-

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

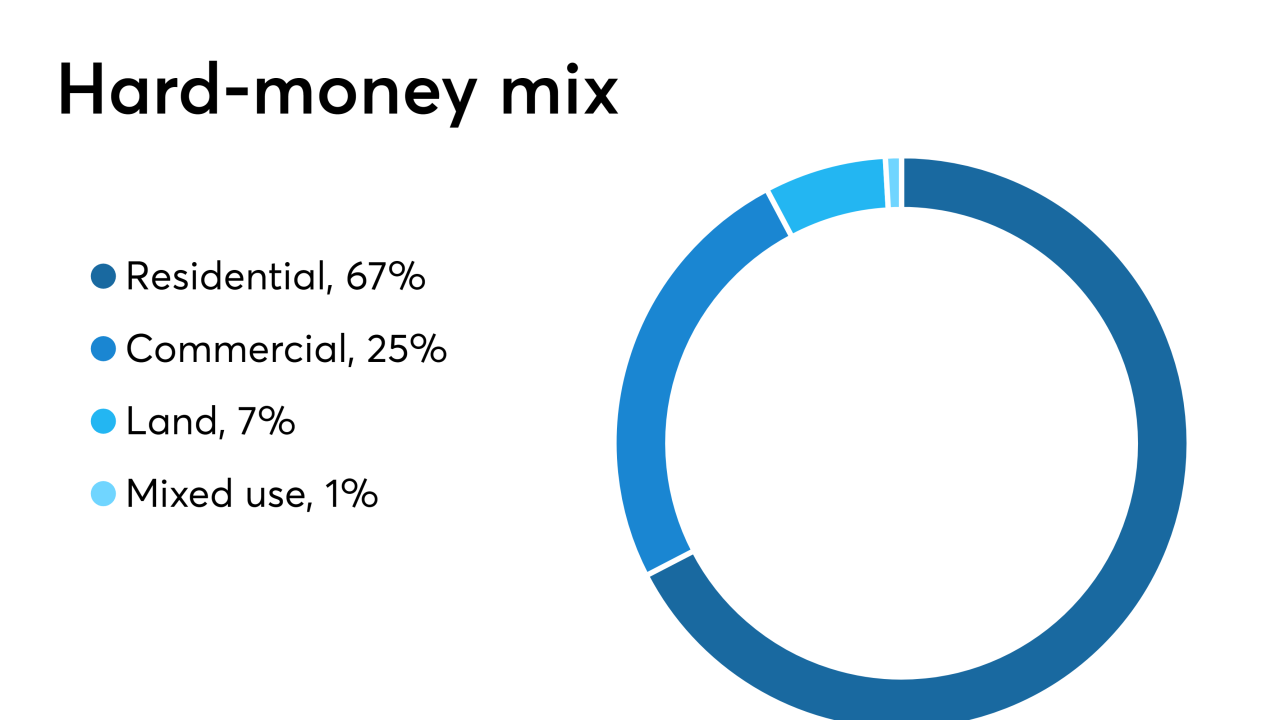

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

EF Hutton admitted in a court filing that it has defaulted under the terms of its contract with a real estate company and that the company has rightfully accelerated the debt.

June 27 -

First National Bank of Pennsylvania has filed a commercial mortgage foreclosure action against Conneaut Lake Park Volunteer Fire Department to collect more than $400,000 in outstanding loan debt, interest and penalties.

June 25 -

Commercial and multifamily mortgage debt outstanding continued rising, aided by low mortgage rates and the steady incline of property values, according to the Mortgage Bankers Association.

June 12 -

Economic strength bolstered the performance of loans included in commercial mortgage-backed securities with delinquencies improving for the seventh consecutive quarter, according to the Mortgage Bankers Association.

June 10 - LIBOR

Commercial and multifamily mortgage lenders need to figure out their plan for replacing the London interbank offered rate index potentially expiring at the end of 2021.

June 4 -

Velocity Mortgage Capital's new loan for income-producing residential and small-balance commercial properties was designed to afford investors more payment certainty than traditional bank financing.

June 3 -

BB&T's acquisition of SunTrust may make the combined company more of a contender in regional metro-area commercial mortgage lending, according to data provider CrediFi.

May 17 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

Stable equity and debt availability should keep multifamily and commercial real estate originations in line with 2017's peak, according to the Mortgage Bankers Association.

February 11 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

The Property Assessed Clean Energy sector is getting a boost from the expansion of improvements eligible to be financed via tax assessments, including fire resiliency and total building renovations, according to DBRS.

December 19