-

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

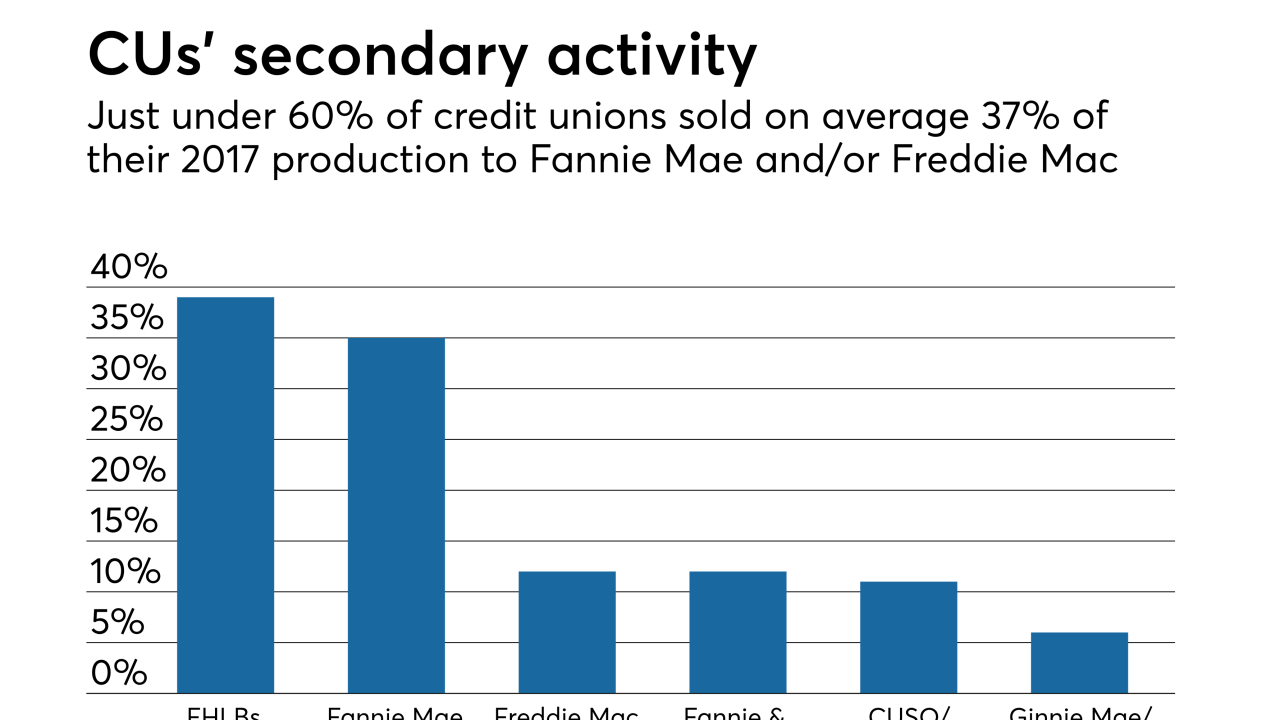

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

Blue Lion Capital, which is upset with the Seattle company's growth strategy, also wants to replace two of the company's directors.

February 26 -

Stephen Calk is in the national media glare because his small Chicago-based bank made two enormous loans to Paul Manafort, President Trump's onetime campaign manager. Here’s a look at Calk's career and how he ended up in this spot.

February 23 -

The war of words between acting Consumer Financial Protection Bureau Director Mick Mulvaney and Sen. Elizabeth Warren, D-Mass., the agency's architect, is escalating.

February 23 -

Delinquencies from Hurricanes Harvey and Irma are starting to subside, even as pre-storm foreclosures that were put on hold resume.

February 23 -

Some Wells Fargo customers on social media Thursday afternoon expressed frustration with not being able to log in to accounts digitally. The San Francisco bank responded in a tweet acknowledging the problem.

February 22 -

William Parsley was most recently PNC's chief investment officer and treasurer and had previously served as head of consumer lending.

February 22 -

The Chicago bank is denying a report that its CEO, Steve Calk, made $16 million in mortgage loans to former Trump campaign chairman Paul Manafort in exchange for a job in the White House.

February 21 -

The Puerto Rico-based bank failed in 2015. The FDIC, its receiver, is seeking unspecified economic and punitive damages from 16 lenders, including Bank of America, Barclays and Credit Suisse.

February 21 -

The Michigan company has been acquisitive lately, buying California branches and a wealth advisory firm.

February 21 -

Banco Santander joined existing investors JPMorgan and USAA as well as others in raising $25 million in secondary-round financing for Roostify, which seeks to build a paperless mortgage process.

February 15 -

It’s too soon to gauge the true impact of recent tax cuts on loan demand, but anecdotes from bankers suggest that, after months of stagnation, pipelines are filling up again.

February 14 -

Nonbank mortgage firms are seeking formal assurance from the Consumer Financial Protection Bureau that they will not become subject to surprise audits or enforcement without involvement of a state regulator.

February 14 -

The acting director of the Consumer Financial Protection Bureau on Tuesday had his first taste of the withering congressional criticism endured by his predecessor on trips to Capitol Hill.

February 13 -

In some states, total mortgages outstanding are at all-time highs, but in others hard hit by the financial crisis they remain well below their 2008 peaks, the New York Fed said Tuesday in its quarterly report on household debt.

February 13 -

Darryl White sees an opportunity for Bank of Montreal to take more market share in the United States, and he’s betting on investments in mortgage lending, commercial banking and capital markets to get there.

February 9 -

For many newcomers to the U.S., establishing credit is a big challenge. A handful of entrepreneurs are developing tools to help verify their financial histories.

February 9 -

There was an increase in total mortgage defaults during the fourth quarter but that rise has to be measured in context of what had been a favorable environment prior to the third-quarter storms.

February 8 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7