-

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

By Kevin WackMay 23 -

Software startups say bringing borrowers, builders and lenders onto one digital platform can remove some of the risks lenders faced during the crisis.

March 14 -

Some companies on SourceMedia’s Best Fintechs to Work For list offer their employees extra time off to live boldly.

February 24 -

CrediFi helps bankers pursuing commercial real estate loan growth minimize the risk in lending to customers they historically haven't served.

January 29 -

Plaid, which moves consumer data between financial institutions and fintechs, could expand overseas as part of a broad growth plan, according to a venture investor.

December 11 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

The bank pared down its application to 50 questions and allows customers to do the easy work before turning it to the loan officer.

September 18 -

To help close deals, there are steps online lenders can take to establish a quick and personal connection with real estate agents.

September 18 -

Capital One's dispute with Plaid raised questions about the ability of banks and aggregators to work together. But the end of that fight, and Capital One's deal with Finicity, show common ground can be reached — eventually.

August 10 -

Other aggregators came to the bank's defense, while one CEO suggested Plaid's very public protest was unfounded.

July 17 -

The credit union service organization now serves almost 200 CUs across the continental United States.

January 23 -

Lower East Side People's Federal Credit Union's case against the appointment of Mick Mulvaney as head of the CFPB turns on whether it has standing to sue.

January 15 -

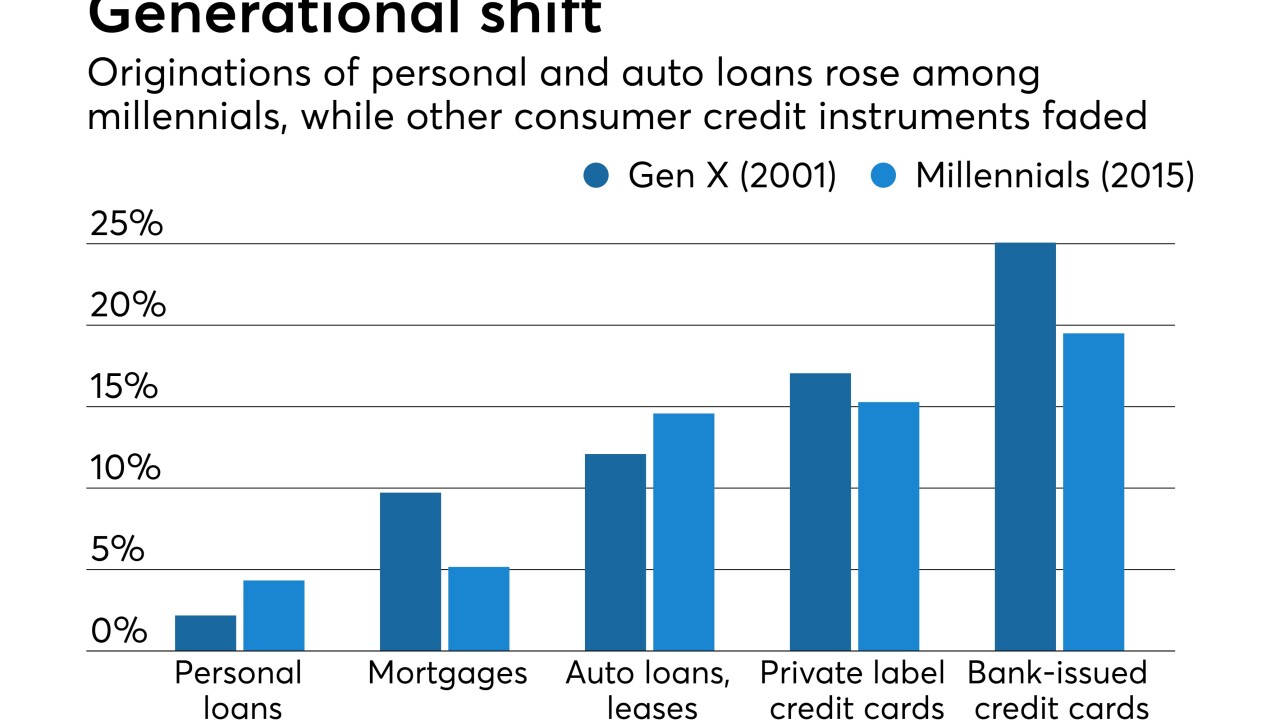

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

By Laura AlixSeptember 11 -

The service, which carries a $9.95 monthly fee, recently completed a private beta test, with users managing more than $1 billion on the platform.

August 22 -

The California lender, which specializes in trade finance, reported strong growth in commercial and other lending categories last quarter, and it urged the Trump administration to seek fair trade deals with China.

July 20 -

The Pennsylvania bank's mortgage performance contributed to stronger loan growth, fee income and profits.

July 18 -

Expenses also rose, as well as the provision for loan losses, but credit quality remained spotless at the lender to the wealthy.

July 14 -

Mexico's decision to reduce imports of soybean meal, corn and chicken has put more pressure on certain farmers, while creating another situation for lenders to monitor.

June 27