Community banking

Community banking

-

CrediFi helps bankers pursuing commercial real estate loan growth minimize the risk in lending to customers they historically haven't served.

January 29 -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

The American Bankers Association has called for an end to the government shutdown, saying it has prevented customers from securing loans and threatens even more damage.

January 11 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

Bank OZK's George Gleason, one of our community bankers to watch in 2019, needs to rein in the Arkansas bank's commercial real estate exposure to placate nervous investors.

December 31 -

Cash-strapped lenders need to find a way to consistently fund marketing that resonates with more cultures if they really want to be able to replace lost volume by reaching underserved borrowers.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

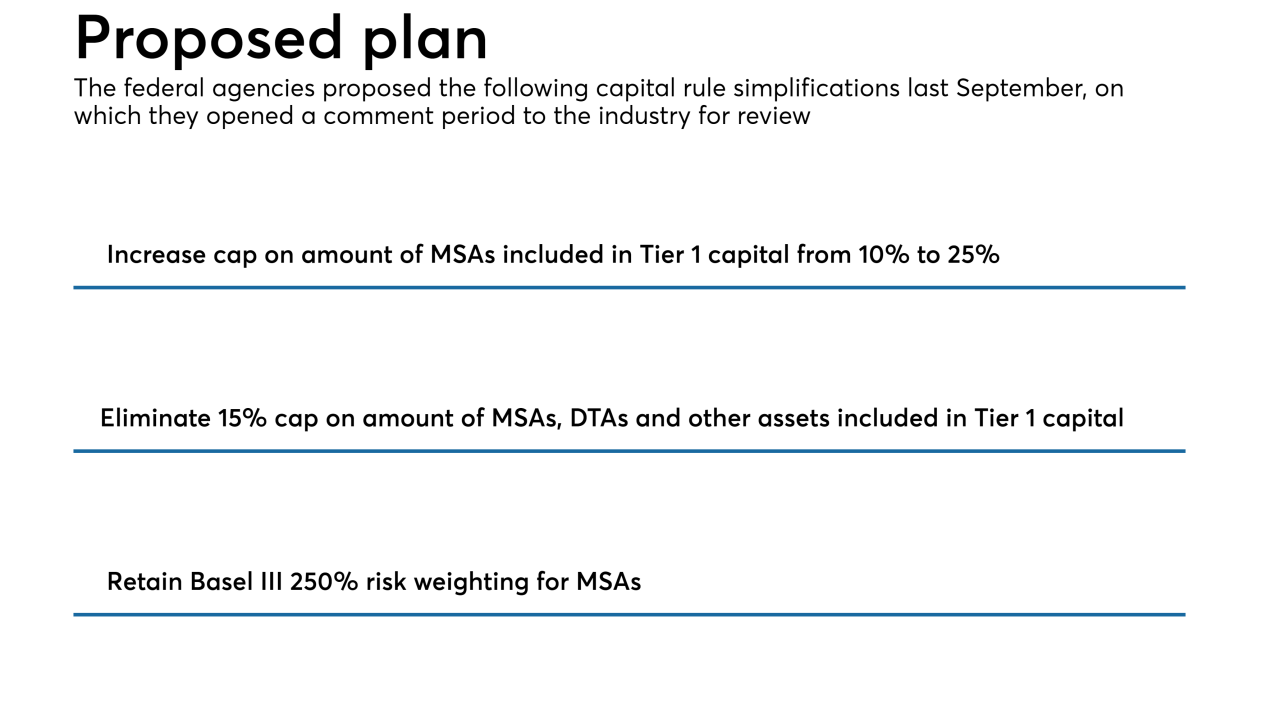

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

Merchants has agreed to buy NattyMac, a company it has been in business with since 2014.

December 6 -

The Federal Savings Bank is trying to persuade a judge to look beyond its CEO's alleged complicity in a fraud perpetrated by President Trump's former campaign chair.

November 29 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

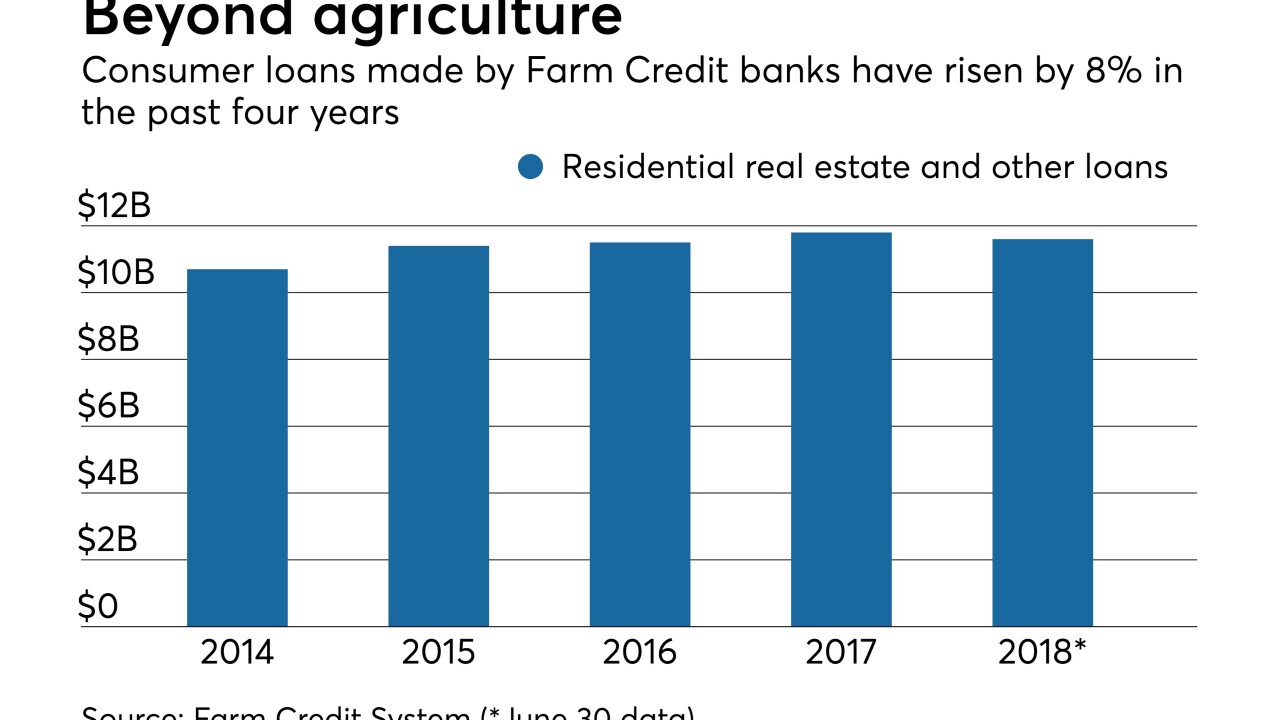

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

October 30 - Non-profits

City National Bank said the foundation will buy houses and hold onto them until the buyer lines up financing.

October 25 -

The company is facing criticism after a big chargeoff on two properties, showing that investors have little patience when a risky business model shows signs of distress.

October 19 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

Casey Crawford, CEO of Movement Mortgage, bought First State Bank in Virginia last year. He has since injected more capital into the bank in an effort to reinvent it.

September 10