-

Sage Bank in Lowell, Mass., has agreed to pay about $1.2 million to settle Justice Department allegations of discrimination against minorities in mortgage lending.

December 1 -

With an interest rate increase by the Federal Reserve Bank increasingly looking imminent, what else has to happen to set the stage for a return to adjustment-rate mortgages?

December 1 -

Broadway Financial Corp. in Los Angeles has been released from an enforcement action requiring it to improve its corporate governance.

November 30 -

Though regulation-mandated technology upgrades give vendors little time to rest, the growing acceptance of data standardization should appeal to both lenders and regulators.

November 30 eLynx

eLynx -

A plan by the government-sponsored enterprises to begin collecting the new Closing Disclosure data is designed to promote Fannie Mae and Freddie Mac's loan quality goals. But the initiative may also prompt broader use of e-signatures and paperless processing.

November 30 -

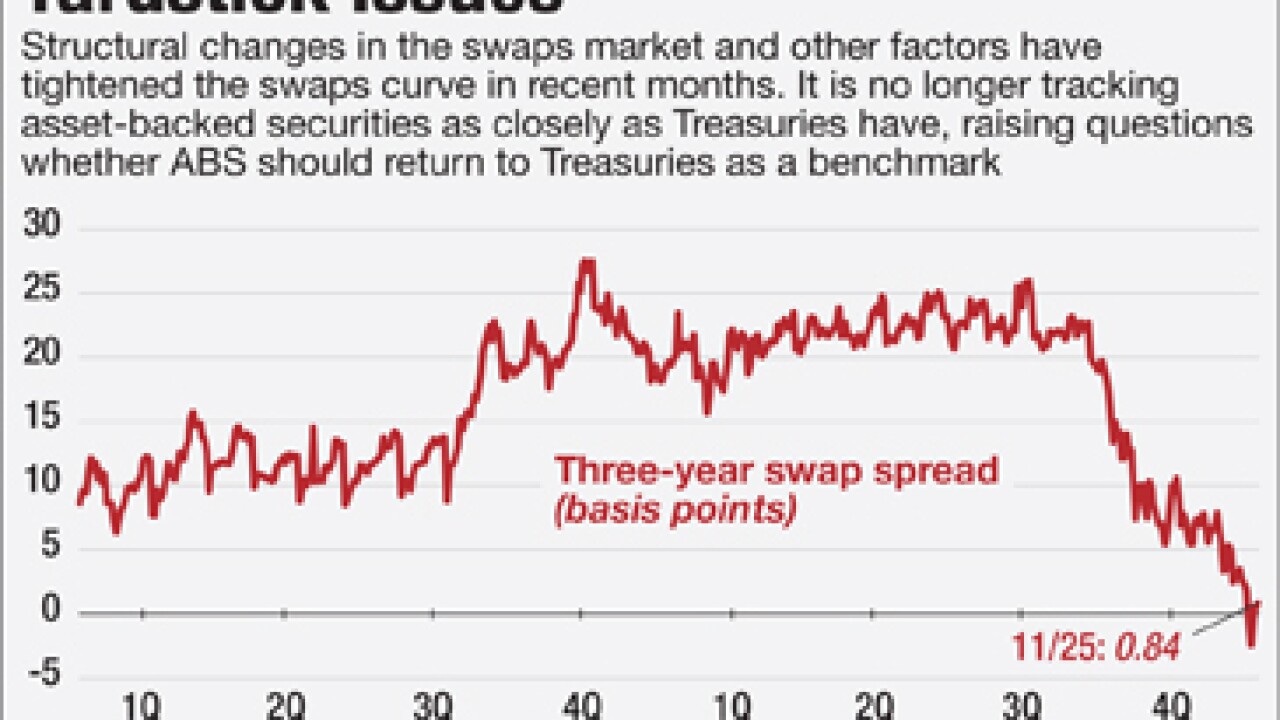

Commercial-mortgaged-backed, auto-loan and other securitizations use what is known as the swaps curve to price floating-rate deals. But pricing volatility is causing some to ask whether the market should go back to Treasuries after a 15-year hiatus.

November 25 -

A recent CFPB action against a payday lender demonstrates why lenders across industries must disclose both the best and worst case repayment scenarios to consumers.

November 25 Offit | Kurman

Offit | Kurman -

Three county governments in metro Atlanta have sued Bank of America for engaging in the practice of equity stripping, where the bank targeted minority borrowers with high-interest mortgage loans.

November 25 -

No two mortgage servicing rights portfolios look the same, and buyers have strong opinions about the kinds of deals they want to do. Here are some factors that can swing MSR transaction values, according to Matt Maurer, managing director at MountainView Capital Holdings.

