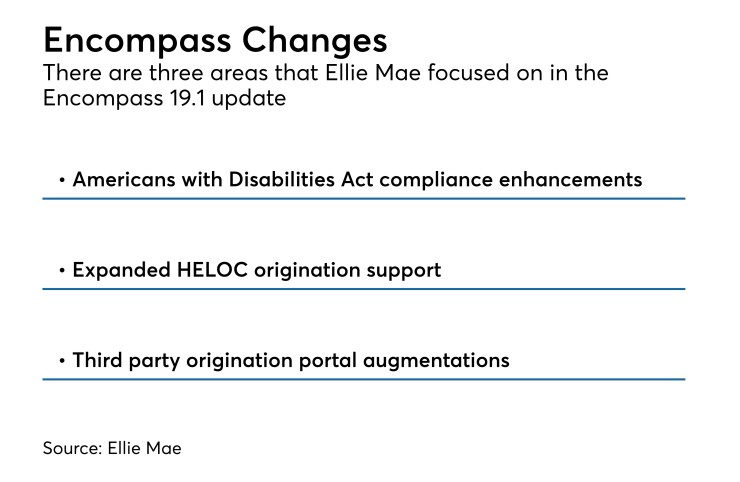

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

"With this new release we're offering multichannel opportunities for growth with innovation to help lenders engage with more homebuyers, capitalize on the growing HELOC demand and boost loan acquisition productivity and efficiencies for correspondent and wholesale channels," Ellie Mae President and CEO Jonathan Corr said in a press release.

Over the past few years, a growing number of plaintiff's attorneys are going after banks, credit unions and other financial institutions over allegations their websites

In 2018, there were

To make its Consumer Connect sites compliant, Ellie Mae created out-of-the-box ADA accessible website templates for the borrower portal and loan application. These new templates conform to the usability standards created by the Web Content Accessibility Guidelines 2.0 Level A and AA, an industry-standard for creating online content that is accessible to a wide range of people with disabilities.

Also included in the Encompass 19.1 update is a home equity line of credit calculator to let loan officers identify their client's maximum draw amount and credit limit. There is also the ability for lenders to view all HELOC details that integrates with the Encompass Product and Pricing Service to make it easier to sell the loan on the secondary market. The first phase of HELOC support was issued in the

Ellie Mae also made enhancements to its TPO Connect broker and correspondent seller portal. These include automated document upload notifications and multichannel workflow improvements, along with support for additional third party credit provider integrations to help correspondent investors and wholesale lenders collaborate more effectively with brokers and sellers. There are also enhanced trade management purchase advice workflows for investors to acquire whole loans faster.