-

The number of remodeling establishments hit at a record high earlier this decade and now accounts for over 60% of home construction-related businesses.

January 2 -

The government-sponsored enterprise is under fire from dozens of the more than 100 workers it fired last spring for allegedly committing fraud.

January 2 -

A definitive move could occur as early as fiscal year 2026 or take until 2033, depending on what the government is willing to do, according to one analyst.

January 2 -

The Federal Home Loan Bank of Chicago will be offering more funding and higher per-member limits as part of its 2026 Community Advance program.

January 2 -

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

January 2 -

The merger of equals, which received a chilly reception from investors when it was announced in July, closed faster than analysts had expected.

January 2 -

For 2026, most Wall Street interest-rate strategists expect stable-to-higher Treasury yields as the Fed's rate-cutting cycle comes to an end.

January 2 -

After the ceremony on Thursday, Mamdani announced three executive orders focused on housing affordability to kickstart his agenda.

January 2 -

Kind Lending, Class Valuation, also add CFOs, Mortgage Capital Trading boosts artificial intelligence efforts and Acra welcomes an industry veteran.

January 2 -

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

A majority of recent sellers said they offered to cover closing costs, with many also buying down mortgage rates, according to a new report from Zillow.

December 31 -

Developing class action cases could corral hundreds of thousands of plaintiffs in fights against lenders who allegedly defrauded customers and employees.

