-

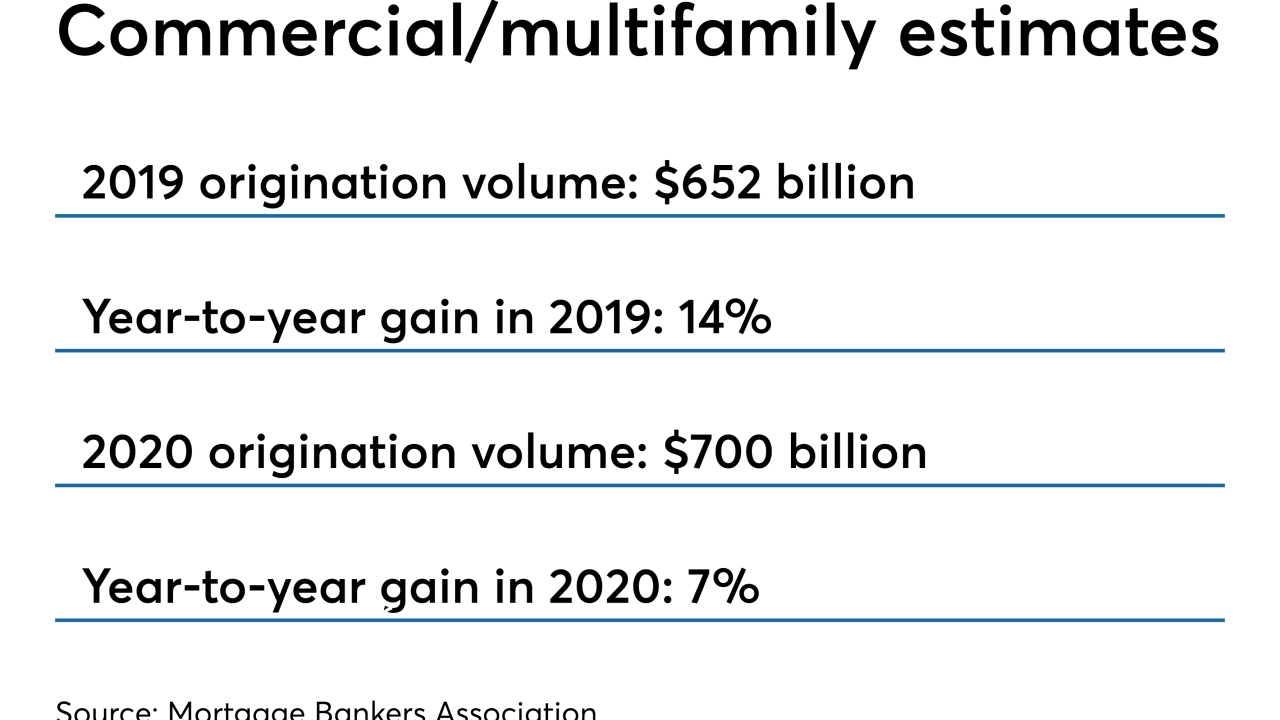

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

The Federal Trade Commission wants to block the merger of Fidelity National Financial and Stewart Information Services stating the deal would reduce competition for title insurance, including for large commercial real estate transactions.

