-

Providing support to affordable rental developments is a key component in the Biden administration's efforts to increase housing supply.

October 17 -

But a great deal of variation in distress levels were reported between individual markets and property sectors, according to two new reports.

September 12 -

Decreased availability of bank capital for new commercial construction helped slow activity from the previous nine quarters, according to a new report.

September 8 -

Economic analysis from the real estate advisory CBRE finds that community banks are particularly imperiled by their exposure to commercial real estate loans. Others see looming risks in indirect lending.

June 9 -

But when compared past periods of upheaval, those rates remain relatively low, the Mortgage Bankers Association report showed.

June 1 -

The Federal Deposit Insurance Corp. said in its quarterly banking profile that the banking industry remains resilient despite a challenging economic backdrop, but exposure to commercial real estate losses and interest rate risks could make continued stability difficult.

May 31 -

Banks could be in for a long, slow trickle of bank failures and consolidation in the coming months and years, particularly if inflation persists and interest rates keep rising. A downturn in commercial real estate could add to banks' problems.

April 11 -

Federal Deposit Insurance Corp. Chairman Martin Gruenberg said that the rise of hybrid and remote work, alongside rising interest rates, could be creating lingering risk in the maturity of some bank loans.

March 6 -

CEO Michael Nierenberg hinted at an upcoming partnership, as the rebranded New Residential reported a quarterly loss from residential mortgages plus management internalization costs.

August 2 -

The two companies will integrate platforms to streamline sales in the single-family, build-to-rent property market.

November 29 -

The industry had tightened up last year in the face of COVID-19. But as the economic outlook improves, banks are now easing criteria amid heightened competition, according to the Federal Reserve’s survey of loan officers.

August 2 -

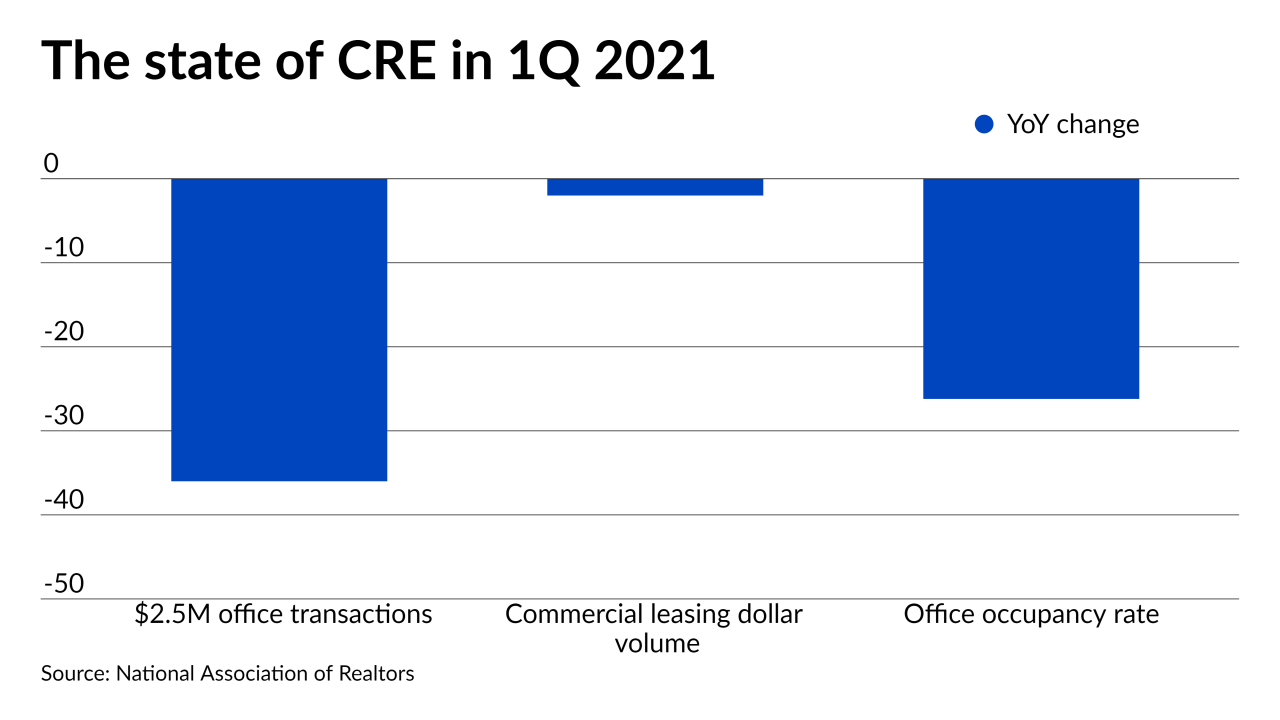

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

However, conditions for commercial mortgages overall worsened slightly due to persistent concerns in the hotel and office sectors, a Moody’s Investors Service report found.

April 26 -

The bond issuance out of Fortress' CF Hippolyta master trust will finance 19 newly constructed or planned Amazon distribution and logistics facilities in 15 states.

March 9 -

Already contending with stressed retail, hotel and restaurant loans, bankers are beginning to view office lending — historically a safe bet — as increasingly risky as companies of all types rethink their space needs.

February 28 -

The Federal Reserve warned of significant risks of business bankruptcies and steep drops in commercial real estate prices in a report published on Friday.

February 19 -

Volumes should rise this year but it could become more difficult to get loans for certain property types, the Mortgage Bankers Association said.

February 10 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12