-

BOK Financial benefited from rising interest rates in the third quarter even as it reported declines in fee income and commercial real estate loan balances.

October 25 -

The Michigan company's third-quarter results were down slightly from a year earlier despite increased commercial lending and a wider net interest margin.

October 24 -

Net income at the Livingston, N.J., company climbed 67% due to a variety of one-time items tied to its ongoing restructuring.

October 24 -

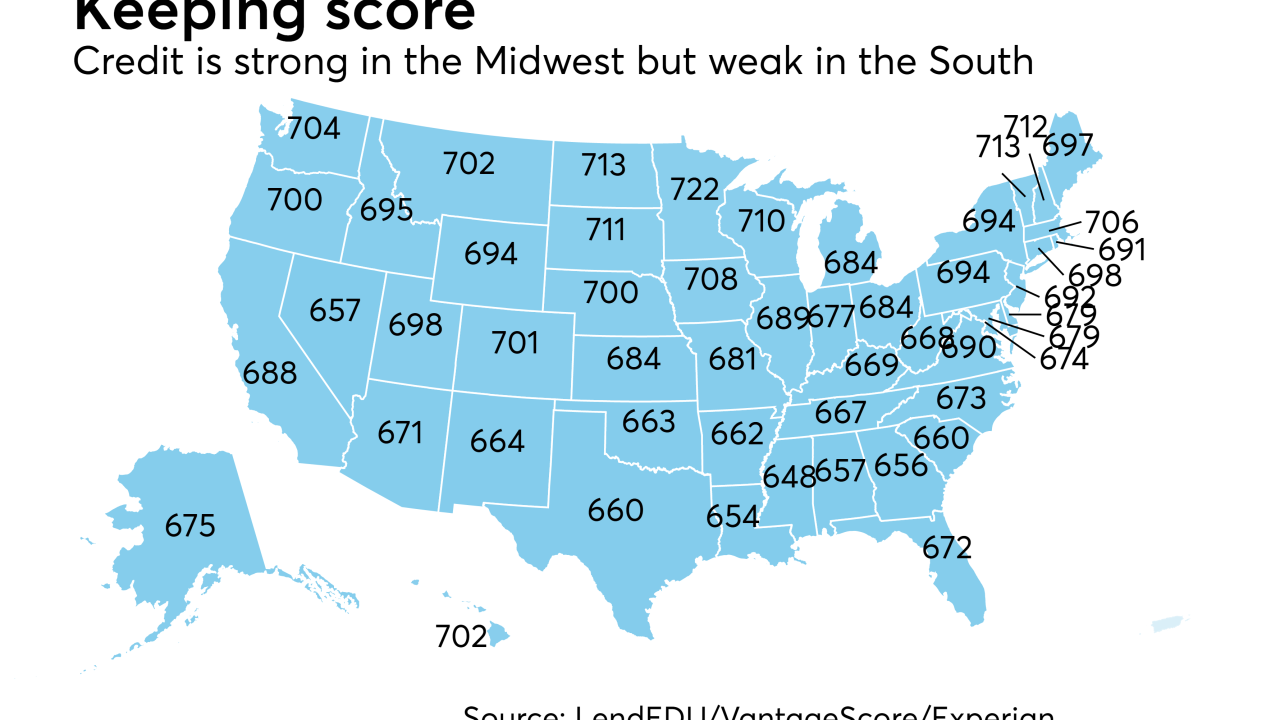

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

SunTrust’s yields have improved as it has increased its credit-card and student lending and made more online personal loans through its LightStream subsidiary.

October 20 -

With online retailers beginning to challenge the dominance of brick-and-mortar grocery stores, CRE loans to strip mails anchored by them look riskier.

October 19 -

The $36.3 billion-asset bank reported double-digit growth in C&I loans, commercial real estate loans and specialty loans to the private-equity, entertainment and energy industries in the third quarter.

October 19 -

Net income for the Oregon regional bank was $61.3 million, a slight decline from the same quarter last year. It earned 28 cents per share and fell short of analysts’ expectations,

October 19 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

The nonbinding guidance, which followed a nearly yearlong inquiry about industry practices, said consumers should have greater ability to obtain information about their financial data, among other principles.

October 18 -

The percentage of refinance loans rose in September as interest rates dipped to a 2017 low, according to Ellie Mae.

October 18 -

Cybersecurity and breach notification procedures have caught the most public attention following the massive hack at Equifax, but lawmakers are also interested in the accuracy of credit reports.

October 17 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Fintech and marketplace lender LendingHome is getting more than $450 million in investment and funding from different channels to help support mortgage production growth and technology improvements.

October 16 -

Entrepreneurs like LendingHome's Matt Humphrey are upending mortgage finance with tactics borrowed from fintech, marketplace lending and the traditional mortgage playbook.

October 16 -

With issuance of marketplace securitizations now exploding — rising 300% cumulatively in the past two years — the idea of online lending as a niche is quickly deteriorating.

October 13 -

Fee income also surged as the San Francisco bank reached the $100 billion mark in wealth management assets.

October 13 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

October 13 -

Wells Fargo took a surprise $1 billion charge in the third quarter for previously disclosed pre-crisis, mortgage-related regulatory investigations. It contributed to a 19% fall in profits.

October 13