September 9 -

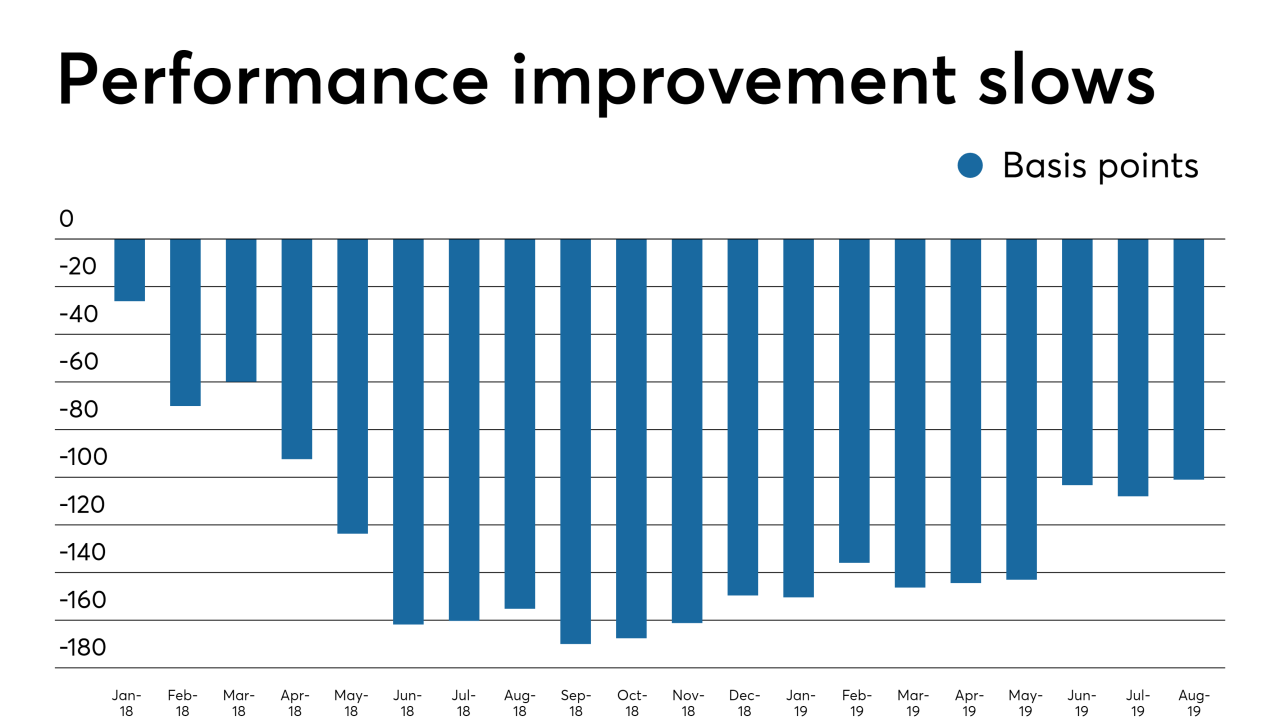

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

The Hamilton, Ohio City Council soon will consider whether to require owners to register their vacant industrial or commercial buildings.

September 3 -

Extell Development, facing an Aug. 30 maturity for a construction loan, signed an agreement for a new loan on the New York property, using the unsold units in the 815-apartment project as collateral.

August 30 -

Prospective buyers of the boarded-up East Hills Mall recently reached out to Bakersfield city officials with a new vision for demolishing and redeveloping the property into a village-like mixed-use center.

August 30 -

The second half of 2019 is a prudent time to examine the CRE market in the context of an inevitable slowdown, taking into account how the current landscape is impacting lending practices.

August 29 EDR Insight

EDR Insight -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

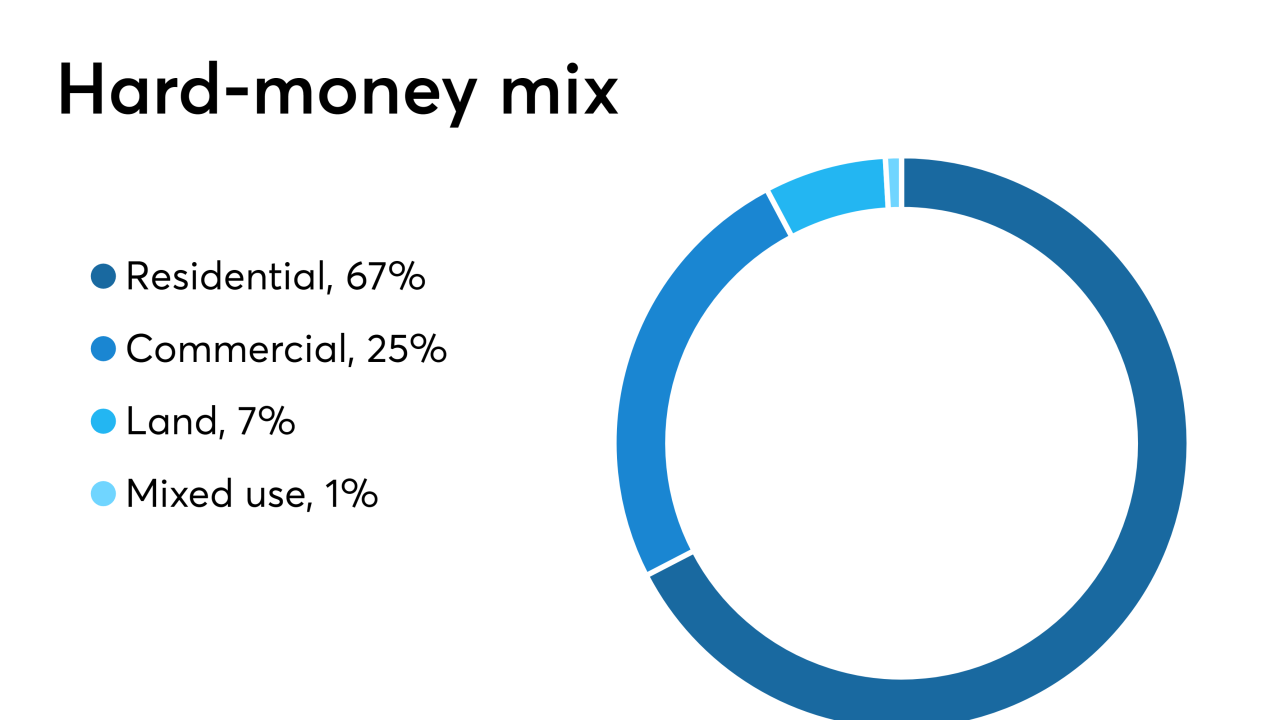

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18