-

Credible Labs, which lets consumers shop for the best rates on student loans, mortgages and other credits, would be part of an evolving digital strategy at Fox after the multibillion-dollar sale of many of its traditional media assets to Disney.

August 5 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

The regulators have yet to complete rules on regional bank supervision, community bank capital and other provisions meant to ease institutions' burden.

August 1 -

Bankers are downplaying such concerns, but others say a sharp decline in values on rent-regulated buildings means landlords will have less cash flow to acquire new properties.

July 31 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

The bill, similar to legislation that passed the chamber last year, would permit the inclusion of items such as rent and telecom payments to help consumers build their credit profiles.

July 25 -

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

Lawmakers who called for sweeping reforms after the massive breach are likely to scrutinize the settlement with regulators and continue to push for changes.

July 22 -

The timing of the settlement serves as a warning to other companies of the risks they face in an increasingly data-focused economy.

July 22 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

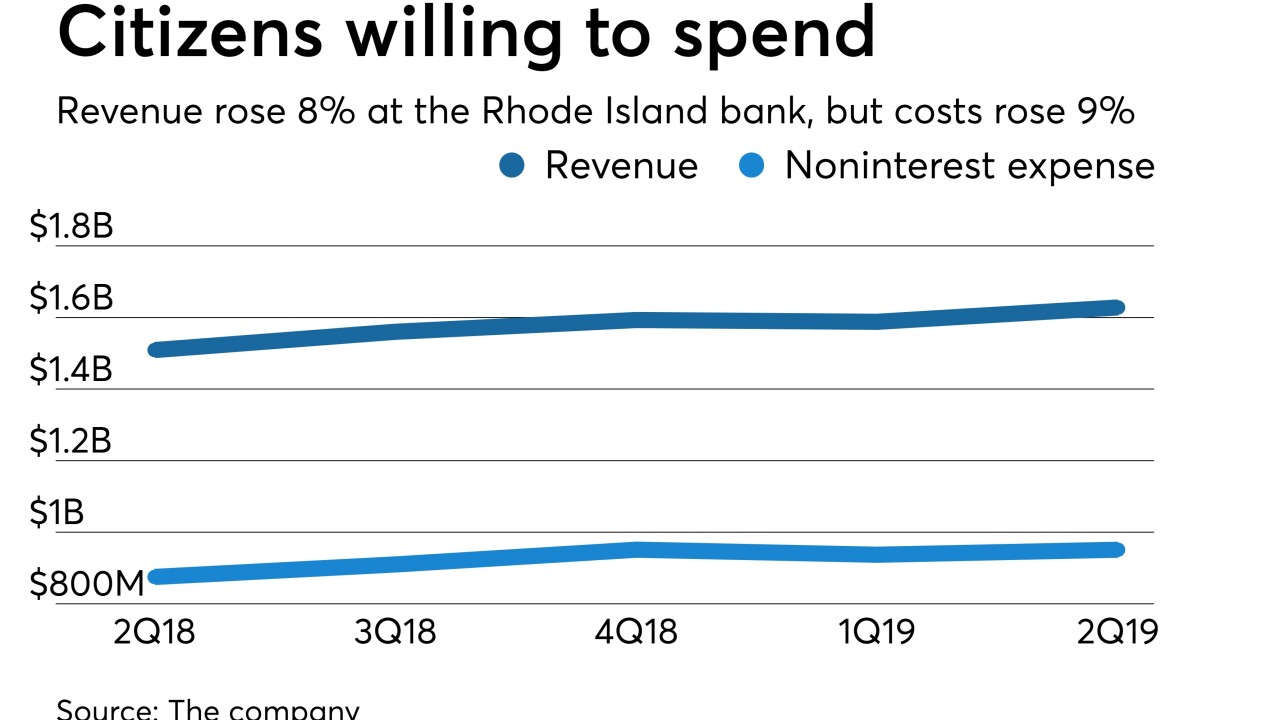

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

A bill by Rep. Patrick McHenry, R-N.C., would give the CFPB authority to oversee cybersecurity efforts at the credit bureaus.

July 19 -

As budget questions loom over the most popular Small Business Administration loans, lenders have embraced the previously overshadowed 504 program after a key policy tweak.

July 18 -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

With affordability still an issue despite falling interest rates and harnessed home value growth, lenders further loosened credit standards in June, according to the Mortgage Bankers Association.

July 9