-

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

February 5 -

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3 -

Mortgage rate trends in late 2025 led the lender into the red in the fourth quarter, even as Newrez originations picked up from the prior quarter and year.

February 3 -

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

January 30 -

Fourth quarter pretax income of $900,000 and net income of $656,000 for the segment compared with year ago losses of $625,000 and $197,000 respectively.

January 30 -

Competition that impacted margins and prepayments in excess of expectations were challenges during the period, but executives report first quarter improvement.

January 29 -

Analysts estimate Pennymac, Rocket, UWM and Loandepot will post an improved earnings per share and total loan origination volume than the same time a year prior.

January 29 -

Supply chain attacks have doubled since 2021, with professional services firms increasingly acting as "stepping stones" to access bank data.

January 29 -

The Tulsa, Oklahoma-based bank expects the pace of loan growth to quicken this year, driven in part by its nine-month-old warehouse lending business.

January 27 -

The estimated range for net income to common shareholders at the company formerly known as Ocwen rose in part due to a deferred tax asset valuation.

January 26 -

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

January 21 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

In the fourth quarter of 2025, America's second-largest bank posted earnings that came in just above Wall Street's forecasts.

January 14 -

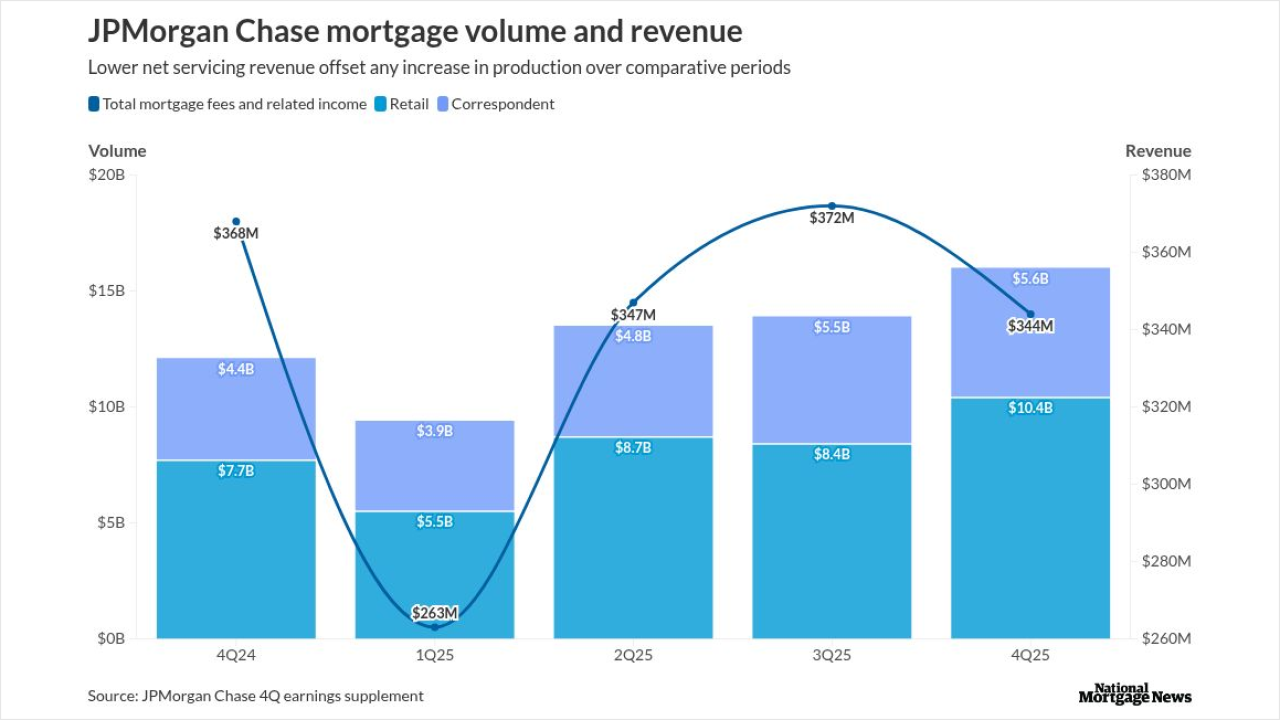

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

For 2026, the mortgage industry operating environment will improve, while nonbank financial metrics should be within Fitch's rating criteria sensitivities.

December 12 -

BTIG is waiting with "baited breath" for Fannie Mae and Freddie Mac to relist their common stocks, but if spreads widen, it could derail it from happening.

December 5 -

Non-banks tracked by Morningstar DBRS reported combined net income of $367 million for the third quarter, down from $807 million three months prior.

November 26 -

The vendor, SitusAMC Group Holdings, LP, said in a statement Saturday that someone compromised its systems and took client data including "accounting records and legal agreements."

November 23