November 23 -

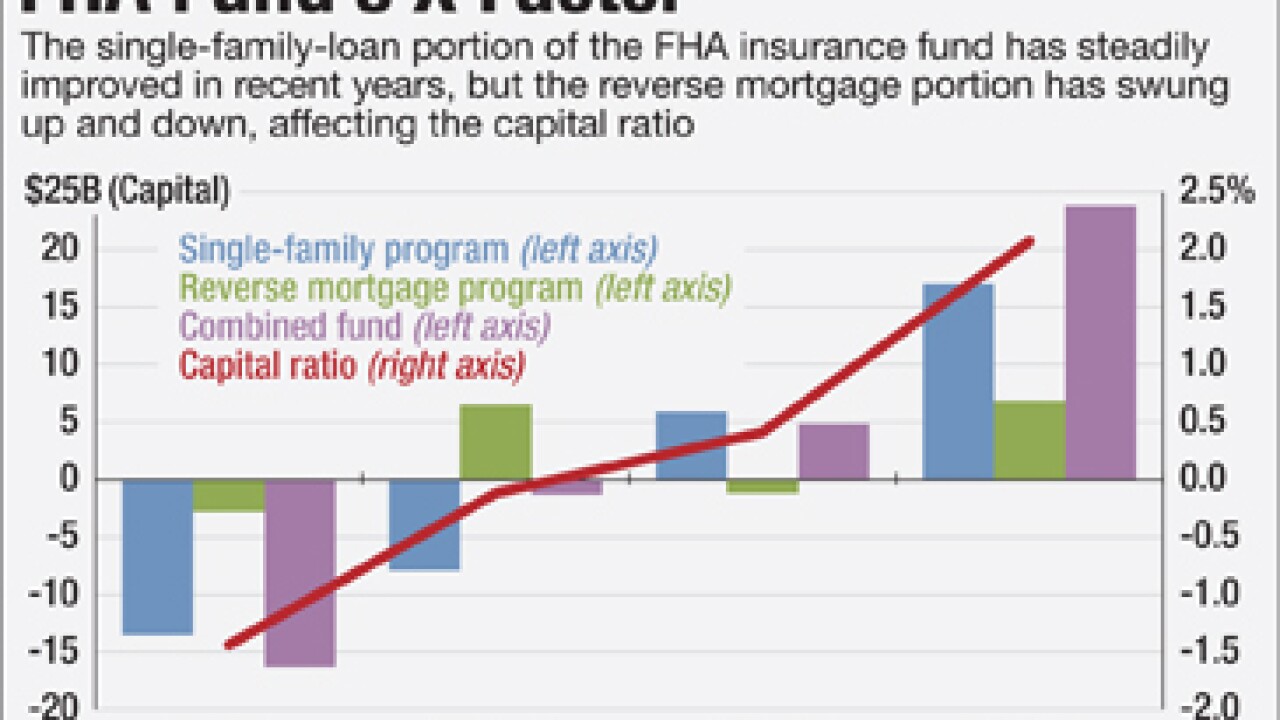

The Federal Housing Administration's annual financial report demonstrates the outsized influence of reverse mortgages on the performance of its insurance fund, fueling a debate about whether those loans belong there.

November 23 -

People's United Financial in Bridgeport, Conn., has dismissed three employees in the wake of alleged fraud on commercial real estate loans.

November 23 -

Higher mortgage rates and other macroeconomic challenges may dampen lending under the Federal Housing Administration's single-family program, but they will produce a net benefit to the insurance fund. Here's why.

November 20 -

The New York Department of Financial Services has ordered NewDay Financial to surrender its New York State license, as the fallout continues from its exam-cheating scandal.

November 19 -

Prospect Mortgage, a Sherman Oaks, Calif., nonbank lender, has agreed to pay $10.1 million in borrower restitution and penalties for violating federal and state laws, California's Department of Business Oversight said Thursday.

November 19 -

The House passed two controversial regulatory relief bills Wednesday evening ahead of the looming yearend budget fight.

November 19 -

From single-point-of-contact requirements to the need for better self-service options, servicers surveyed by National Mortgage News are taking a much-needed hard look at the full range of customer touch-points that they operate.

November 19 -

The White House threatened to veto two bills on Tuesday one that would mandate new cost-benefit requirements on the Federal Reserve and the other to allow loans held in portfolio to qualify as a qualified mortgage.

November 18 -

In one instance, a single complaint in the Consumer Financial Protection Bureau's database was counted as 35 different ones while in another, a complaint against a payday lender was filed against an unrelated bank. Current and former officials say that's par for the course, leading to inflated complaint numbers and inaccurate data.

November 18 -

Mortgage One in Sterling Heights, Mich., has signed a conciliation agreement with the Department of Housing and Urban Development regarding alleged disability discrimination.

November 17 -

The House approved a bill Monday night capping pay for Fannie Mae and Freddie Mac's top executives, sending the measure to President Obama's desk to be signed into law.

November 17