-

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

Real estate investor Tom Barrack said predicted a “domino effect” of catastrophic economic consequences if banks and government don’t take prompt action to keep commercial mortgage borrowers from defaulting.

March 23 -

The credit watch involves single-borrower securitizations of commercial mortgages for high-priced resorts in Florida and Hawaii.

March 19 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Most of the pool is made up of office-property loans, but also includes a sizeable exposure to hotel and retail properties.

February 27 -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Over 67% of the loan balances in Sabal Capital Partners' commercial mortgage MBS deal were for apartment buildings financed through the Irvine, Calif.-based firm.

February 19 -

The notes in Citigroup Commercial Mortgage Trust 2020-555 are backed by a beneficial interest in the trust’s $350 million portion of the 119-month fixed-rate commercial loan. The loan is secured by a 52-story New York luxury apartment building in Manhattan’s Midtown West submarket.

February 18 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

The loan participation is part of a debt refinancing package that paves the way for expanding the Parkmerced mega-development.

January 28 -

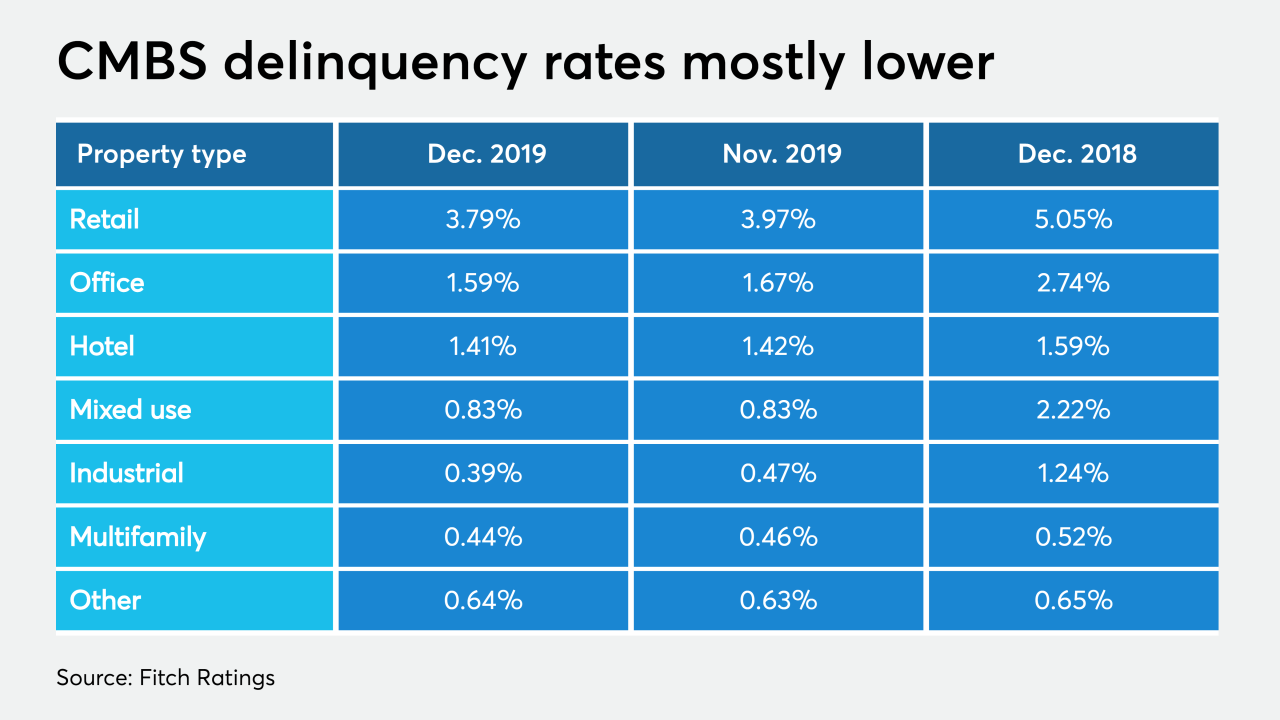

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

A New York-based real estate investment firm is financing its acquisition of a portfolio of nationally branded hotels via the commercial mortgage securitization market.

January 9 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

DBRS Morningstar's presale report raises concerns that the securitized loan for Onni Group's Wilshire Courtyard faces considerable risks from the business volatility of its largest tenant.

December 20 -

Blackstone Real Estate Partners is planning a $1.7 billion bond sale secured by a commercial mortgage loan that financed its newly acquired controlling interests in Great Wolf Lodge waterpark entertainment resort properties.

December 11 -

REIT Paramount Group is getting a $140M equity pay-out in a debt refinancing for the noted Broadway Theater district office tower, home to the Gershwin Theater and several prominent tenants.

December 10