-

The long-awaited proposal includes safe harbors to protect collectors from getting sued, but would restrict phone collection attempts and allow borrowers to opt out of receiving other communications.

May 7 -

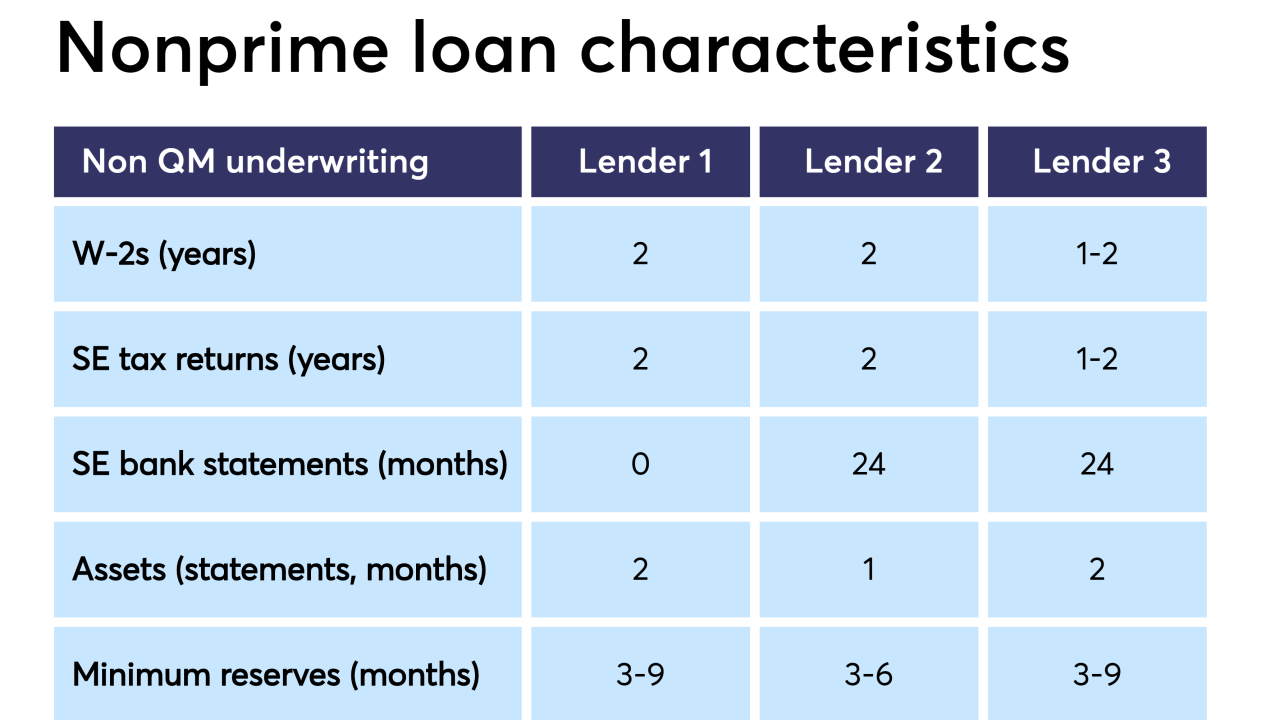

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

As the CFPB moves closer to updating its debt collection regulations, revising restrictions on phone calls and other communications with consumers must be a priority.

May 1

-

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

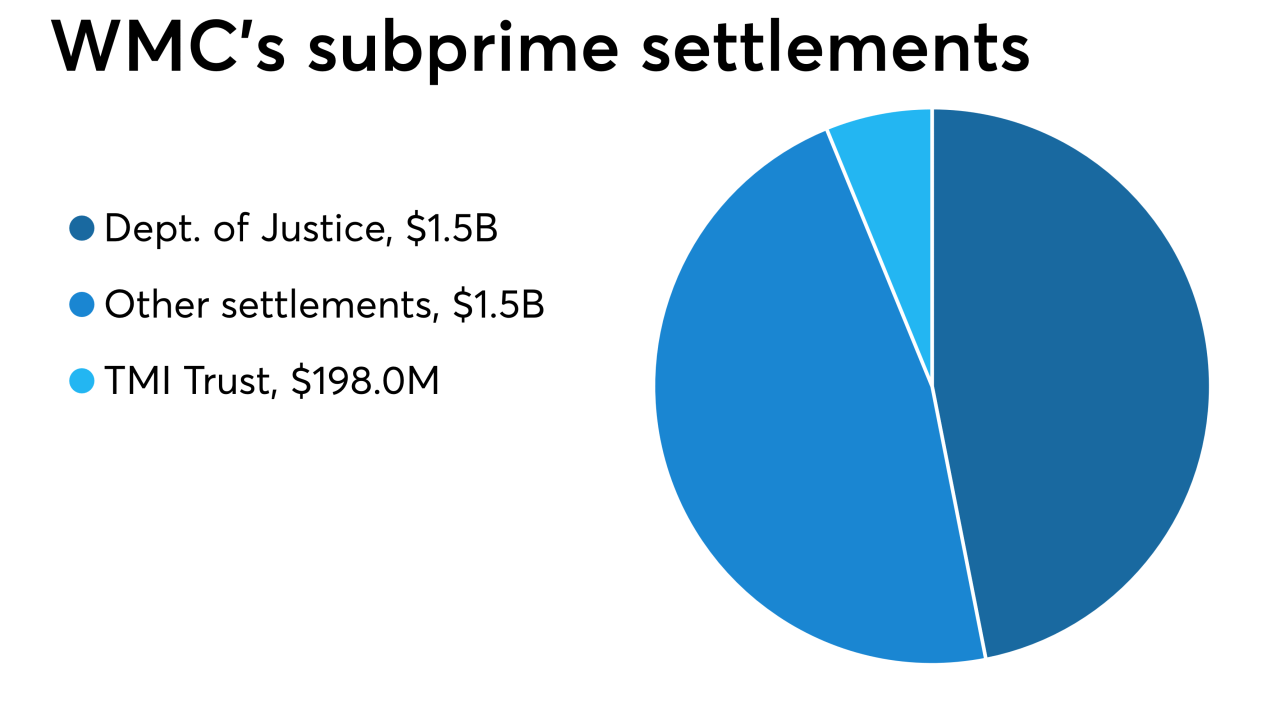

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Marianne Lake, seen in recent months as a leading candidate to replace CEO Jamie Dimon, got the post she may have needed to round out her resume — consumer lending chief. And Jennifer Piepszak, another rising star at the company, will take over as CFO from Lake.

April 17 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12