Community banking

Community banking

-

Call it mutual respect. Bankers from mutually owned British building societies and similarly structured U.S. thrifts recently gathered in New England to address common challenges and share ideas about staying relevant at a time of rapid change in financial services. Here are the takeaways from their meetings.

May 18 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

Capitol Federal Financial has mostly relied on mortgages throughout its history. Its acquisition of a commercial lender will change that.

May 11 -

Mutual of Omaha Bank's purchase of Synergy One Lending will add reverse mortgages to its product line.

May 10 -

Lorie Shannon, recruited from SunTrust, will oversee a strategy that features large, non-QM mortgages in key markets.

May 7 -

The removal of costly appraisal requirements on tens of thousands of smaller commercial properties could help community banks better compete for loans they say they have been losing to nonbank lenders.

May 4 -

Preferred Bank's experience with an apartment developer is a reminder of how important strict underwriting terms will be as loan demand increases, rates rise and lenders try to outdo each other.

May 4 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

The Seattle company has faced criticism from an investor over its commitment to the business, which lost money in the first quarter.

April 24 -

The Chicago company said its decision was largely based on intense competition, very low margins and economic changes.

April 12 -

TriStar Bank in Tennessee says a shortage of appraisers is slowing down its commercial real estate lending and raising the cost of appraisals. The claim has outraged appraisers, who argue that the bank is simply trying to avoid paying their fees.

April 11 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6 -

China’s threat to impose hefty tariffs on dozens of U.S. imports could weaken demand for soybeans, pork and other agricultural products. Here's what that could mean for farmers, ranchers and the banks that lend to them.

April 4 -

The Treasury's recommendations come as federal bank regulators have indicated they will soon release a proposal to reform Community Reinvestment Act policy.

April 3 -

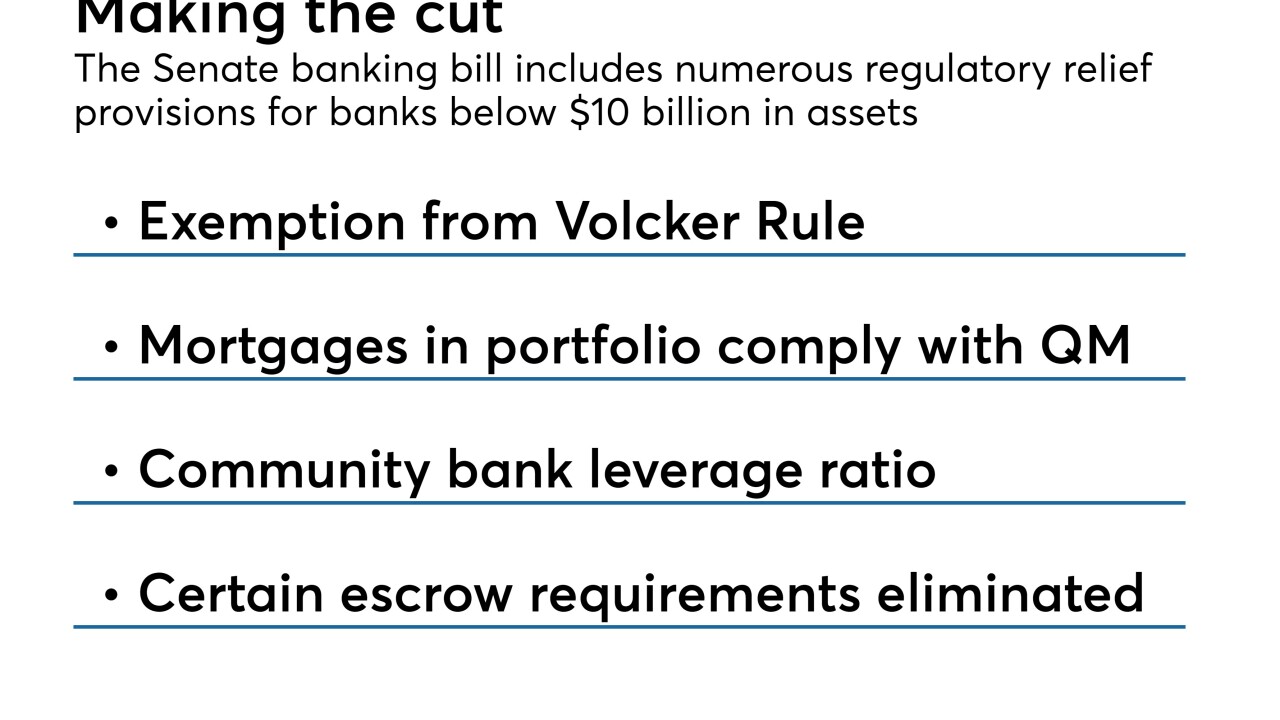

One purpose of the Senate bill was for small banks to rein in skyrocketing costs, but some bankers question whether the changes will save them money, and adapting to the reforms may even increase spending.

March 28 -

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

March 26 -

A bill to allow captive insurance companies to be reinstated as members of the Federal Home Loan Bank System appears to be dividing the FHLB community.

March 21 -

BankFirst Financial Services in Columbus, Miss., has acquired HomeFirst, a mortgage services firm.

March 15 -

To attract new customers, banks are getting rid of the paper-based payments process between builders and subcontractors.

March 2