-

Add retail customers to the list of groups raising concerns about possible high-pressure product-sales tactics at Wells Fargo; many of them are considering jumping ship in response, according to a new survey of customer attitudes at big banks. However, Wells' rivals shouldn't celebrate they are at risk of losing customers, too, for a variety of reasons.

December 3 -

Banks have added so much capital in the past several years that they're better protected from declines in real estate values than they were before the financial crisis.

November 10 -

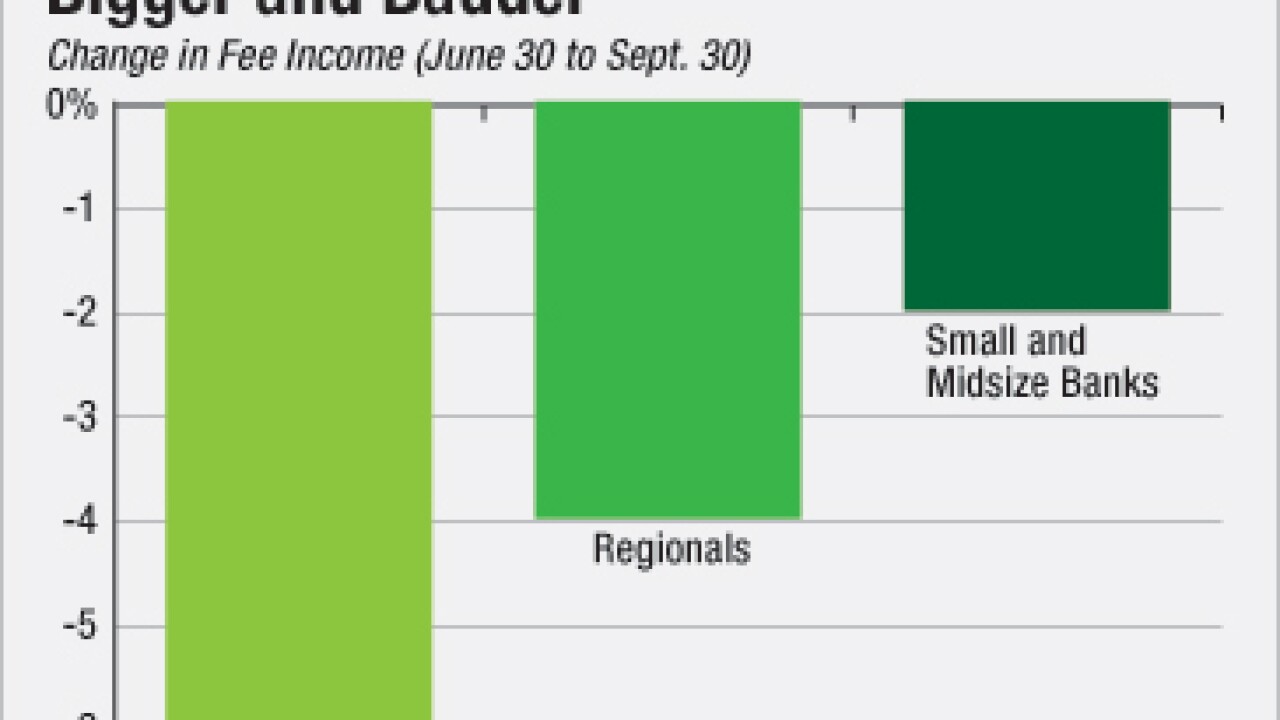

Nobody thought it would be pretty, but last quarter's results were even worse than expected, and low fee revenue is largely to blame. Trading and mortgage banking were particularly bad, and few of the big banks managed to offset the declines.

October 28 -

The Federal Reserve Board has approved the merger of M&T Bank and Hudson City Bancorp after more than three years of delay. The approval came on the day the regulator had set as a deadline to announce its verdict on the deal.

September 30 -

Loan-to-value ratios in commercial real estate lending have returned to their levels from the bubble days, Moody's says. Loss-rates look good for now, but trouble could be coming.

September 11 -

About a fifth of the $163 million in credit Citi has earned under terms of the 2014 settlement would be considered extra credit. Citi can earn extra credit by doing things such as completing loan modifications early or reducing loan-to-value ratios below certain levels.

September 3 -

Citigroup's second-quarter profit got a modest boost from Citi Holdings, a unit set up six years ago as a dumping ground for toxic assets. After losing billions for years, Citi Holdings has now become a minor profit source for its parent.

July 16 -

Commercial real estate lending and mortgages are banks' main source of hope to beat lukewarm expectations for the earnings season that begins Tuesday.

July 10 -

Benjamin Lawsky, the New York regulator known for aggressive investigations and headline-grabbing fines against financial firms, is stepping down, and he reportedly plans to make a living offering banks and other companies advice.

May 20 -

Trading of securities backed by Fannie, Freddie and Ginnie is down sharply since the beginning of the year. Bankers' concerns about capital and rates are among the reasons, and the problem may ultimately make the underlying market for mortgages less liquid.

May 8 -

More community banks are looking to outsource their mortgage operations to reduce the regulatory burden, but structuring such deals and determining proper compensation can be tricky. Here's how two Chicago-area lenders solved the problem.

September 26 -

CertusBank in Greenville, S.C., has agreed to sell its mortgage and wealth businesses as it tries to move past its history of high expenses and heavy losses.

September 15