-

Radian Group's private mortgage insurance subsidiary pulled back from certain pricing discounts that have driven competition in recent months in that business.

October 28 -

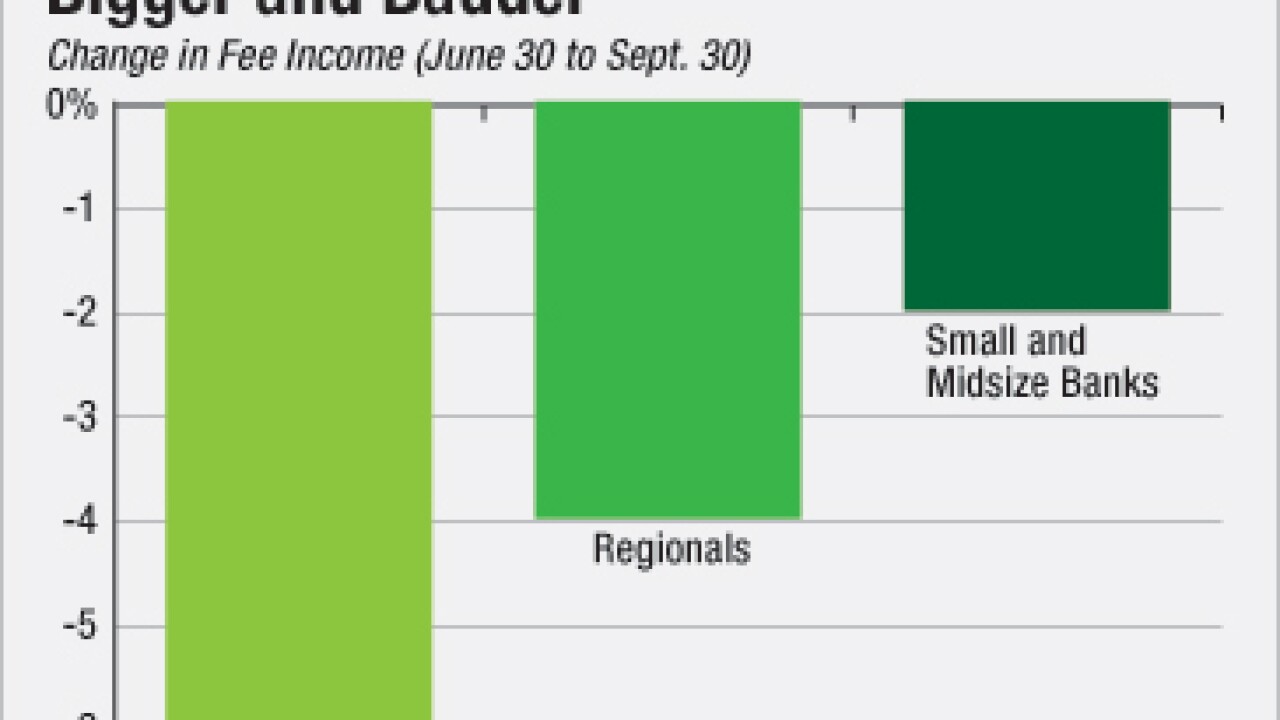

Nobody thought it would be pretty, but last quarter's results were even worse than expected, and low fee revenue is largely to blame. Trading and mortgage banking were particularly bad, and few of the big banks managed to offset the declines.

October 28 -

Freddie Mac is preparing its fourth offering of bonds offloading exposure to actual losses on mortgages that it ensures, according to Fitch Ratings.

October 28 -

The first securitization of single-family rental properties appears to be at risk of a maturity default.

October 27 -

The commercial real estate loans that underlie commercial mortgage-backed securities posted a modest increase in price from August to September, according to DebtX.

October 27 -

Residential mortgage-backed securities servicers are improving their processes despite generally adverse market conditions, Fitch Ratings found.

October 26 -

From thrift deregulation to government domination, the mortgage business is prone to dramatic shifts. Here are 10 people who share the credit, or the blame, for major industry changes.

October 21 -

Fannie Mae's latest offering of Connecticut Avenue Securities, its last of the year, is the first to offer exposure to actual losses on residential mortgages that it insures.

October 20 -

Housing finance reform in Congress is stalled, but Fannie Mae and Freddie Mac (often under pressure from their regulator) are forming partnerships, developing new products and finding ways to share risk with the private sector to correct flaws in the housing system.

October 20 -

Over a third of appraisals during the third quarter featured property quality or condition ratings that did not match previous ratings, according to an Oct. 19 report from Platinum Data Solutions.

October 20