-

A 90-day pause on reciprocal tariffs between the U.S. and China boosted the near-term economic outlook for banks, but tensions and uncertainty around trade barriers remain high.

May 12 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

Banks are taking back more farmland through foreclosure than at any point in the past three years as low crop prices, epic flooding and the Trump administration’s trade spat with China have left many farmers struggling to pay their debts.

September 11 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Farmers were already taking on more debt to cover losses from falling crop prices. New tariffs and other retaliatory moves could hurt ag borrowers further and lead to loan losses and tighter underwriting.

May 16 -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 7 Duke Financial Economics Center

Duke Financial Economics Center -

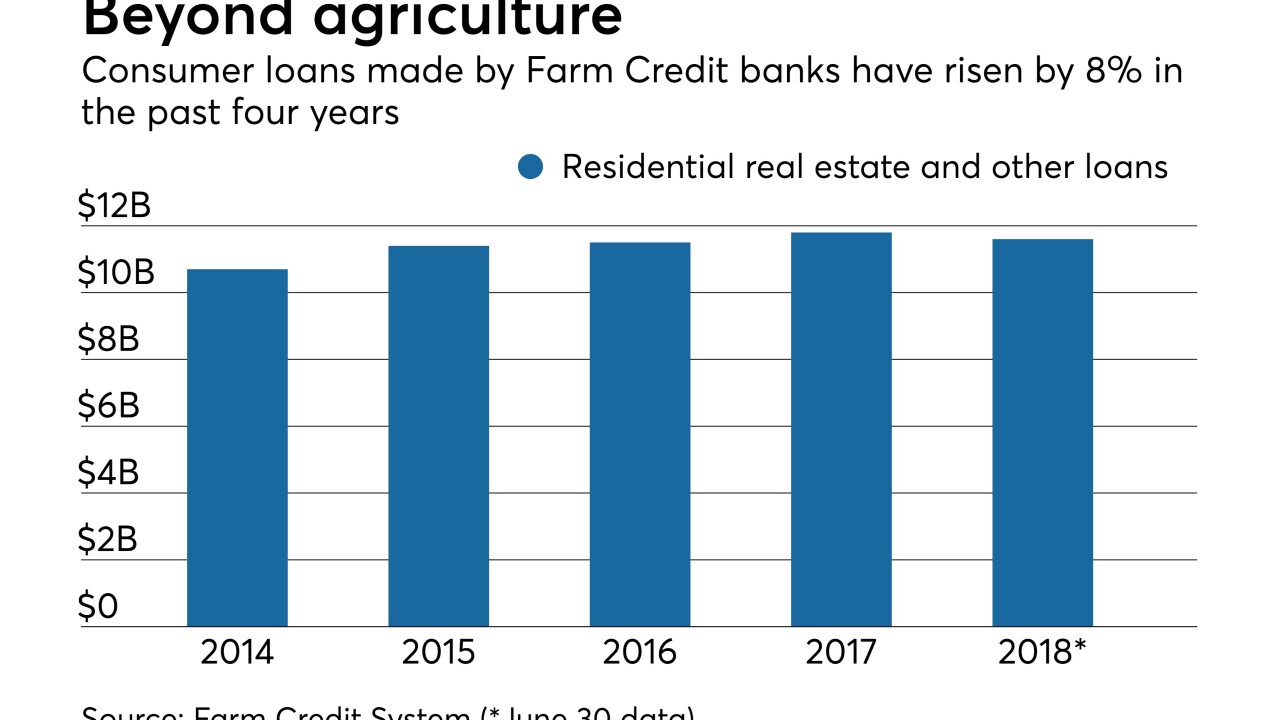

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

China’s threat to impose hefty tariffs on dozens of U.S. imports could weaken demand for soybeans, pork and other agricultural products. Here's what that could mean for farmers, ranchers and the banks that lend to them.

April 4 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

Farmer Mac's second-quarter net earnings increased 46% year-over-year, driven by a boost in net interest income that was enhanced by its growing loan and securities portfolio.

August 9 -

Mexico's decision to reduce imports of soybean meal, corn and chicken has put more pressure on certain farmers, while creating another situation for lenders to monitor.

June 27 -

Farmer Mac's third-quarter net income increased 95% to $16.4 million over the same period one year ago due to a $5.4 million increase in the fair value of financial derivatives.

November 9 -

A new Rural Housing Service construction-to-permanent loan program is garnering strong interest from lenders and builders who see it as a much-needed opportunity.

October 20 -

It's been a tough year for farmers, and lenders are looking for ways to help those borrowers offset sagging income.

October 7 -

The Rural Housing Service has quietly launched a new construction loan program designed to increase the availability of new homes in rural areas.

September 28 -

Farmer Mac posted lower net income than during the second quarter of 2015 on a loss on financial derivatives and hedging activities.

August 9