-

The Vermont Housing Finance Agency is prepping the state’s first sustainability bond sale.

January 2 -

Seattle Mayor Jenny Durkan announced a $100 million-plus investment by the city in affordable-housing projects, including nine new apartment buildings and 26 homes for first-time buyers.

December 21 -

For decades, Fannie Mae and Freddie Mac helped working-class Americans get mortgages. That essential and powerful role in the national economy is fading.

December 20 National Community Reinvestment Coalition

National Community Reinvestment Coalition -

Two affordable housing developers received millions in subsidies and tax credits from Massachusetts to add 135 units of affordable housing in Eastham and Yarmouth.

December 20 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

The tech boom that Mayor Ed Lee embraced ensured that the man who began his career fighting for poor tenants ended up presiding over a city known for some of the nation's most unaffordable housing and pervasive homelessness.

December 14 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

One night in January, volunteers across the country counted 40,056 veterans living on the streets or in transitional housing and shelters — 585 more than in 2016 and the first increase of homeless veterans since 2010.

December 8 -

Freddie Mac on Thursday priced the first transaction to result from its pilot in the single-family rental market.

December 7 -

The homeless Navigation Center that Aaron Peskin proposed for a North Beach parking lot has led to a power struggle between the supervisor and his longtime political foe, Mayor Ed Lee, who wants to use the site for affordable housing.

December 4 -

A provision in the tax bill passed by the House of Representatives would only intensify the housing crunch by crippling affordable housing construction, developers and local government officials say.

December 1 -

The Federal Housing Finance Agency's final guidelines for evaluating "duty to serve" activities create new ways for Fannie Mae and Freddie Mac to get extra credit for going above mandatory levels of lending to underserved markets.

November 30 -

New Penn Financial has entered into a pilot program to provide mortgage financing to participants in Home Partners of America's Lease Purchase program.

November 29 -

Nonprofit agencies looking to purchase unsubsidized affordable housing properties can use a new impact gap financing program from Freddie Mac to fund the acquisition.

November 28 -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

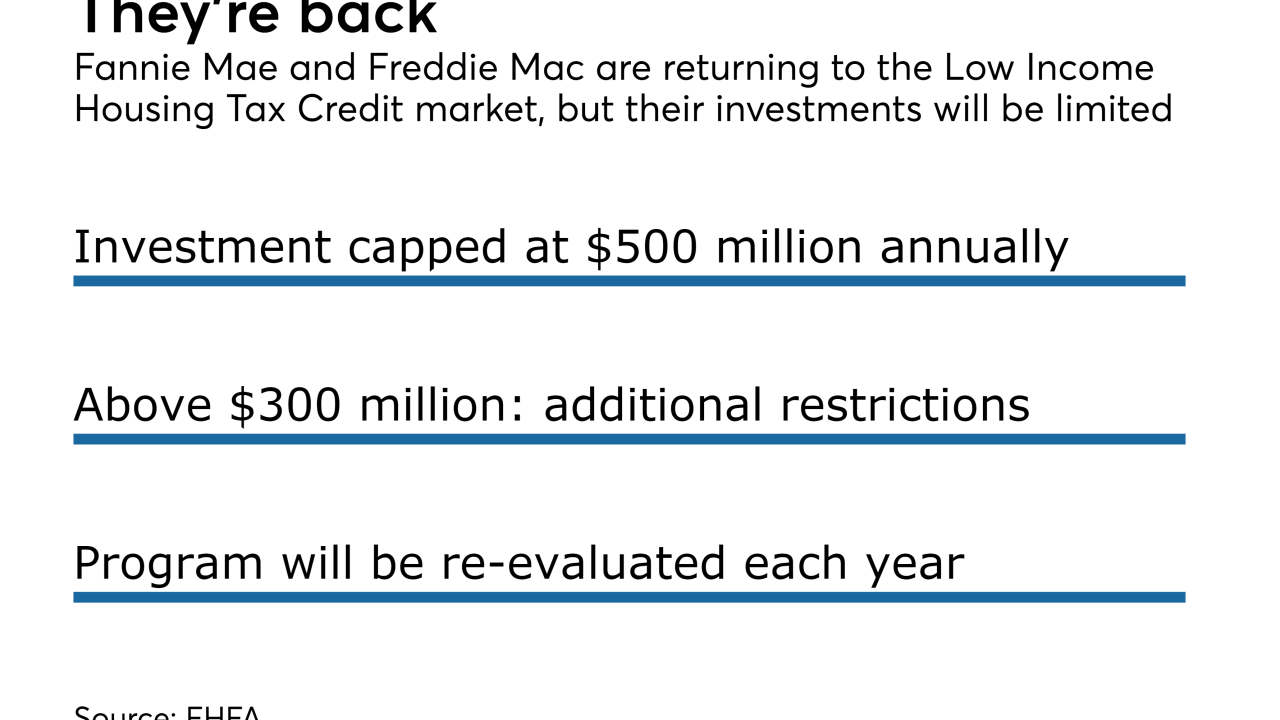

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

The plan is up from the previously announced 200,000 homes.

November 15 -

Housing advocates are pressing Senate Republicans to expand the low-income housing tax credit program while pushing back against a House GOP plan that would eliminate financing for half of all affordable housing units.

November 14 -

A new city program approved by the Chicago City Council will offer vacant lots to affordable housing developers for $1 each.

November 10 -

The elimination of private activity bonds “would throw gasoline on a housing shortage," said John Chiang, California's treasurer.

November 9