-

The Consumer Financial Protection Bureau faced hostile questions from two judges during oral arguments before a federal appeals court Tuesday as it sought to argue the constitutionality of its single-director structure in a lawsuit brought by nonbank mortgage lender PHH Corp.

April 12 -

Hint: businesses should be focused on data strategy and security, from the individual up to the enterprise level.

April 11 Sapient

Sapient -

An Altisource Residential Corp. affiliate is taking management's side in the real estate investment trusts fight with activist investors.

April 11 -

New lender disclosure requirements aren't just disrupting the market for private-label mortgage bonds; they could also impact the market for bonds that transfer credit risk of mortgages insured by Fannie Mae and Freddie Mac to the private sector.

April 11 -

Annaly Capital Management, the largest real estate investment trust that buys mortgage debt, agreed to purchase Hatteras Financial Corp. for $1.5 billion as the company expands its property business.

April 11 -

The U.S. Court of Appeals for the D.C. Circuit will hear oral arguments Tuesday about the Consumer Financial Protection Bureau's structure, in a case that has national implications. Even though a ruling isn't expected until the end of the year, legal experts say there are four major legal issues involved.

April 11 -

Fannie Mae and Freddie Mac's experiments with selling credit risk to investors are a critical element of new plan to merge the two entities and move them out of conservatorship, but what form so-called credit risk transfers take could make a big difference.

April 8 -

The housing market has been improving but mortgage credit remains "stubbornly" tight on loans bought by the government-sponsored enterprises, according to a chief housing adviser at the White House.

April 7 -

The U.S. Supreme Court's decision last week not to review a mortgage-backed securities lawsuit renewed interest in a long-brewing legal conflict over the mandate of the Financial Institutions Reform, Recovery, and Enforcement Act.

April 5 -

After nearly 20 years of talk, the time for e-closings is finally here, thanks to a push from government regulators and a broad shift in acceptance across demographics.

April 4 eLynx

eLynx -

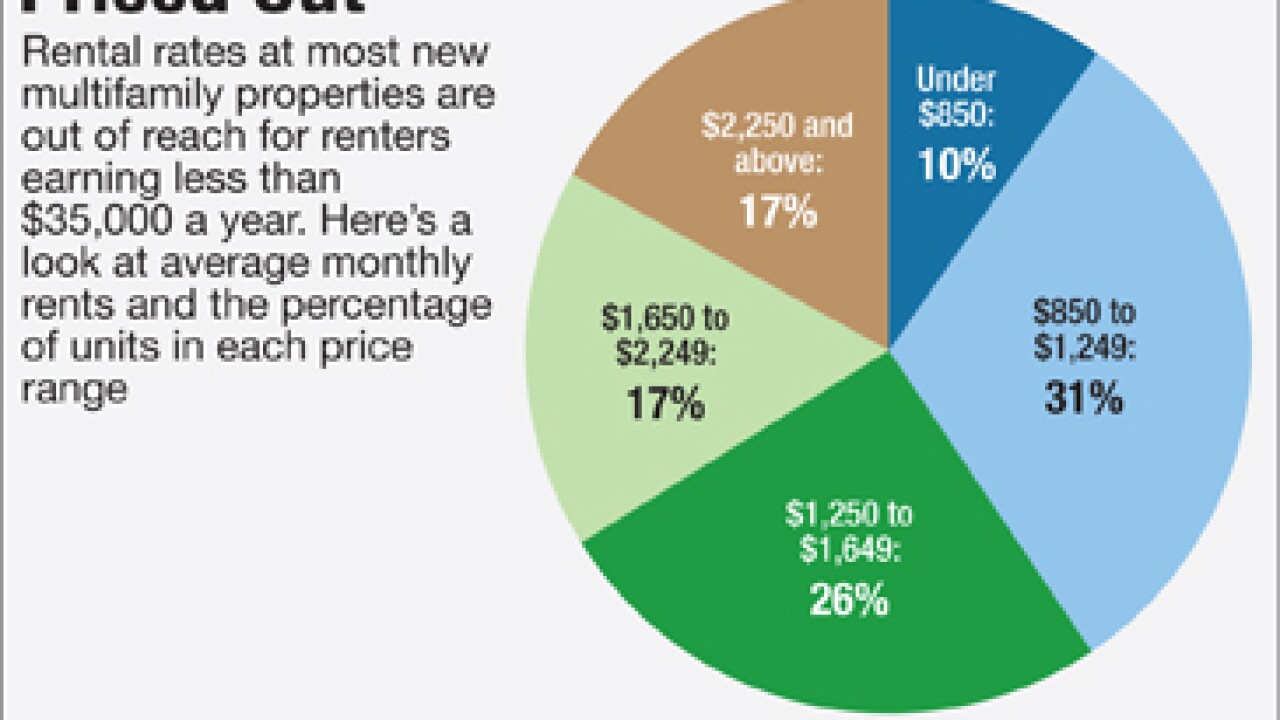

The agency's insurance-rate cut could spur the rehab of thousands of affordable units, but it's far from a total solution, housing advocates say.

April 4 -

The USDA mortgage production operation makes up a very small part of JPMorgan Chase's overall lending business.

April 4 -

From electronic closings to e-warehouse lending, these executives are leading a movement to recast the industry's approach to digital.

April 4 -

In a letter to CFPB Director Richard Cordray, the Association of Mortgage Investors said that the "Know Before You Owe" rule has "resulted in a climate of legal uncertainty" and is "chilling" private investment in the U.S. mortgage market.

April 1 -

The government agency that guarantees securitizations of Federal Housing Administration-insured loans is experimenting with a pool type that consists only of modifications and reperforming loans.

March 31 -

Fannie Mae has unveiled a mortgage for borrowers who want to finance energy and water efficiency improvements to their homes.

March 30 -

Freddie Mac has obtained new insurance policies under its Agency Credit Insurance Structure program.

March 30 -

The Depository Trust & Clearing Corp. and Digital Asset Holdings are targeting the repurchase agreement market as the latest use case for a blockchain solution.

March 30 -

Bankers are fighting back against a plan that would allow Fannie Mae and Freddie Mac to invest in low-income housing tax credits, arguing they are critical for meeting Community Reinvestment Act requirements.

March 30 -

Redwood Trust has promoted its chief financial officer, Christopher Abate, to replace its departing president, Brett Nicholas.

March 28