-

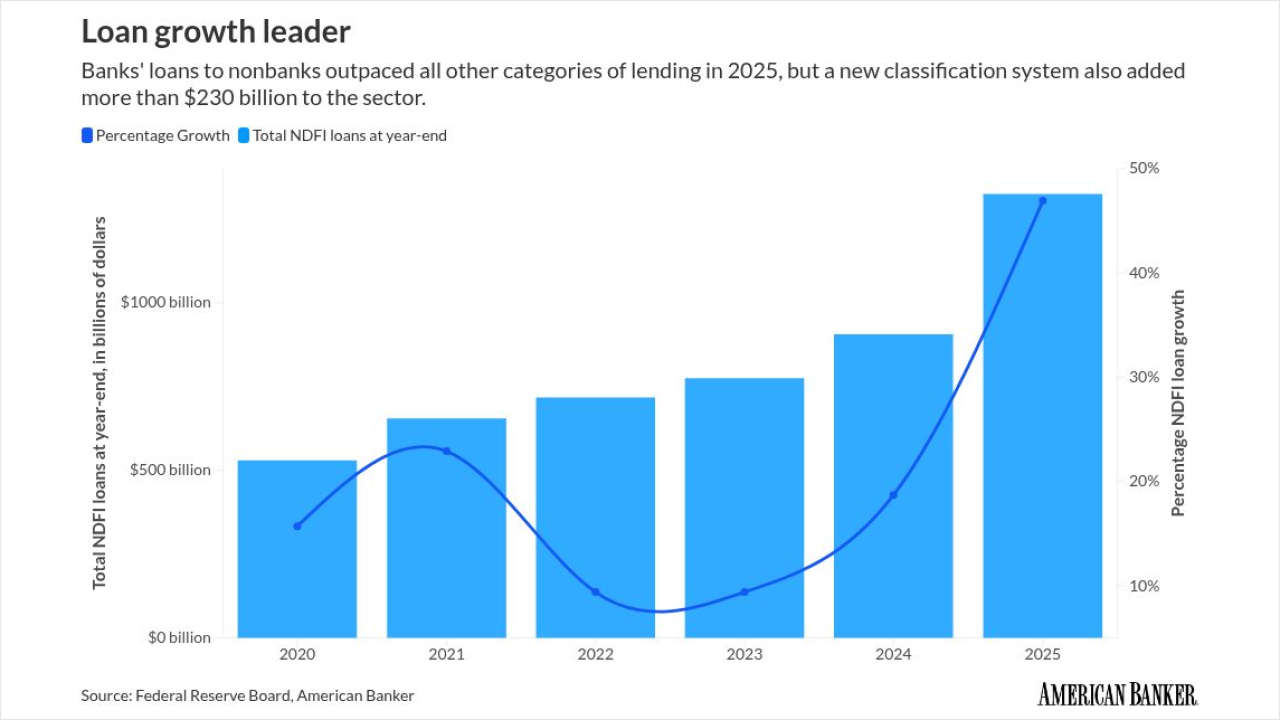

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

Following a $60 million credit hit, the Salt Lake City bank said that it hasn't found any other related problem loans.

October 20 -

The Cincinnati, Ohio-based bank delivered third-quarter earnings that mostly met expectations, even as it took a $200 million blow to credit.

October 17 -

Zions Bancorp. is among the latest banks to report material losses due to alleged borrower fraud. Stocks of regional lenders plunged on Thursday.

October 16 -

Orlando-based Cogent Bank has hired a team to finance single-tenant net lease properties, an asset class characterized by exceptional credit quality.

September 2 -

The first year of Otting's tenure as the New York lender's CEO brought substantial change, but the job isn't done. His goal: to build a powerhouse, profitable regional bank.

April 3 -

An American Bankers Association panel of forecasters predicted slower growth, but it said the U.S. economy would likely avoid a recession, sparing lenders deep credit quality woes.

September 30 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

July 18 -

-

Washington Trust shares plunged after the Westerly, Rhode Island, company disclosed it booked an office deal in the third quarter, boosting the size of its portfolio while other lenders are pulling back.

October 27 -

Residents in the top five cities have an average median credit score of 800.4 in 2022, according to WalletHub.

June 5 -

Taking a second look at those who were denied credit is very costly for lenders under the FHA's antiquated rules, writes the Chairman of Whalen Global Advisors.

April 25 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Late-payment rates are rising at nonbanks that lend to people with lower credit scores. "We're probably entering a stretch where you're going to see a separation between those that are relatively good underwriters and those that are not," one analyst said.

August 7 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

In November, more loan products were being offered both at the upper and lower ends of the market.

December 8 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

Deferrals may be hiding credit issues, leading lenders to track deposit flows, property maintenance and other factors to gauge the true health of their portfolios.

October 8