-

A bankruptcy court judge denied a lender's motion to foreclose on properties controlled by an Austin real estate investor. But the judge then issued a warning, saying an exit plan better be ready by Feb. 2.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

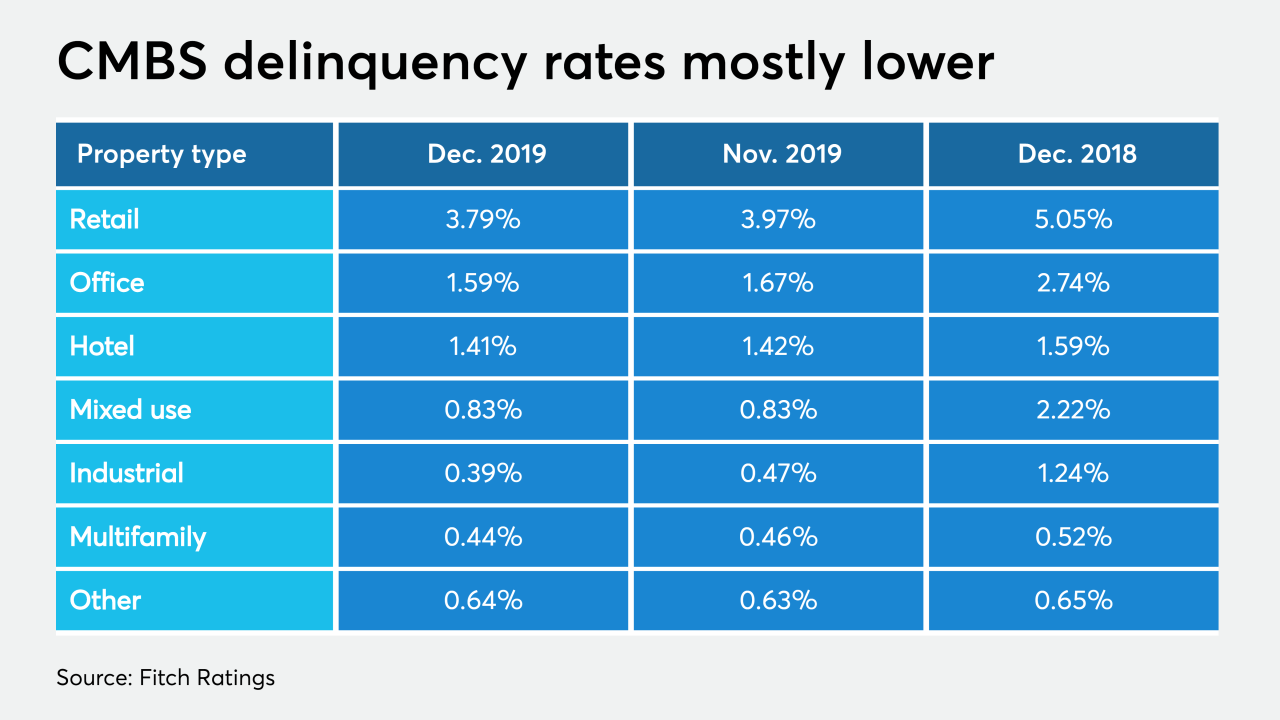

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

The foreclosed former home of Fireman's Fund Insurance in Novato, Calif., could become the site of a mixed-use development.

January 6 -

General Motors is providing $40 million in seller financing to the purchaser of its Lordstown, Ohio assembly plant.

December 9 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

The Chateau Hotel and Conference Center in Bloomington, Ill., is under new ownership after a judge agreed to enter a foreclosure judgment.

October 7 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

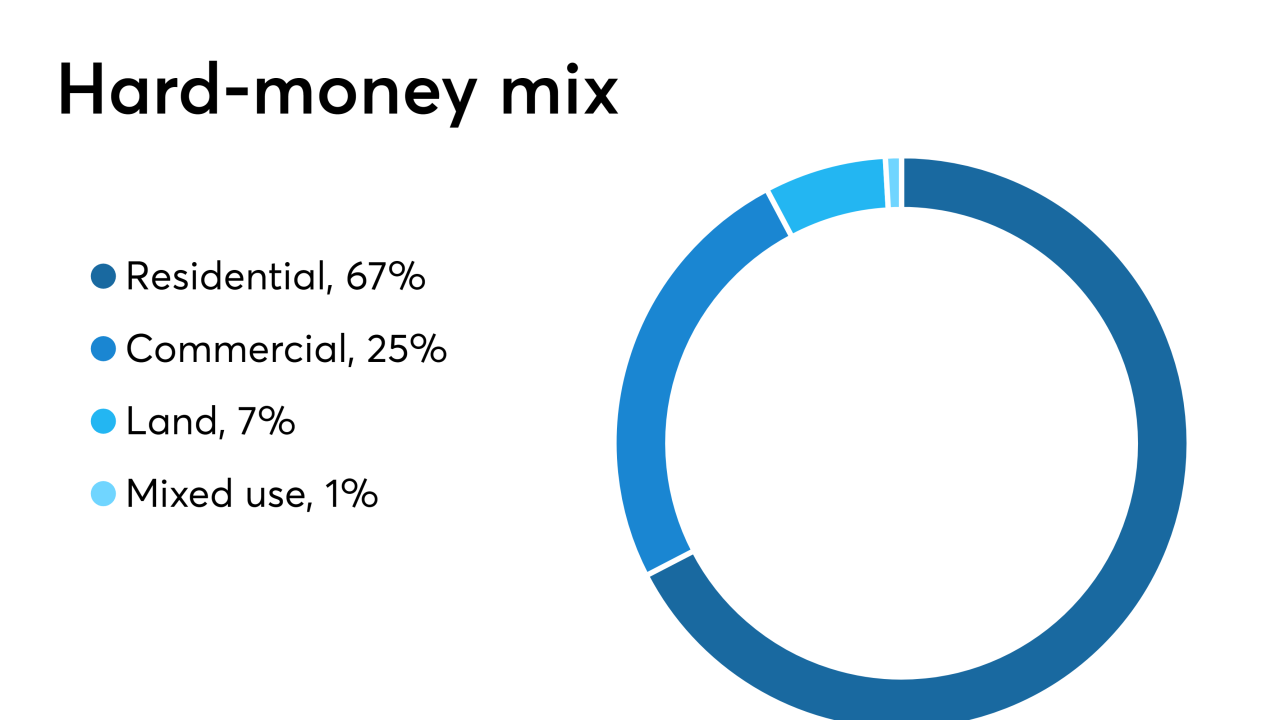

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

EF Hutton admitted in a court filing that it has defaulted under the terms of its contract with a real estate company and that the company has rightfully accelerated the debt.

June 27 -

First National Bank of Pennsylvania has filed a commercial mortgage foreclosure action against Conneaut Lake Park Volunteer Fire Department to collect more than $400,000 in outstanding loan debt, interest and penalties.

June 25 -

Commercial and multifamily mortgage debt outstanding continued rising, aided by low mortgage rates and the steady incline of property values, according to the Mortgage Bankers Association.

June 12