-

Payoffs of maturing office loans in securitizations may be delayed more often in the next few years if increasing inventory constrains occupancy and rent growth, according to Morningstar.

May 8 -

Bank 34 will no longer sell mortgages in the secondary market as it looks to reduce its reliance on volatile revenue streams.

May 7 -

The long-awaited proposal includes safe harbors to protect collectors from getting sued, but would restrict phone collection attempts and allow borrowers to opt out of receiving other communications.

May 7 -

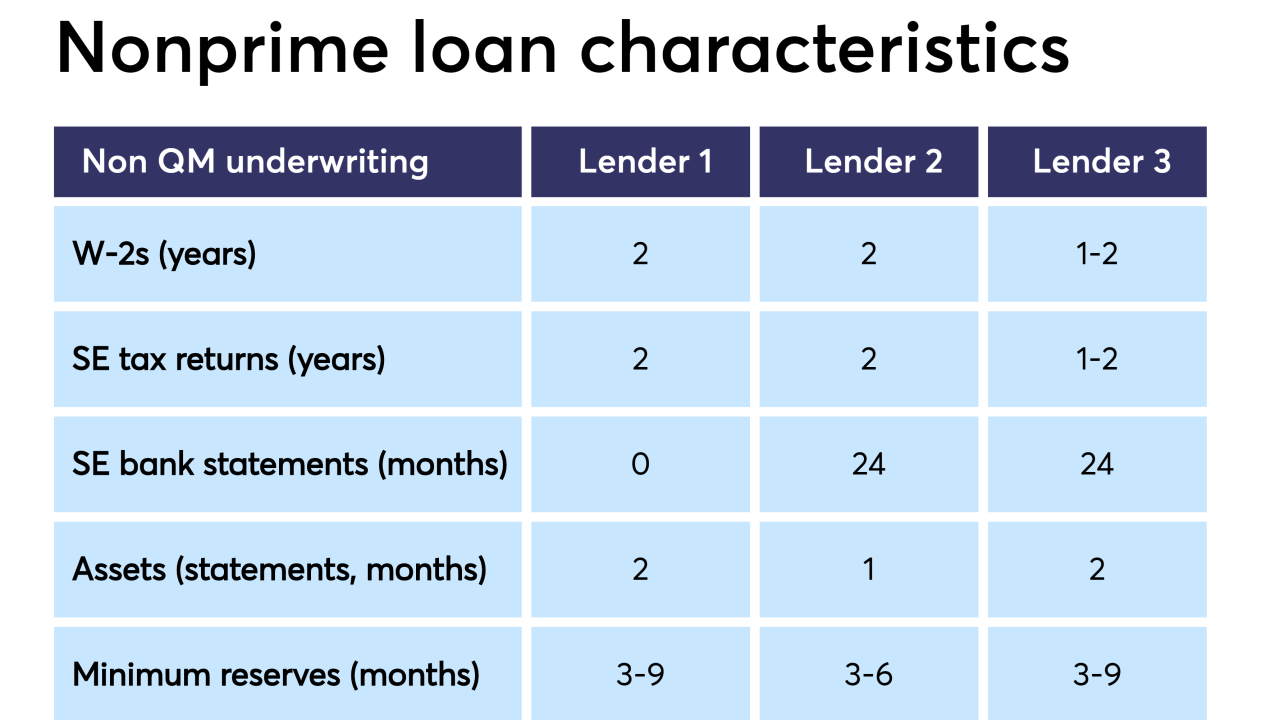

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

The Consumer Financial Protection Bureau proposed steps to ease Home Mortgage Disclosure Act requirements, just days after announcing it was retiring a platform to let users analyze raw mortgage data.

May 2 -

As the CFPB moves closer to updating its debt collection regulations, revising restrictions on phone calls and other communications with consumers must be a priority.

May 1

-

Having poor credit doesn't necessarily keep someone looking to become a mortgage broker from obtaining a surety bond, but it can complicate matters.

May 1 JW Surety Bonds

JW Surety Bonds -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

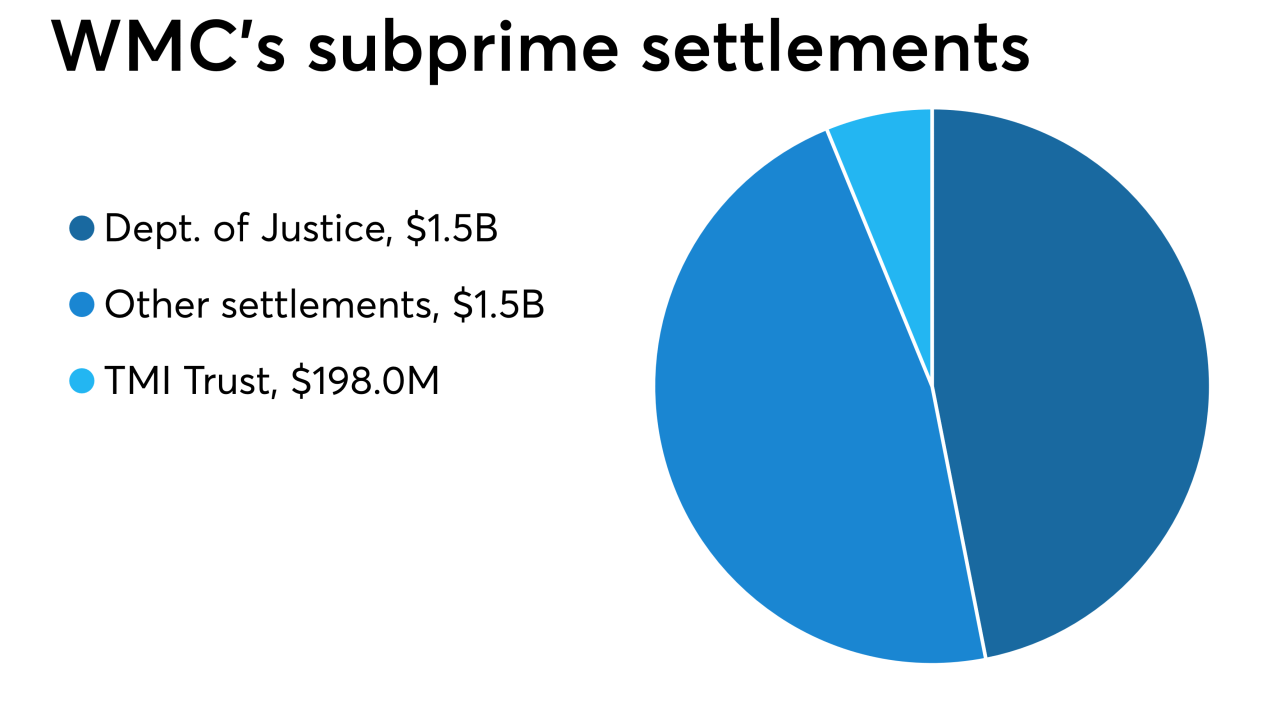

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

Blue Lion Capital, which has been critical of the Seattle company in recent years, has nominated two individuals to become directors.

April 23 -

The bank is expecting to benefit from the discount airline's first flights to the Aloha State even as a white-hot local housing market starts to cool.

April 22 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Marianne Lake, seen in recent months as a leading candidate to replace CEO Jamie Dimon, got the post she may have needed to round out her resume — consumer lending chief. And Jennifer Piepszak, another rising star at the company, will take over as CFO from Lake.

April 17 -

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

JPMorgan Chase's banner quarter didn't stop executives from warning that the pause in rate hikes could crimp profits, or from hinting that the bank might downsize its mammoth mortgage operation.

April 12 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12