-

For 2026, most Wall Street interest-rate strategists expect stable-to-higher Treasury yields as the Fed's rate-cutting cycle comes to an end.

January 2 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

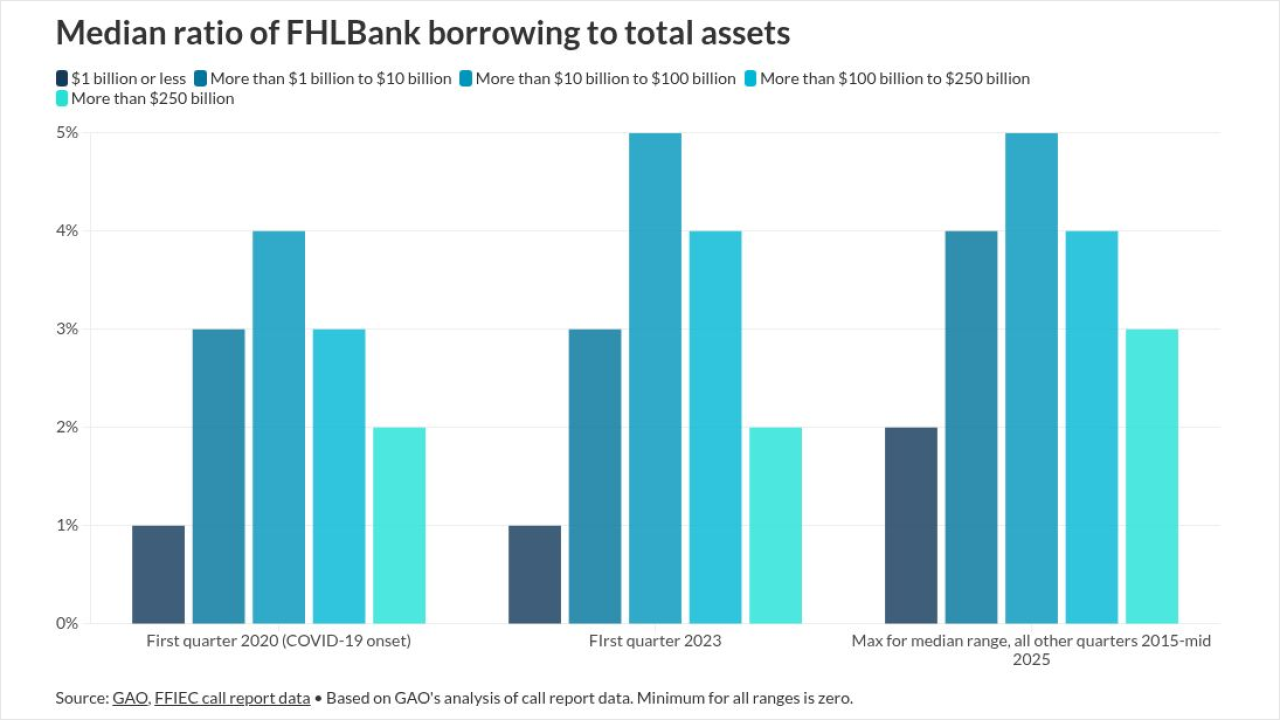

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18 -

Further mortgage payment reductions and other "aggressive" changes to federal policy impacting homeowners are on the roadmap for the coming year.

December 18 -

The latest data offered some relief to traders worried about more pronounced inflation that could keep a lid on rate cuts.

December 18 -

Bloomberg Intelligence puts odds on a release from conservatorship and issuing new shares. Its study estimates critical steps would take "months if not years."

December 18 -

The Treasury official renewed a pledge to avoid hurting how mortgages trade in a Fox Business News interview as a new study highlighted one way to do that.

December 17 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11 -

The government-sponsored enterprise removed a limit on adjustable-rate mortgages, and added flexibilities for repair, manufactured home and ADU financing.

December 11 -

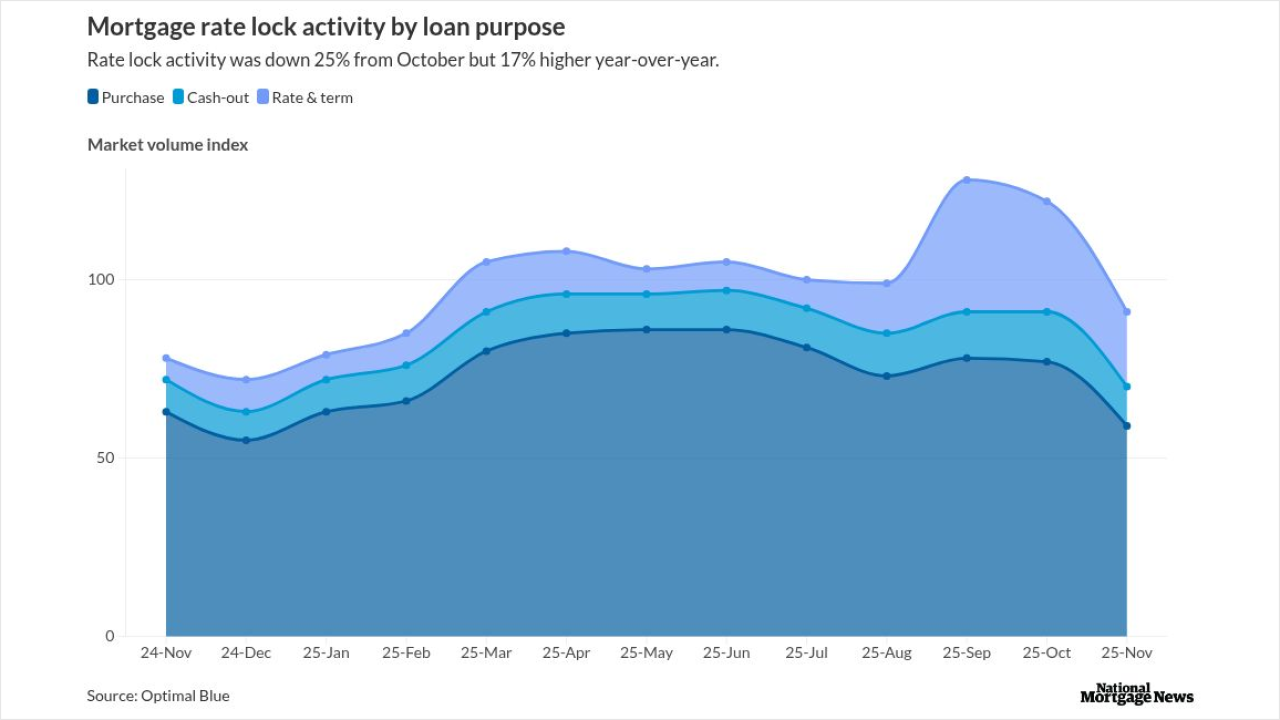

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

The company's latest funding announcement caps off a year of tailwinds that propelled growth for home equity investment platforms and related lending products.

December 9