-

Block One Capital has signed a binding term sheet to acquire 40% of the equity of Finzat, a private entity aiming to develop a blockchain system to create a safer, more compliant digital mortgage process.

December 6 -

Ocwen Financial Corp. will move its servicing portfolio to Black Knight's LoanSphere MSP system of record, following years of regulatory scrutiny of its existing technology provided by Altisource Portfolio Solutions.

November 1 -

Lennar Corp.'s record takeover of CalAtlantic Group Inc. is a bullish sign for homebuilding in the U.S. Trade groups, meanwhile, worry that lawmakers are about to kneecap the industry.

October 30 -

Credit Suisse's plan for consumer relief in a multibillion-dollar Department of Justice settlement related to residential mortgage-backed securities could reduce the costs involved, according to the settlement monitor's first report.

October 30 -

The Federal Housing Administration has extended waivers on timelines for disaster-related re-inspections to properties in Puerto Rico affected by Hurricane Maria as well as other properties impacted by California wildfires.

October 25 -

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

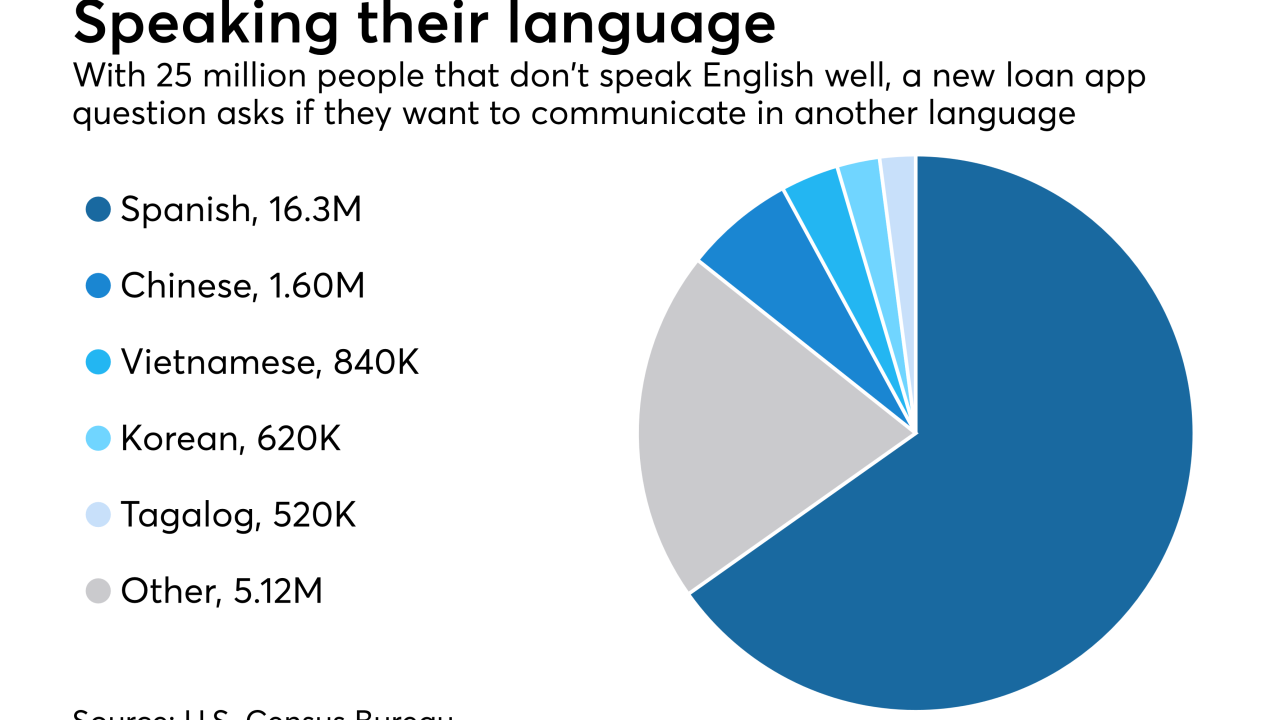

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

For the past eight years, Brian Montgomery has helped mortgage lenders fight penalties sought by the Federal Housing Administration. Now he's President Trump's nominee to lead the agency.

October 19 -

A six-lane highway lined with strip malls cuts through a patchwork of tamed lawns and suburban houses in Delran, N.J., where population has sprouted rapidly in recent decades.

October 17 -

Ginnie Mae and the Department of Veterans Affairs have described in more detail the VA loan refinancing practices they will crack down on to eliminate a long-running churning concern.

October 16 -

The latest version of Ellie Mae's Encompass loan origination system includes new features for Home Mortgage Disclosure Act compliance and digital mortgages.

October 16 -

A group backed by billionaire industrialists Charles and David Koch unveiled a television and digital campaign that argues "corporate welfare" threatens Republican efforts to dramatically alter the U.S. tax code.

October 11 -

TILA-RESPA integrated disclosure rule amendments are in effect and the Consumer Financial Protection Bureau is beginning to digest comments on an outstanding "black hole" mortgage companies want more clarification on.

October 11 -

The Tupelo, Miss., company has recouped its “satisfactory” community reinvestment rating, removing a regulatory obstacle to two pending acquisitions.

October 11 -

Lenders could be responsible for water quality issues affecting borrowers and properties if the Federal Housing Administration follows through with its response to an inspector general's report.

October 6 -

A bankruptcy judge who spent 107 pages excoriating Bank of America Corp. over its "heartless" foreclosure on a California couple is not happy that the homeowners want him to erase his words.

October 4 -

Ocwen Financial Corp. received more breathing room on the legal front as the Securities and Exchange Commission is not pursuing an enforcement action against the company regarding its debt collection practices.

October 4 -

Fannie Mae and Freddie Mac's regulator may have a travel kerfuffle of his own.

October 3 -

The ruling said there was no lien on the titles because the Resolution Trust Corp. agreed to the foreclosure, making it legal.

October 3 -

Wall Street firm Morgan Stanley is almost done completing tasks mandated under the terms of a mortgage settlement in New York.

October 2