JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

President Donald Trump's recently filed lawsuit against megabank JPMorganChase and its CEO Jamie Dimon is not expected to succeed in court, legal experts say.

January 26 -

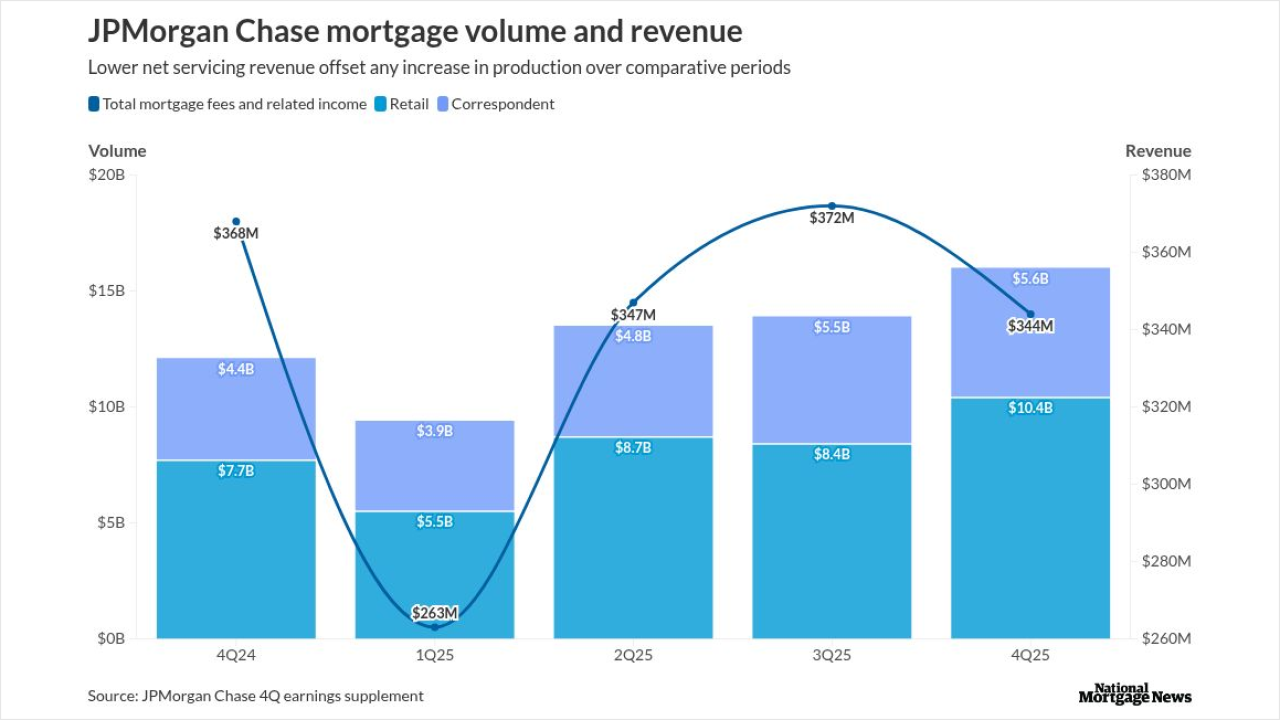

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

The bank is adding trusted contacts, specialized teams and new tech against scams, but consumer advocates say reimbursement is the key missing piece.

November 17 -

A new research report this week found AI could 'unlock' $370 billion in profits for banks, though they're not yet ready to capture it. But big-bank executives say they are already seeing measurable results from their generative and traditional AI investments.

November 6 -

Previously, Kim was a managing director in J.P. Morgan Chase & Co.'s strategic investments group, where she managed a diverse portfolio of fintech investments.

November 5 -

The $4.6 trillion-asset company's report comes after it committed to funneling $1.5 trillion into industries deemed important to national security.

October 14 -

President Trump in an interview Tuesday morning railed against big banks for allegedly discriminating against conservatives, a notable shift in tone that puts more responsibility for the debanking debacle on banks rather than regulators.

August 5 -

Late-payment rates among U.S. borrowers rose again in the second quarter, according to a report from the New York Fed. The trend reflects a sharp increase in student loan delinquencies, which have been climbing as pandemic-era policies have expired.

August 5 -

President Donald Trump accused two of the nations' largest banks of rejecting his business, following a report his administration was preparing an executive order threatening financial institutions who refused to do business on ideological grounds.

August 5 -

Chairman and CEO Jamie Dimon said in a Tuesday statement that "the U.S. economy remained resilient" during the second quarter, adding that the recent tax cuts and potential deregulation are "positive for the economic outlook."

July 15 -

The deal is the seventh prime jumbo issuance from Chase Home Lending Mortgage Trust in 2025.

July 8 -

Marianne Lake will oversee strategic growth and the company's fast-growing overseas consumer bank.

June 4 -

The question of when the CEO would retire and who might succeed him has hung over JPMorganChase for years.

June 2 -

As the flames continued to spread, banks closed more branches while others donated to relief efforts.

January 9 -

Underwriting methods have been steadily shifting to traditional full documentation, which accounts for 13.3% in the VERUS 2024-9, KBRA said, its largest share since VERUS 2024-6.

December 5 -

The longtime JPMorgan Chase CEO discussed the Basel III endgame capital rules, interchange fees and open banking during a fireside chat at the American Bankers Association's annual conference.

October 28 -

The megabank reported a big increase in credit costs for the third quarter, which included a reserve build of $1 billion.

October 11 -

Wall Street banks are expected to capitalize on ultra-low credit spreads and strong demand from investors after they report quarterly results.

October 10 -

JPMorgan Chase & Co. plans to sell credit risk on a $531 million portfolio of adjustable-rate mortgages, a new kind of offering by the bank and the latest example of the industry's efforts to de-risk balance sheets.

August 15 -

Thanh Roettele will help guide the Canadian bank's growth in the mortgage warehouse space in one of its latest moves aimed at the U.S. market.

August 14