-

KeyCorp will keep and expand First Niagara Financial Group's Buffalo, N.Y.-based mortgage operations to spur along its return to being a player in residential lending.

December 17 -

TowneBank in Suffolk, Va., has agreed to buy Monarch Financial Holdings in Chesapeake, Va., for $220.6 million in stock.

December 17 -

U.S. Bancorp has plucked longtime lending executive Tom Wind from EverBank Financial to run its mortgage business.

December 10 -

Eileen Serra, 61, the chief executive of the Chase Card Services unit, will step down in January and become an adviser to the company on growth initiatives, according to a memo Wednesday from Gordon Smith, JPMorgan's CEO of consumer and community banking.

December 9 -

Amanda Sessa of SWBC Mortgage relies on a broad depth of market expertise, offbeat outings and her partner and husband for support, to propel her business.

December 8 -

Add retail customers to the list of groups raising concerns about possible high-pressure product-sales tactics at Wells Fargo; many of them are considering jumping ship in response, according to a new survey of customer attitudes at big banks. However, Wells' rivals shouldn't celebrate they are at risk of losing customers, too, for a variety of reasons.

December 3 -

When Guaranteed Rate's Sam Sharp discovered past clients' online reviews were bringing in new business, he started making customer feedback a major part of his digital marketing strategy.

November 20 -

First Bancshares in Hattiesburg, Miss., has agreed to buy Mortgage Connection in Jackson, Miss.

November 19 -

Wells Fargo has promoted Tim Sloan to president and chief operating officer, a move that likely puts him on a short list of candidates to succeed John Stumpf as chief executive.

November 17 -

Loan originations for commercial and multifamily properties rose in the third quarter, the Mortgage Bankers Association reported, backing up the group's projection from last month.

November 10 -

Arch MI U.S. did $3.2 billion in new insurance written, approximately 60% more than the nearly $2 billion done in the same quarter in 2014.

October 29 -

BOK Financial reported a small drop in third-quarter profit, as a decline in the value of mortgage servicing rights offset loan and fee income growth.

October 29 -

New York Community Bancorp has agreed to buy Astoria Financial for about $2 billion in cash and stock, combining two of the largest New York-area banks to create an institution with about $64 billion in total assets.

October 29 -

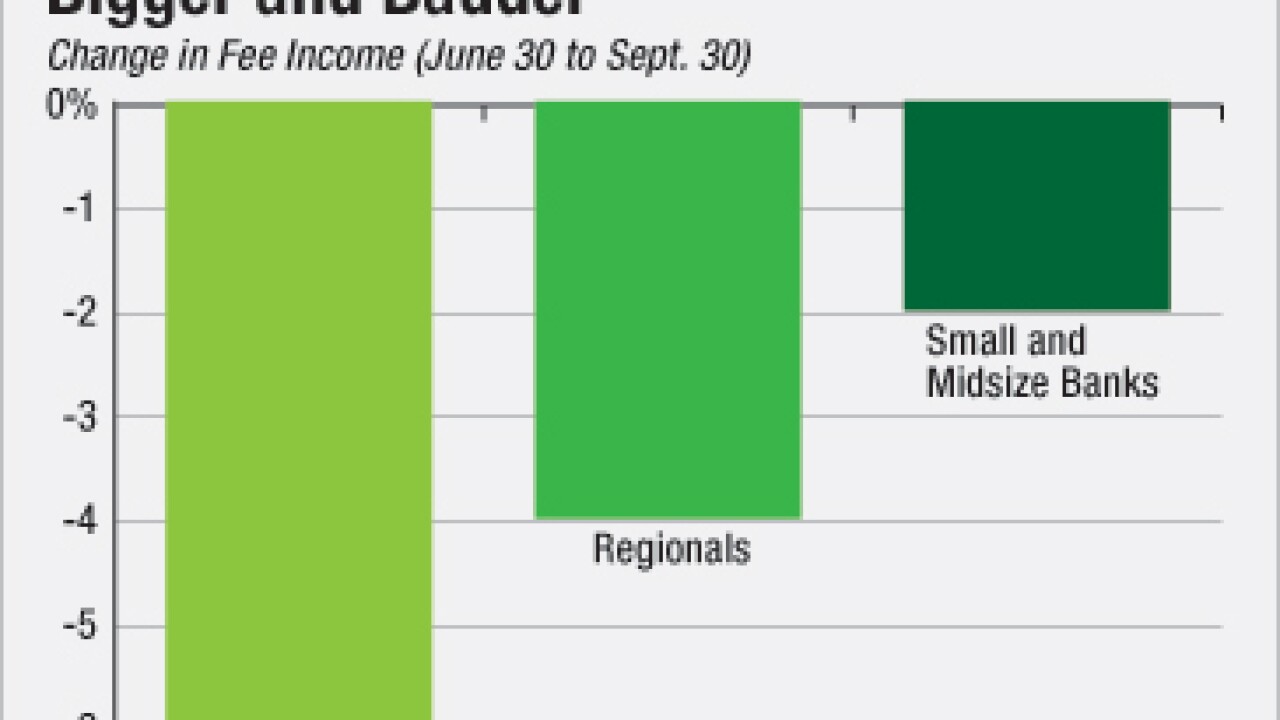

Nobody thought it would be pretty, but last quarter's results were even worse than expected, and low fee revenue is largely to blame. Trading and mortgage banking were particularly bad, and few of the big banks managed to offset the declines.

October 28 -

Flagstar Bancorp reported a third-quarter profit, as it originated more residential mortgages and recorded higher fee income.

October 27 -

Quicken Loans CEO Bill Emerson's term as chairman of the MBA underscores how the consumer-direct mortgage channel has grown from a quirky novelty to the force leading a technology revolution.

October 26 -

Astoria Financial, a New York City-area thrift under pressure from activist investor Basswood Capital Management to boost the share price, is exploring a sale, according to people familiar with the matter. The stock climbed as much as 6.2%.

October 23 -

Should credit unions step into a giant breach gradually being vacated by the big banks, or is the bank pull-out a sign that CUs should do the same?

October 20 -

Average fixed mortgage rates perked up the week ending Oct. 15, but remained under the 4% level for the 12th consecutive week.

October 15 -

PNC Mortgage's chief executive and president Joseph C. Guyaux will retire in the spring of 2016, the Pittsburgh-based company announced Thursday. He will be replaced by treasurer and chief investment officer E. William Parsley III.

October 15