December 31 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

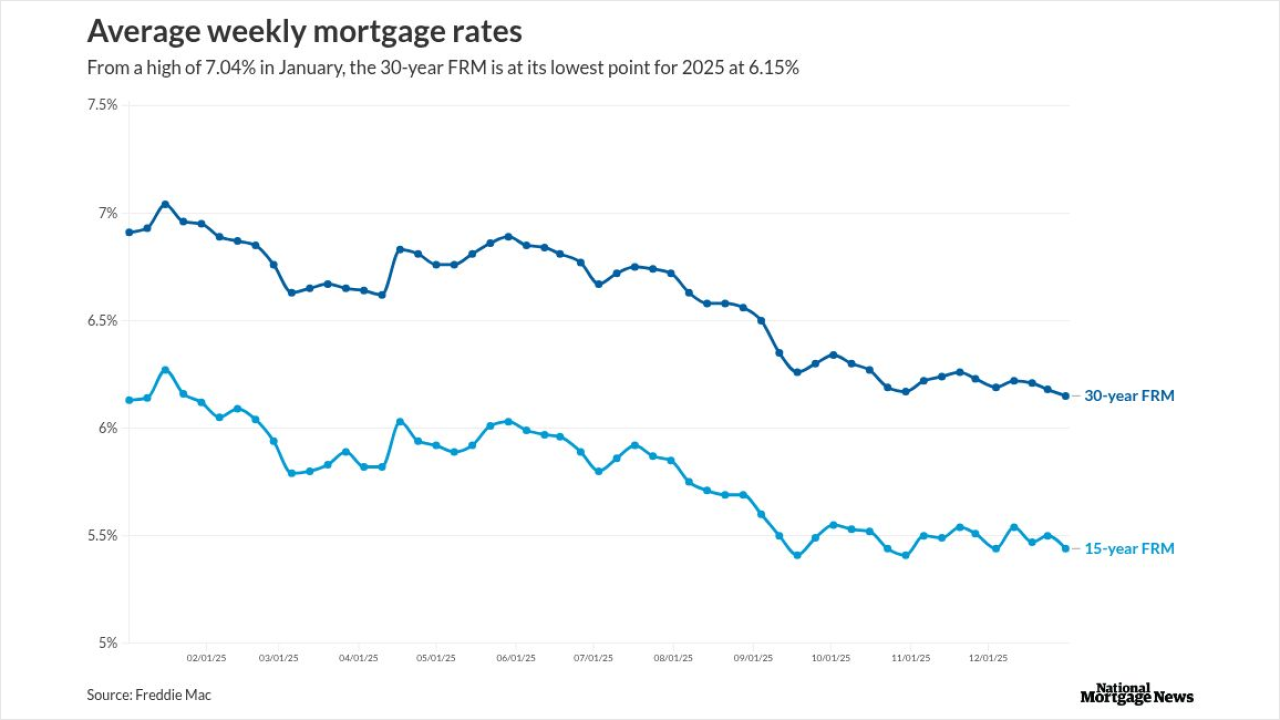

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

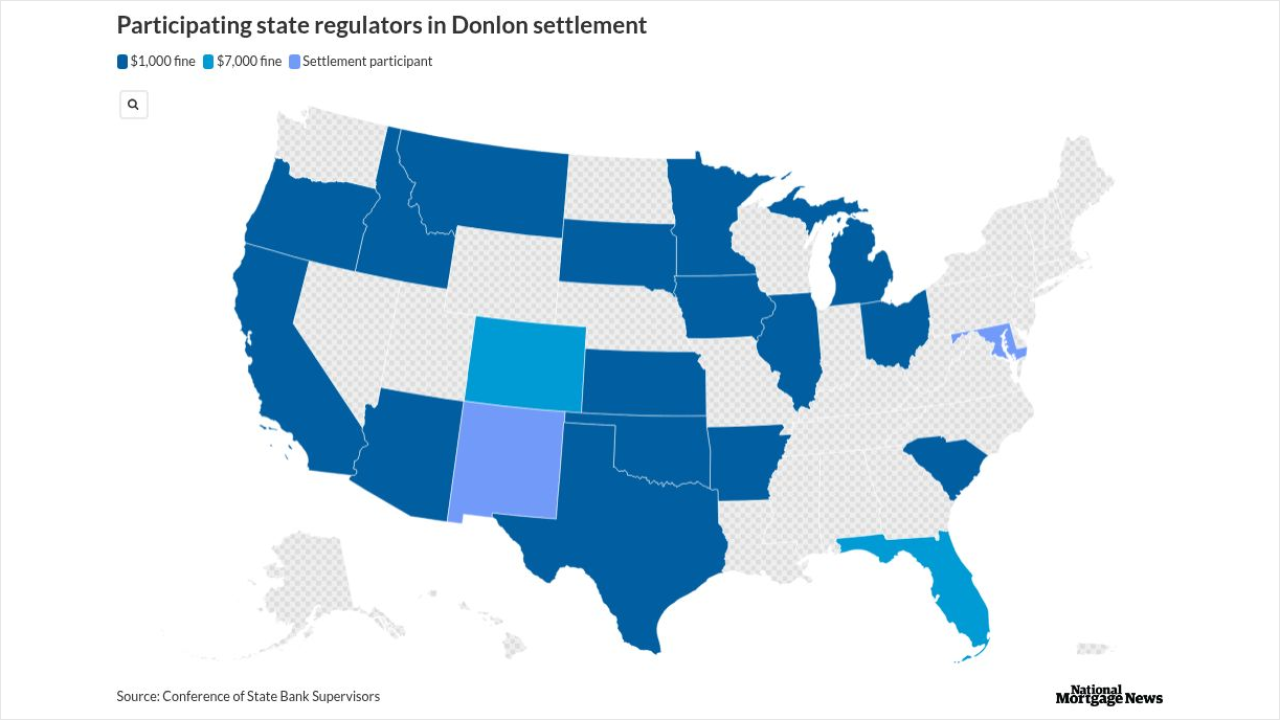

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

AI's capabilities far exceed how the technology is being used in mortgage, but an all-in strategy will quickly put companies ahead of the pack, leaders say.

December 31 -

National home prices grew monthly and annually in October, but considerably less than last year, according to S&P Dow Jones Indices.

December 30 -

The professionals can't originate loans in their local cities for various stretches, following a federal judge's ruling granting most of the lender's wishes.

December 30 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30