-

Movement Mortgage purchased the two branches that comprise Huntsville, Ala.-based Platinum Mortgage's retail business just weeks after the latter company sold its wholesale division.

May 3 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

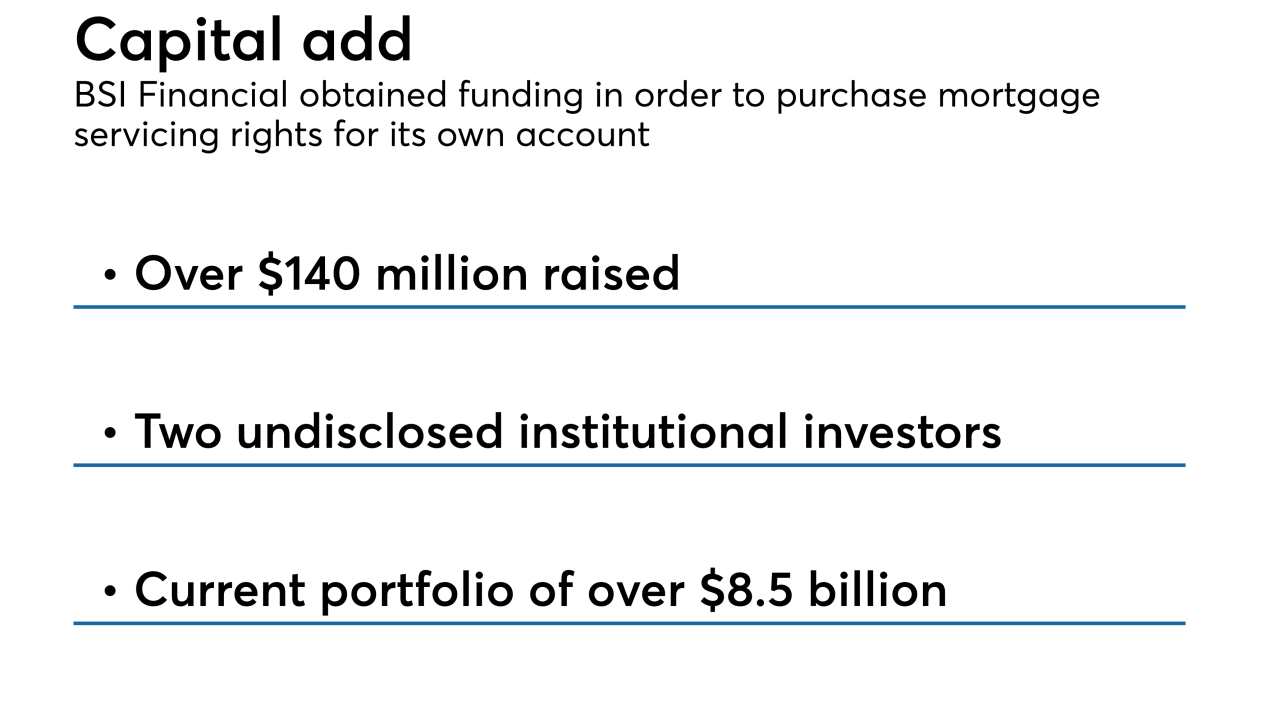

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

February 11 -

Wells Fargo and JPMorgan Chase had reduced mortgage-related earnings in the fourth quarter as home loan activity continues to fall short of expectations.

January 15 -

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29 -

The Money Source is the latest mortgage company partnering with Ellie Mae to streamline workflows between lenders and correspondent investors through Encompass Investor Connect.

October 25 -

Wells Fargo Home Lending is tapping eOriginal to launch an electronic note program, marking a step forward for the mortgage industry's push toward a more digital process.

October 15 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

Gateway Mortgage's owners are acquiring the majority interest in Farmers Exchange Bank and will merge the lender into the Cherokee, Okla.-based depository.

August 8 -

Redwood Trust's net income was down 30% from the prior quarter as mortgage banking activities earnings fell by 60%.

August 8 -

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

A new round of expense reductions is getting underway at Nationstar Mortgage as the company moves toward its acquisition by WMIH Corp., a shell company holding Washington Mutual legacy businesses.

July 17 -

Overcapacity in the mortgage industry led to more competitive pricing in the first quarter, said Wells Fargo CEO Tim Sloan.

June 1 -

Citizens Bank's $511 million acquisition of Franklin American Mortgage will beef up the bank's servicing portfolio and diversify its origination business at a time when higher interest rates have put a damper on refinance volume.

May 31 -

Impac Mortgage Holdings generated almost $4 million in net income during the first quarter as it continued to downsize to adjust for origination declines and benefited from servicing gains.

May 10