-

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Blackstone stock fell by as much as 9.3% after Trump said he was "immediately taking steps to ban large institutional investors from buying more single-family homes."

January 7 -

Although some of the cohort surveyed were flush with savings, others admitted having precarious debt situations and steadfast attitudes toward luxury purchases.

January 6 -

The number of remodeling establishments hit at a record high earlier this decade and now accounts for over 60% of home construction-related businesses.

January 2 -

Kind Lending, Class Valuation, also add CFOs, Mortgage Capital Trading boosts artificial intelligence efforts and Acra welcomes an industry veteran.

January 2 -

A majority of recent sellers said they offered to cover closing costs, with many also buying down mortgage rates, according to a new report from Zillow.

December 31 -

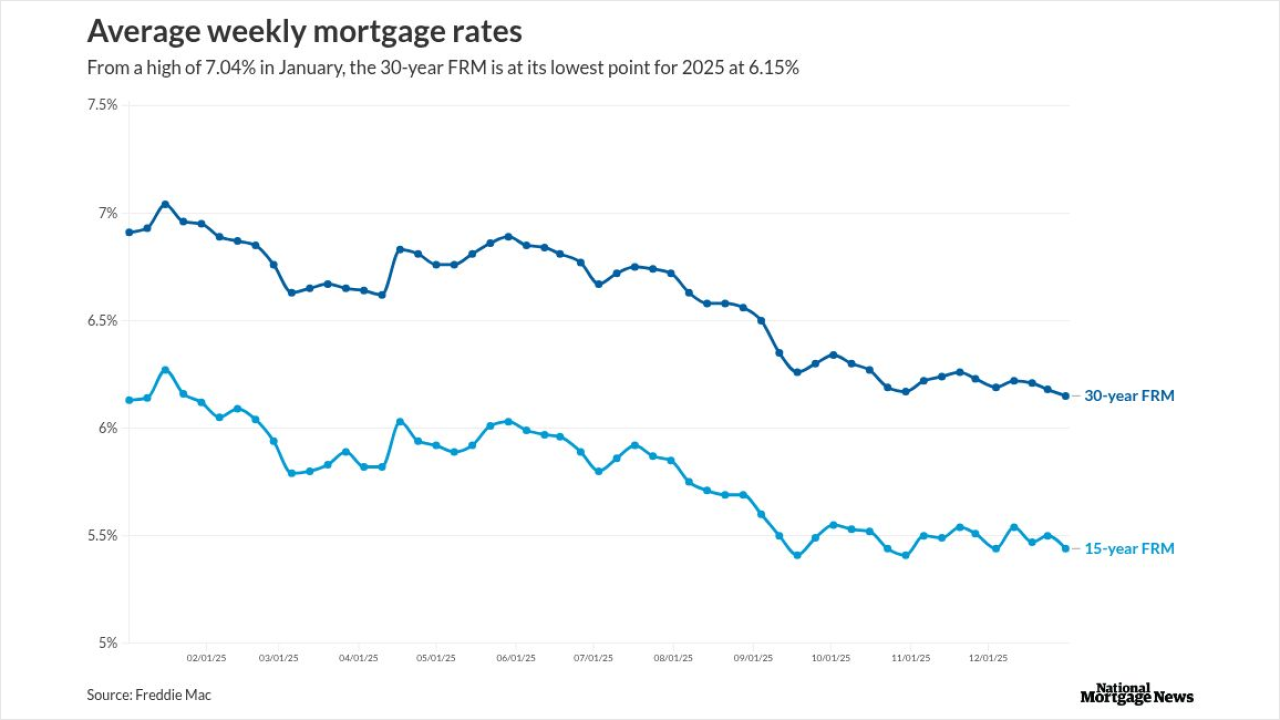

