-

Development on the Common Securitization Platform has reached a point where Fannie Mae and Freddie Mac may be able to issue a uniform mortgage-backed security sometime in 2018, the Federal Housing Finance Agency said Thursday.

December 8 -

Mortgage rates moved higher for the sixth consecutive week, according to Freddie Mac, even though yields on the 10-year Treasury are down from their post-election peak.

December 8 -

Some mortgage bond traders tangled up in investigations are moving into the shadow banking system, where their new employers have greater latitude to hire people with blemishes on their records.

December 7 -

Fannie Mae joined Freddie Mac in announcing plans to delist some previously issued Connecticut Avenue Securities, which transfer the credit risk on residential mortgages, from the Irish Stock Exchange.

December 7 -

Flushing Financial in Uniondale, N.Y., made $12.3 million on a recent property sale, part of a series of moves as it restructures its balance sheet.

December 6 -

The National Fair Housing Alliance and 20 local fair housing groups have filed a lawsuit in federal court against Fannie Mae over its maintenance and marketing of foreclosure properties.

December 6 -

While the designation of retired neurosurgeon Ben Carson to run the Department of Housing and Urban Development appears like an unusual choice, lenders are hoping he can bring a fresh perspective to the industry.

December 5 -

The mortgage interest deduction will be limited in reforms designed to provide tax cuts for middle-class borrowers, but not those with higher incomes, according to Treasury Secretary-designate Steve Mnuchin.

December 1 -

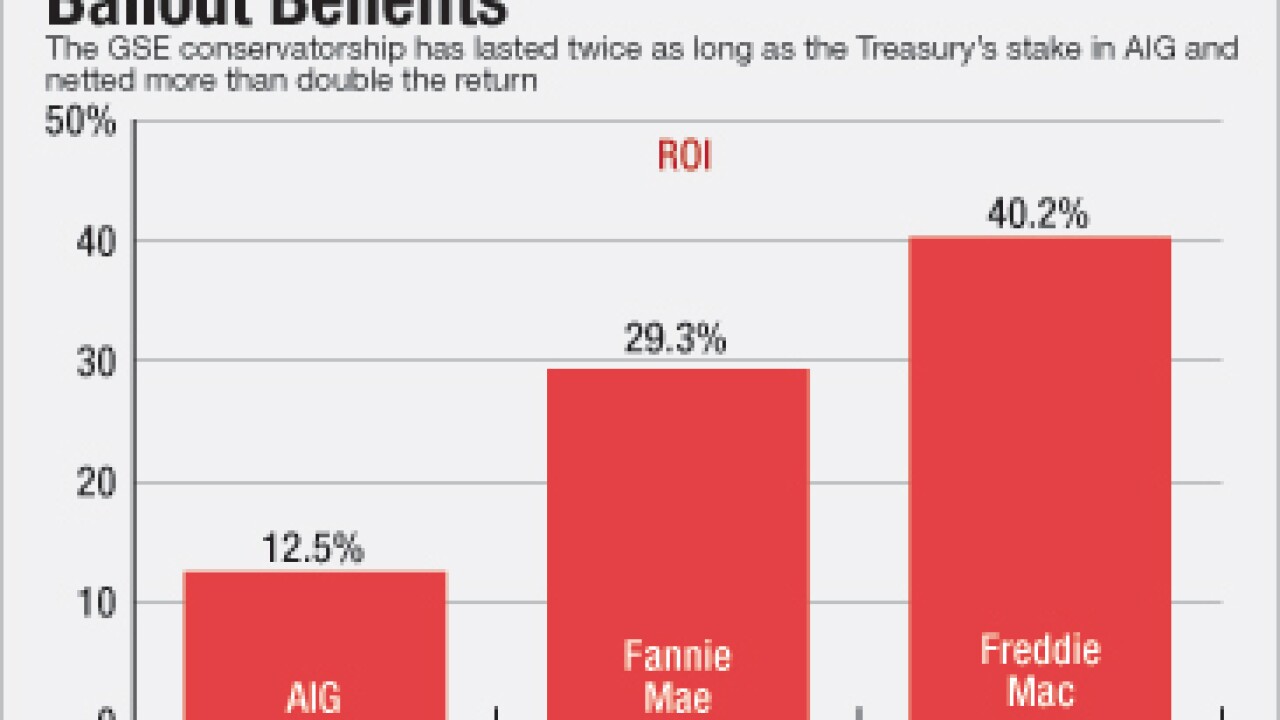

Privatizing the government-sponsored enterprises is a priority for Treasury Secretary-designate Steven Mnuchin. Here's a look at what it will take to pull off and the potential implications for the mortgage industry of unwinding the conservatorship.

December 1 -

Conforming mortgage rates are at their highest level this year after increasing 51 basis points since Election Day, according to Freddie Mac.

December 1 -

Treasury Secretary-designate Steven Mnuchin's plan to remove Fannie Mae and Freddie Mac from government control could mean increased competition for lenders' loans. But it could also prompt a rise in mortgage rates.

November 30 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

Arch Capital Group plans to offer $950 million of senior notes, using the proceeds to fund a portion of its acquisition of United Guaranty Corp. and AIG United Guaranty Insurance (Asia) Ltd. from AIG.

November 30 -

Treasury Secretary-designate Steven Mnuchin wasted no time Wednesday wading into one of the thorniest debates in the financial services arena, saying the Trump administration would seek to end government control of Fannie Mae and Freddie Mac.

November 30 -

Much like President-elect Donald Trump himself, expected Treasury Secretary-designate Steven Mnuchin represents something of a question mark for bankers when it comes to his agenda.

November 29 -

Mortgage bankers are anxiously waiting to see who President-elect Donald Trump will pick as the next Treasury secretary. Several prominent names have been floated for the job, though with every passing day, a new possible choice seems to pop up. Following is a look at the current crop of candidates and their chances.

November 29 -

Freddie Mac has published a list of companies that meet its requirements regarding the creation, signing and storage of electronic promissory notes.

November 29 -

FirstKey Mortgage is marketing its fifth portfolio consisting primarily of formerly troubled first-lien residential mortgages that have rebounded to reperforming status.

November 28 -

The Federal Housing Finance Agency's choice to raise conforming loan limits in 2016 for the first time in a decade is being met with enthusiasm from the mortgage industry, as it should prove to be a positive for future origination volume.

November 23 -

The average for the 30-year fixed-rate mortgage this week topped 4% for the first time since 2015 as 10-year Treasury yields continued their post-election climb, according to Freddie Mac.

November 23