Community banking

Community banking

-

Kasasa's turnkey product for community banks and credit unions offers a "take-back" option.

August 25 -

MatlinPatterson, which once owned more than 60% of the Michigan company, has been paring back its stake in recent years.

August 10 -

-

Thomas O'Brien will take the helm at Sterling Bancorp, which is dealing with internal control issues and probes by the OCC and Justice Department into its mortgage operations.

June 1 -

The sale completes First Choice affiliate Berkshire Hills Bancorp's exit from the mortgage origination business.

May 19 -

The move is part of an effort by CFPB Director Kathy Kraninger to help smaller lenders by significantly raising loan thresholds for collecting and reporting mortgage data.

April 16 -

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

April 13 -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

The North Carolina company will hold onto the loans after the Fed's decision to slash interest rates.

March 11 -

The company disclosed that an internal review of a now-discontinued loan program found that employees engaged in misconduct tied to income verification and requirements, among other things.

March 9 -

Unity National Bank of Houston, which has reported losses three straight years, is receiving guidance and resources from Citigroup through a Treasury mentoring program.

March 6 -

MVB in West Virginia will gain a 47% stake in the partnership in exchange for contributing its mortgage unit's assets to the new company.

March 3 -

Bernie Sanders’ rise to front-runner status for the Democratic nomination worries many bankers, but their opinions diverge on his electoral chances and whether a Sanders presidency would pose a direct threat.

February 23 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31 -

Tom Lopp abruptly suspended a program that accounted for 83% of Sterling Bancorp's mortgage production this year. An ongoing audit of the program and pressure to diversify beyond mortgages are reasons to watch Lopp and Sterling in 2020.

December 27 -

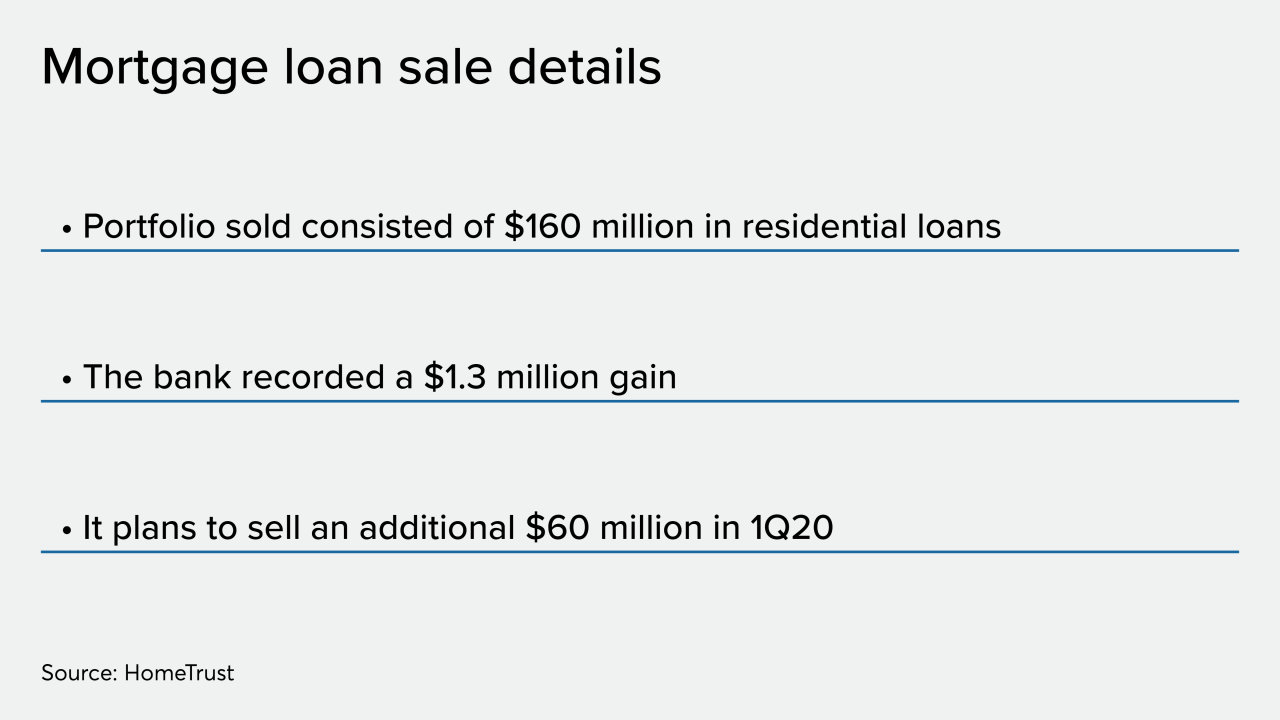

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5