Commercial banking

-

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

Fee income also surged as the San Francisco bank reached the $100 billion mark in wealth management assets.

October 13 -

A 38% increase in new loan originations led to another quarter of record earnings.

October 11 -

Demand for commercial loans has been weak for much of the past year and among the big questions bank executives will face this earnings season is when they can expect the pace to finally pick up.

October 10 -

Putting faith in its team of experts analyzing every loan application, the Arkansas bank is shrugging off warnings of a real estate downturn.

September 28 -

A slight decline in core deposits in the second quarter stoked worries that tighter liquidity is around the corner. Bankers are exploring responses beyond the typical CD rate special if third-quarter results show the trend is continuing.

September 22 -

“You can’t serve the public if your employees are shellshocked,” said one top banker, comments echoed by other institutions dealing with the aftermath of Hurricane Harvey.

September 5 -

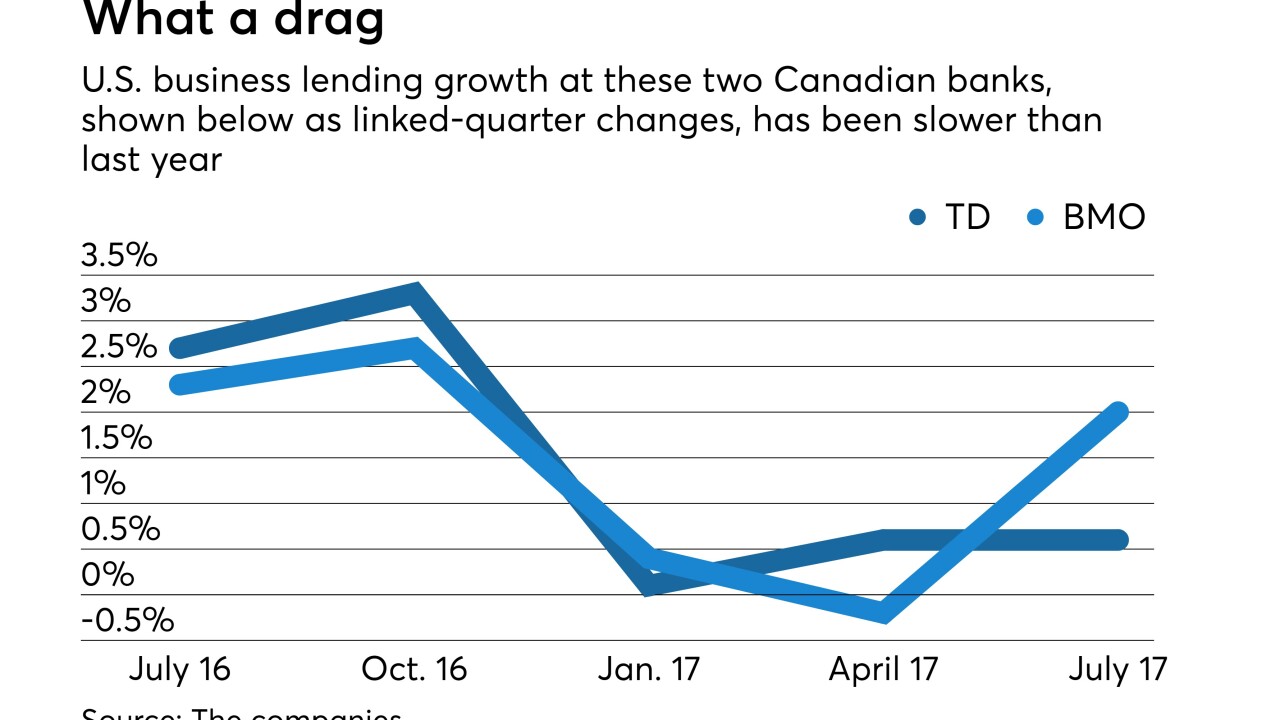

Pain stemming from slow U.S. commercial loan growth has spread north of the border, contradicting the yearslong narrative that Canadian banks are

relying on their U.S. operations to offset economic problems at home. However, TD and BMO executives said this week there is still upside in U.S. consumer banking.August 31 -

Doug Bowers said the company has moved beyond past issues, including corporate governance shortcomings and the abrupt departure of his predecessor, and is ready to bring in more loans and core deposits.

August 1 -

The Pennsylvania bank's mortgage performance contributed to stronger loan growth, fee income and profits.

July 18 -

Canada's big banks are pursuing wholesale banking, capital markets and select M&A opportunities across the border to hedge against a slowing mortgage market and other economic concerns on the home front.

May 26 -

The German bank posted two consecutive years of losses partly because of misconduct fines tied to the Libor and other scandals.

May 18 -

First Financial in Ohio says financial health tools for its clients’ employees will build more lasting commercial banking relationships.

May 4 -

Growth in commercial real estate loans is a big reason the New Jersey bank had a strong quarter.

April 26 -

The Atlanta company's profits rose on stronger net interest income and investment banking income as well as a tax maneuver.

April 21 -

The Birmingham, Ala., company's profit climbed 8% as higher market interest rates and investment securities balances offset lower average loan balances.

April 18 -

The Columbus, Ga., company also announced late Monday that it is buying the credit card assets and brokered deposits of the retailer Cabela's and will then sell the card portfolio to Capital One.

April 18 -

Net income climbed 13% as as the Fed's hike improved loan yields and the stock market’s surge boosted returns from PNC’s stake in BlackRock, the world’s largest asset manager.

April 13 -

First-quarter revenue at the scandal-plagued bank missed analysts’ estimates as profit fell in the lender’s troubled retail bank and expenses climbed.

April 13 -

Bank earnings could be hurt this year as big retailers close stores and file for bankruptcy. The situation has sparked a debate about how much CRE and C&I books will suffer just as lenders were putting other commercial woes behind them.

April 11