-

Although new HMDA data shows no negative effects from CFPB mortgage rules that went into effect last year, industry representatives argue it isn't showing the full picture.

September 22 -

Ginnie Mae may soon raise its liquidity and cash requirements for independent mortgage banking firms since it seems almost certain that Congress won't increase the agency's budget for fiscal year 2016.

September 22 -

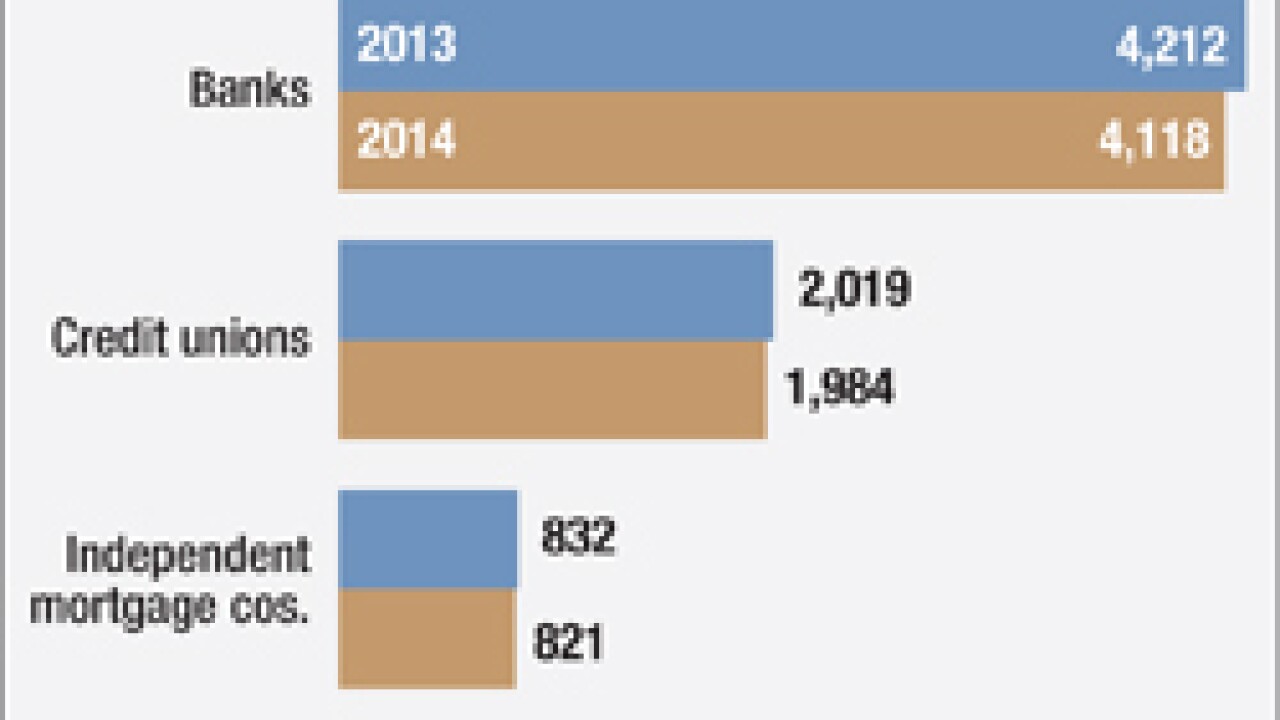

The number of mortgage originations dropped 31% to 6 million in 2014 due largely to a decline in refinancing as interest rates increased, according to a report issued Tuesday by the Federal Financial Institutions Examination Council.

September 22 -

A former court clerk in Illinois has been indicted for accepting a cash bribe, in exchange for creating a forged deed on a home.

September 21 -

Despite pledges last year to move aggressively to implement new credit scoring models at the government-sponsored enterprises, the Federal Housing Finance Agencys effort appears to have stalled.

September 21 -

Banks that want more explicit regulatory guidance on rules requiring managers to keep "skin in the game" with deals for collateralized loan obligations may be forced to keep waiting.

September 21 -

Lenders and vendors found no bad surprises in the Truth in Lending Act/Real Estate Settlement Procedures Act integrated disclosure exam guidance, but it didn't clarify much industry confusion either.

September 18 -

Wells Fargo is raising minimum credit score requirements on Federal Housing Administration loans, part of the ongoing jockeying by large banks to limit lawsuits by the Justice Department for defective FHA loans.

September 17 -

WASHINGTON A bipartisan group of senators reintroduced a bill Wednesday that would prohibit lawmakers from using certain housing finance fees to offset unrelated government spending.

September 17 -

There is no universal definition of "TRID-ready," but any vendor claiming it's prepared for the new integrated disclosures should allow lenders to test the changes. Here's what to look for, and the red flags that should be cause for concern.

September 17 International Document Services

International Document Services -

The window for moving financial services regulatory relief through Congress is rapidly closing, but there appears to be little hope that the partisan tensions that have stalled the process will ease in time.

September 16 -

A report to examine the conditions surrounding last years unrest in Ferguson, Mo., is calling for officials to strengthen poor minority communities access to banking services and restrict the prevalence of predatory lending to reduce crime and poverty.

September 16 -

The Consumer Financial Protection Bureau could be doing more to "enhance the accuracy and completeness" of entries into its consumer complaint database, according to the agency's Inspector General.

September 16 -

Ocwen Financial said it expects to report a loss in its current fiscal year, as it continues to cut costs amid an investigation of its practices.

September 16 -

LRES in Orange, Calif., and OSC in Kennesaw, Ga., have partnered to broaden their offerings of real estate services.

September 16 -

License numbers for loan officers, real estate agents and settlement agents will be required on one of the new TILA-RESPA integrated disclosure forms, raising questions about whether they could trigger investigations of possible illegal marketing services agreements.

September 15 -

California lawmakers passed legislation to change the way communities wind down their shuttered redevelopment agencies, leaving cities and their advocates trying to tally the effects of the last-minute bill.

September 15 -

Natural disasters and hidden property defects are about all lenders can count on to constitute a "changed circumstance" delay on the Loan Estimate but prepare for a case-by-case evaluation, anyway.

September 15 Offit | Kurman

Offit | Kurman -

American International Group won a decision that narrowed the claims by six investment funds that opted out of a $970.5 million class-action settlement last year over allegations the insurer misled investors about its exposure to subprime mortgages.

September 11 -

Evans Bancorp in Hamburg, N.Y., has agreed to pay $825,000 to settle a lawsuit that accused the company of mortgage redlining.

September 11