-

It took an average of 49 days to close a residential mortgage loan in December, a week longer than it took one year prior, according to Ellie Mae. This was unchanged from November.

January 20 -

Overlapping missions and jurisdictions are fueling competition between the Consumer Financial Protection Bureau and the Federal Trade Commission, according to former officials at both agencies.

January 20 -

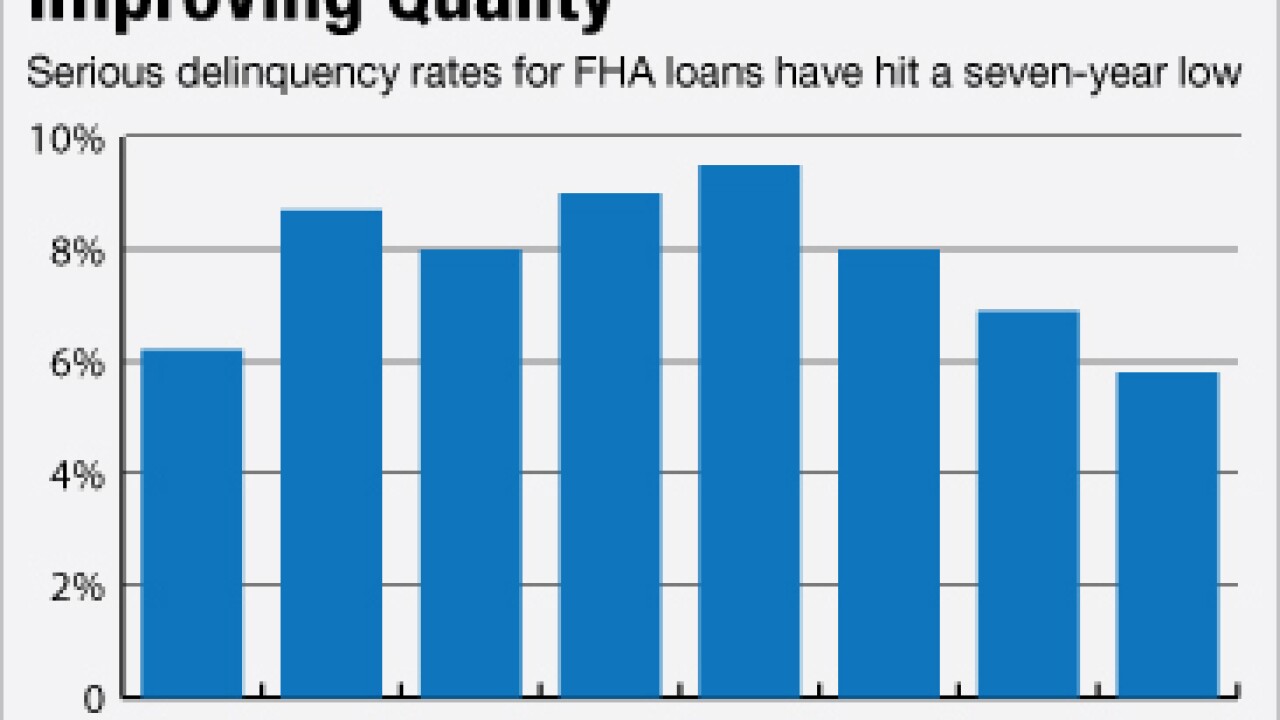

In one corner are groups like the Community Home Lenders Association and the major credit union groups, which are hoping the administration will further cut premiums after a reduction a year ago. On the other are MBA and ICBA, which argue a cut now would be too soon.

January 19 -

Agency and government loan programs will be a little different in the next 12 months. There also will be new rules for private-label securitizations, along with new products available to investors. Here is an overview.

January 18 -

Mortgage real estate investment trusts will be hurt modestly in the long run, now that they have been excluded from membership in the Federal Home Loan Bank System, according to Fitch Ratings.

January 15 -

Brokers and small lenders are being crushed under the weight of heavy regulation, leaving loan officers little choice but to shoulder the burden themselves or move to an organization that can handle the regulatory requirements.

January 15 TD Bank

TD Bank -

Goldman Sachs said it agreed to settle a U.S. probe into its handling of mortgage-backed securities for about $5.1 billion, cutting its fourth-quarter profit by about $1.5 billion.

January 14 -

Home Equity Conversion Mortgage servicers have received an additional three months to explore loss mitigation options when borrowers or their spouses have difficulty paying their property taxes and insurance.

January 14 -

The reverse mortgage industry is optimistic after recent reforms to the Home Equity Conversion Mortgage by the FHA and newfound respect from financial planners.

January 14 -

For luxury-home developers and brokers in Miami and Manhattan who are already contending with slumping prices and slowing demand, the U.S. government's decision to start scrutinizing all-cash buyers was more bad news.

January 14 -

The Department of Housing and Urban Development has rejected a nonprofit housing group's allegations of racial discrimination against U.S. Bank. HUD found that the bank properly maintain foreclosed homes in predominantly black and Hispanic neighborhoods and in some cases spent more rehabilitating the homes than in white areas.

January 13 -

U.S. lawmakers called for federal investigations into Clayton Homes, the mobile-home business at Warren Buffett's Berkshire Hathaway, after the Seattle Times and BuzzFeed News wrote that the company targeted minority borrowers and charged them higher interest rates on average than whites.

January 13 -

The Department of Housing and Urban Development has filed charges against three California-based home loan modification companies and nine of their employees for allegedly violating the Fair Housing Act.

January 13 -

Independent mortgage lenders are expecting a wave of consolidation prompted by excessive compliance costs, a tepid housing recovery and the need for more capital to grow their businesses. Roughly 20% to 25% of independent companies could be eliminated or change hands in less than two years.

January 13 -

President Obama's administration, citing concern about the origin of funds used for all-cash purchases of luxury real estate, said it is stepping up scrutiny of transactions in New York and Miami.

January 13 -

Community bankers and credit unions scored a significant victory while others in the mortgage industry lost out in the Federal Housing Finance Agency's final rule establishing membership standards for the Home Loan banks.

January 12 -

Private-label investors in residential mortgage-backed securities should be at only modest risk for noncompliance with TILA-RESPA integrated disclosure requirements, according to Fitch Ratings.

January 12 -

The agency scrapped a part of its 2014 proposal that would have required Home Loan Bank members to maintain a certain percentage of residential mortgage assets in order to keep their membership. But the agency held fast on a provision that would disqualify captive insurance firms from membership.

January 12 -

Recent Consumer Financial Protection Bureau enforcement actions against lead generation companies emphasize the breadth of lenders' responsibility for the third parties they expose borrower clients to.

January 12 Offit | Kurman

Offit | Kurman -

Department of Housing and Urban Development Secretary Julian Castro will get a boost in public visibility with a scheduled appearance on the Jan. 11 episode of "The Late Show with Stephen Colbert."

January 11