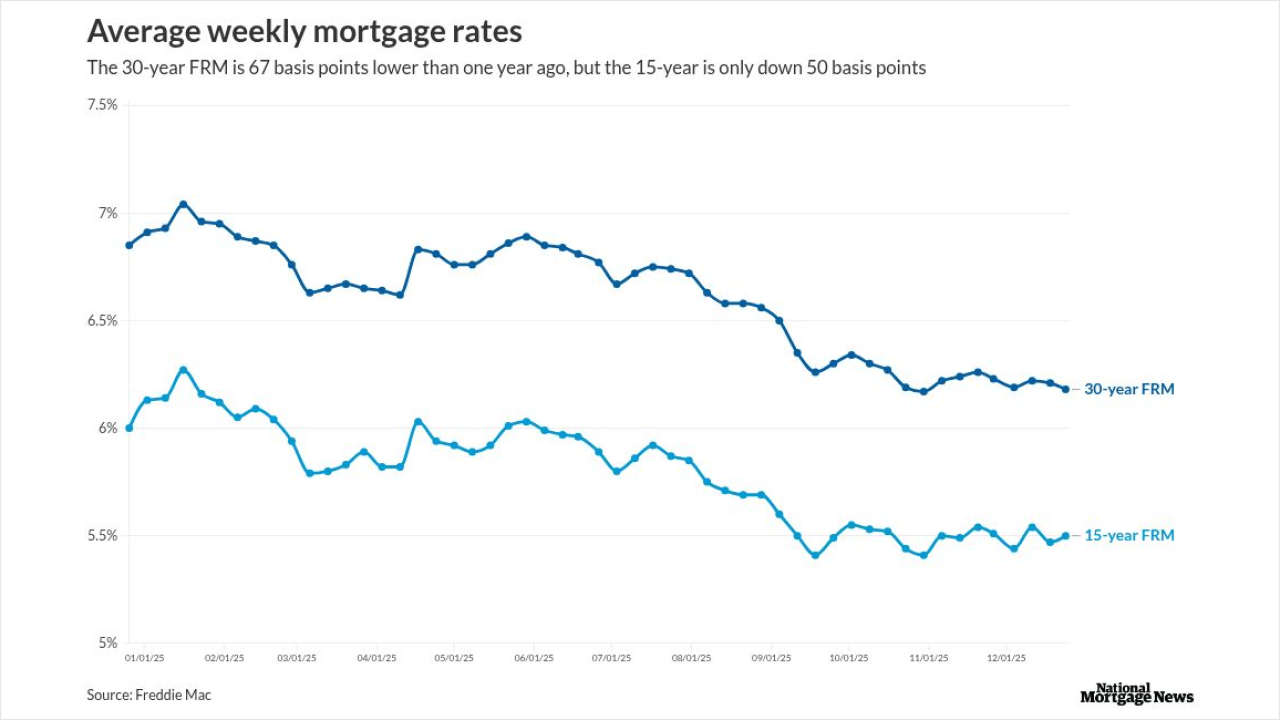

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

A modest improvement in prices and mortgage rates encouraged buyers. Signings have now increased for four straight months, matching a pandemic streak.

December 29 -

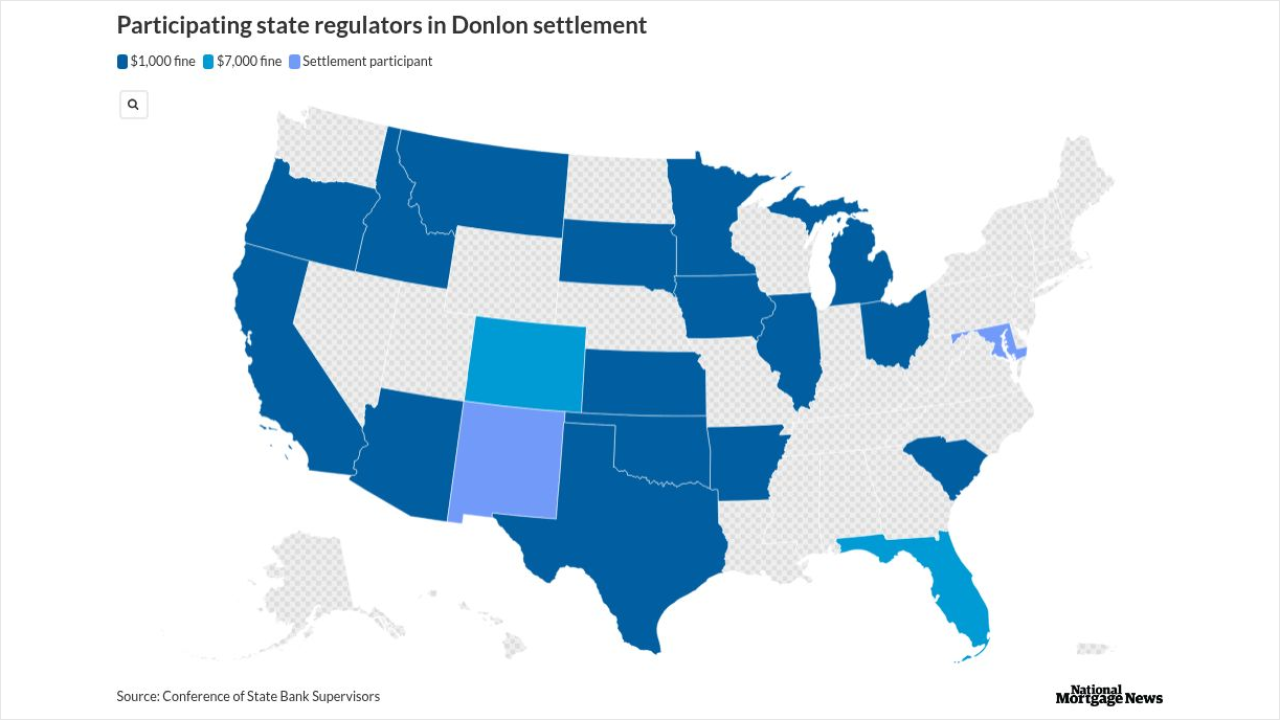

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

December 26 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

Wellness rooms, thoughtful sensory inputs and layouts that boost functionality can reduce workplace stress.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23 -

The inventory slowdown came as properties sold for 1.6% below asking prices, with some sellers opting to remove their listings altogether, according to Redfin.

December 22 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

New-home purchase activity rose 3.1% year over year, but dropped 7% from October, the Mortgage Bankers Association said.

December 16