-

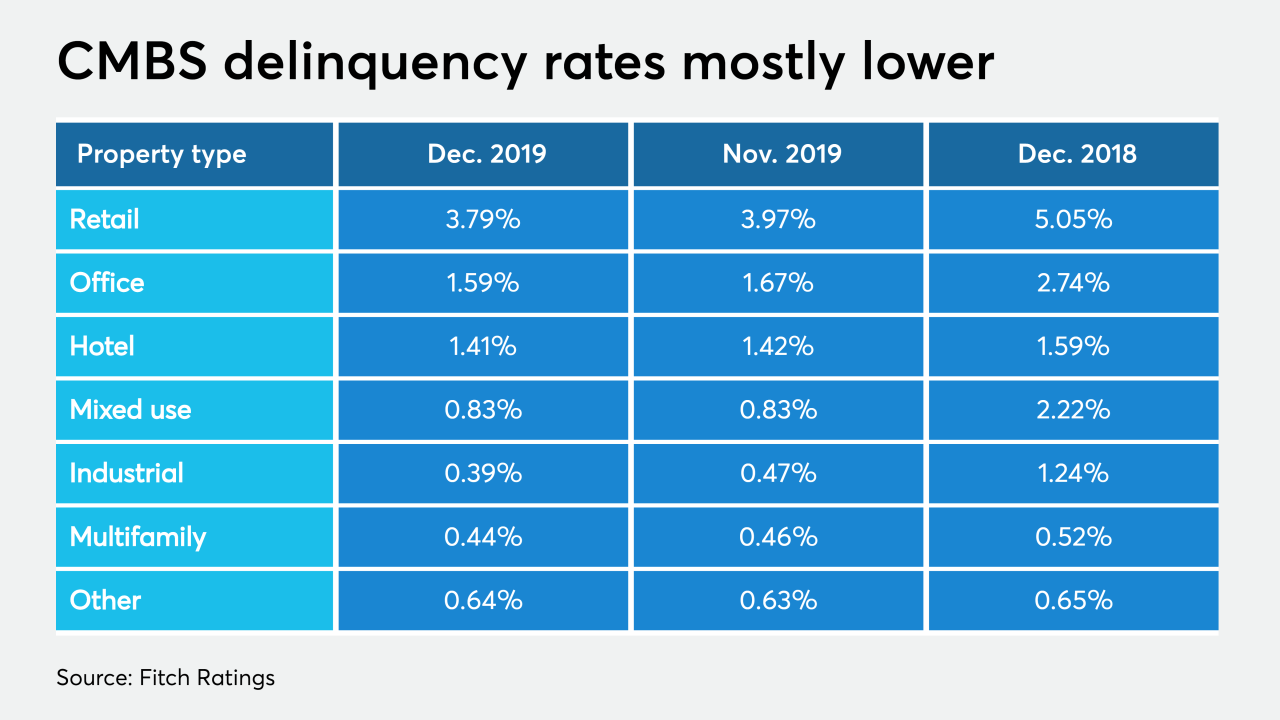

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

The foreclosed former home of Fireman's Fund Insurance in Novato, Calif., could become the site of a mixed-use development.

January 6 -

General Motors is providing $40 million in seller financing to the purchaser of its Lordstown, Ohio assembly plant.

December 9 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

The Chateau Hotel and Conference Center in Bloomington, Ill., is under new ownership after a judge agreed to enter a foreclosure judgment.

October 7 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24