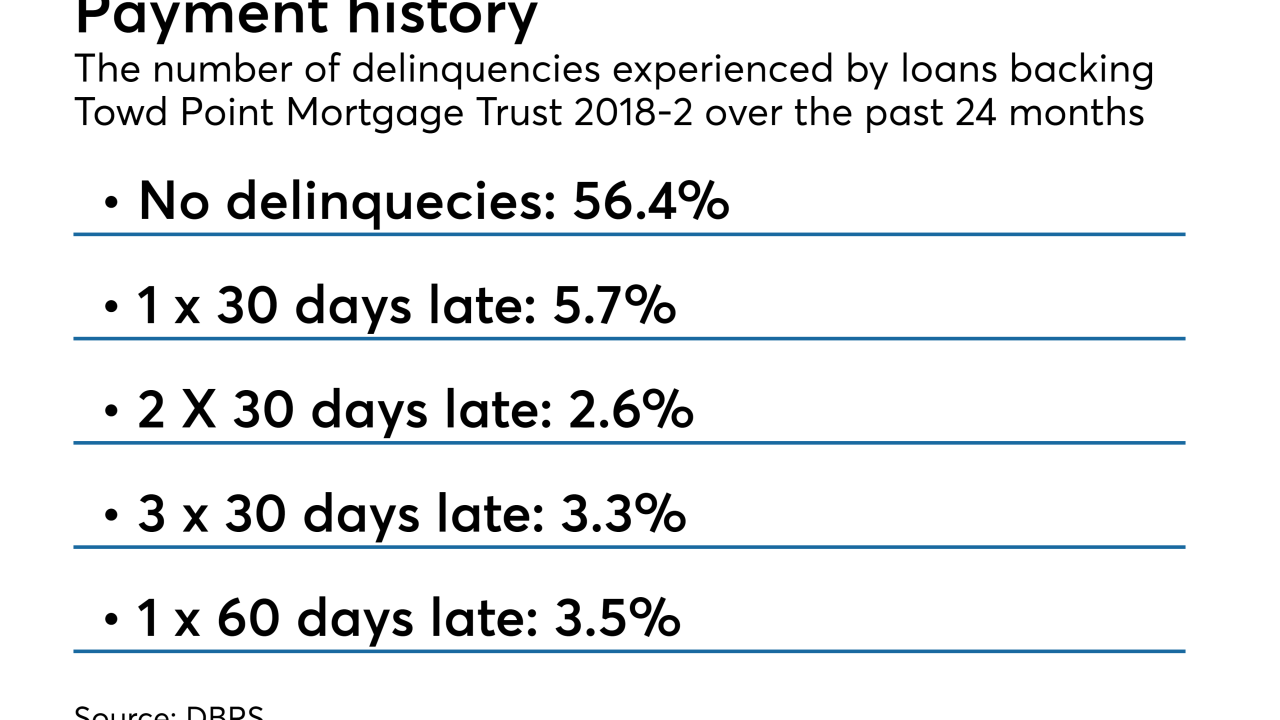

The $1.56 billion Towd Point Mortgage Trust 2018-2 also features higher exposure to loans on investment properties, in some cases loans backed by single-family homes in more than one state.

May 22 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18