-

Commercial mortgage lenders, and investors in their bonds, have been more eager than the residential market to embrace Property Assessed Clean Energy loans even though those loans hold a superior-lien position. Heres why.

November 16 -

Cherry Hill Mortgage Investment Corp. has agreed to sell a portfolio of excess mortgage servicing rights back to its strategic alliance partner Freedom Mortgage.

November 16 -

Shellpoint Partners is preparing its first private-label mortgage securitization in over a year, according to Kroll Bond Rating Agency.

November 15 -

The Federal Housing Administration's insurance fund saw its fourth consecutive annual boost in its ratio of reserves to insured mortgages, reaching 2.32% in fiscal year 2016, the Department of Housing and Urban Development said Tuesday.

November 15 -

Experian, like fellow credit bureaus TransUnion and Equifax, is now offering trended credit reports to lenders that originate single-family loans.

November 14 -

MTLGQ Investors, a Goldman Sachs affiliate, submitted the winning bids in Fannie Mae's sale of $1.3 million of nonperforming loans.

November 10 -

The president-elect faces major questions about credit access, affordable housing, the future of Dodd-Frank and the structure of the Consumer Financial Protection Bureau and the extent to which he will act upon them remains unclear.

November 10 Community Home Lenders of America

Community Home Lenders of America -

While mortgage rates moved somewhat higher in the period before the election, after the results were known, the yield on the 10-year Treasury broke above 2%, according to Freddie Mac.

November 10 -

The heightened refinancing activity is seen as increasing Ginnie Mae prepayment speeds and reducing the value of mortgage servicing rights.

November 10 -

Mortgage lobbyists are eager to seize on Republican victories in the House, Senate and White House races, hoping to advance the industry's aims in the next Congress.

November 9 -

The overwhelming majority of candidates supported by the mortgage industry by and large performed well on Election Day, with one notable exception.

November 9 -

Farmer Mac's third-quarter net income increased 95% to $16.4 million over the same period one year ago due to a $5.4 million increase in the fair value of financial derivatives.

November 9 -

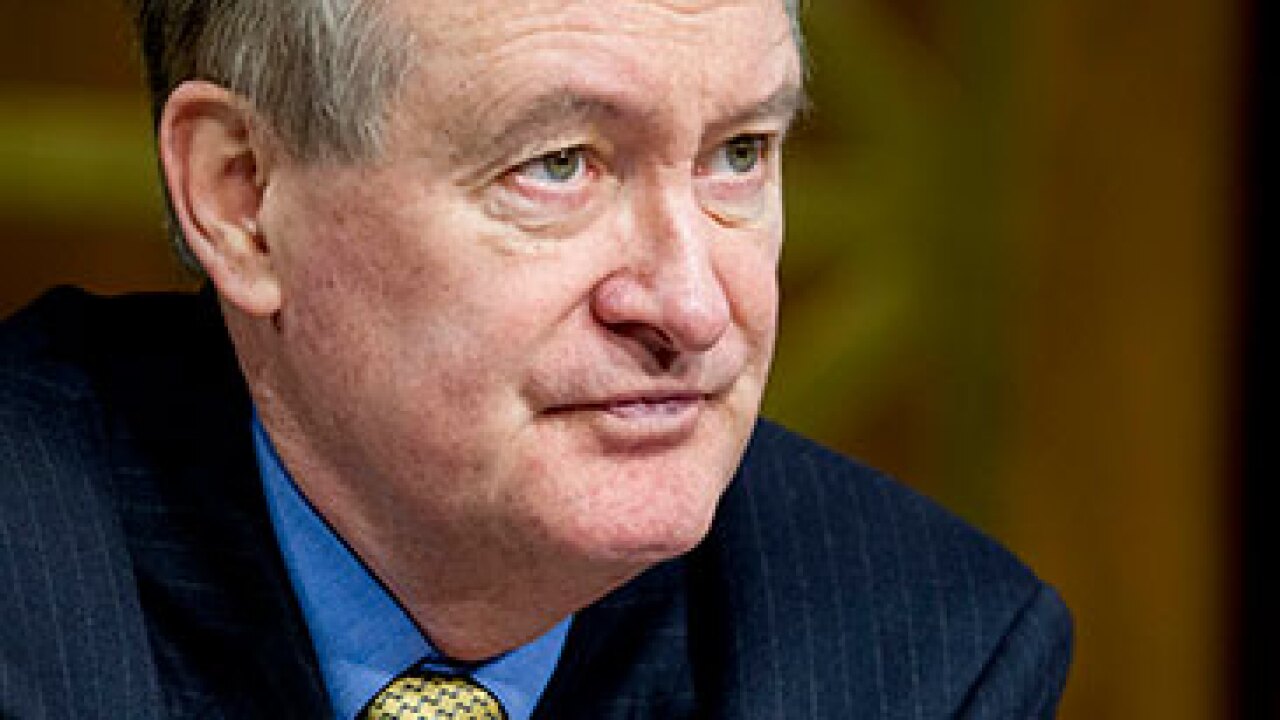

There was another surprise Tuesday as Republicans managed to keep a Senate majority following the elections, likely giving the gavel of the Banking Committee to Sen. Mike Crapo, a right-of-center Idaho lawmaker who has proven willing to reach across the political aisle in the past.

November 9 -

Many issues facing President-elect Trump and the 115th Congress will have far-reaching implications for the mortgage industry. Here's a look at five of those most pressing questions awaiting elected officials when they take office in January.

November 9 -

An index to SourceMedia's comprehensive election analysis for professionals in financial services, healthcare and technology, with coverage of more than 50 contests and ballot initiatives

November 9 -

Housing was the talk of the campaign two presidential elections ago, but it stayed under the radar in the 2016 race, leaving plenty of room to speculate about President-elect Donald Trump's likely mortgage policy for the next four years.

November 9 -

A Florida hedge fund transformed risky Fannie Mae and Freddie Mac debt into investment-grade securities, and it could end up helping the mortgage giants' efforts to offload more of their risk.

November 8 -

Towd Point Master Funding, an affiliate of Cerberus Capital Management, was the winning bidder for two pools of reperforming mortgages with a balance of $789.2 million auctioned by Fannie Mae.

November 8 -

Trends in commercial real estate lending, which has reached record levels at U.S. banks, are unsustainable, Fitch Ratings warned.

November 7 -

San Francisco has completed the transfer of ownership of its public housing sites from the San Francisco Housing Authority to community-based affordable housing teams, part of a long-term bond-financed initiative begun in 2013.

November 7