Point of sale systems that aim to provide better experience for borrowers were a hot topic at the show, which the MBA held in the hometown of the best-known digital platform in the business, Quicken Loans' Rocket Mortgage. Several Quicken executives were on hand to discuss strategies in this area and give attendees tours of the city, and Chairman Dan Gilbert recounted how he built his company at the meeting.

In line with discussions about how to not only provide a strong customer experience but also create a more efficient mortgage process was a lot of buzz around the use of electronic notarization, e-notes,

Governmental hurdles to creating more efficient, digital mortgages also were on the minds of attendees at the residential and commercial mortgage meeting, which was led by MBA Vice Chairman and CBRE executive Brian Stoffers in lieu departing CEO David Stevens. The group, which laid out the changes it is lobbying for to address those concerns, hopes to name Stevens' successor soon.

Fannie Mae and Freddie Mac representatives also attended the meeting and shared tips and information about their latest required technology implementations, including the Uniform Residential Loan Application and the Uniform Closing Dataset.

Cyber security was another theme at the conference, where speakers shared lessons learned from recent breaches and incidents involving wire fraud.

Point of sale system 'co-opetition'

Joe Tyrrell, executive vice president and publicly traded loan origination system provider Ellie Mae, considers it more of a "co-opetition." Ellie Mae allows users to work with the POS system of their choice, but the company also is testing one it plans to roll out broadly to users of its Encompass technology for no additional charge this summer.

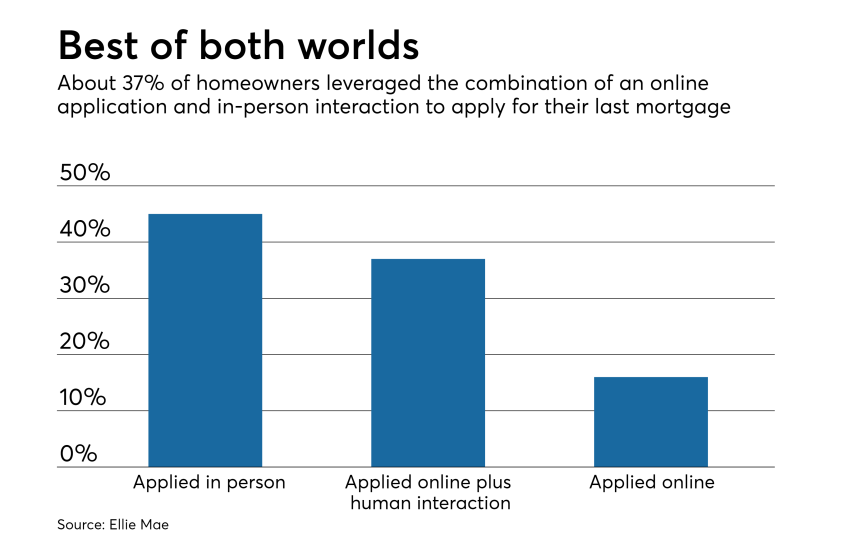

Mortgages shouldn't purely be digital

"It's very rare the customer wants to go end to end and not talk to someone," said MaryAnn Schummer, chief product officer and interim chief information offer at Flagstar Bank.

Wire fraud is spreading

Alexa can help servicers

"Our clients are on Alexa and they want that kind of thing," he said.